Volvo 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

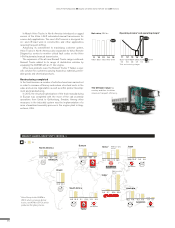

For the Volvo Group 2015 was a year with improved underlying profitability despite unchanged volumes.

IMPROVED UNDERLYING

PROFITABILITY

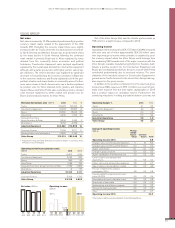

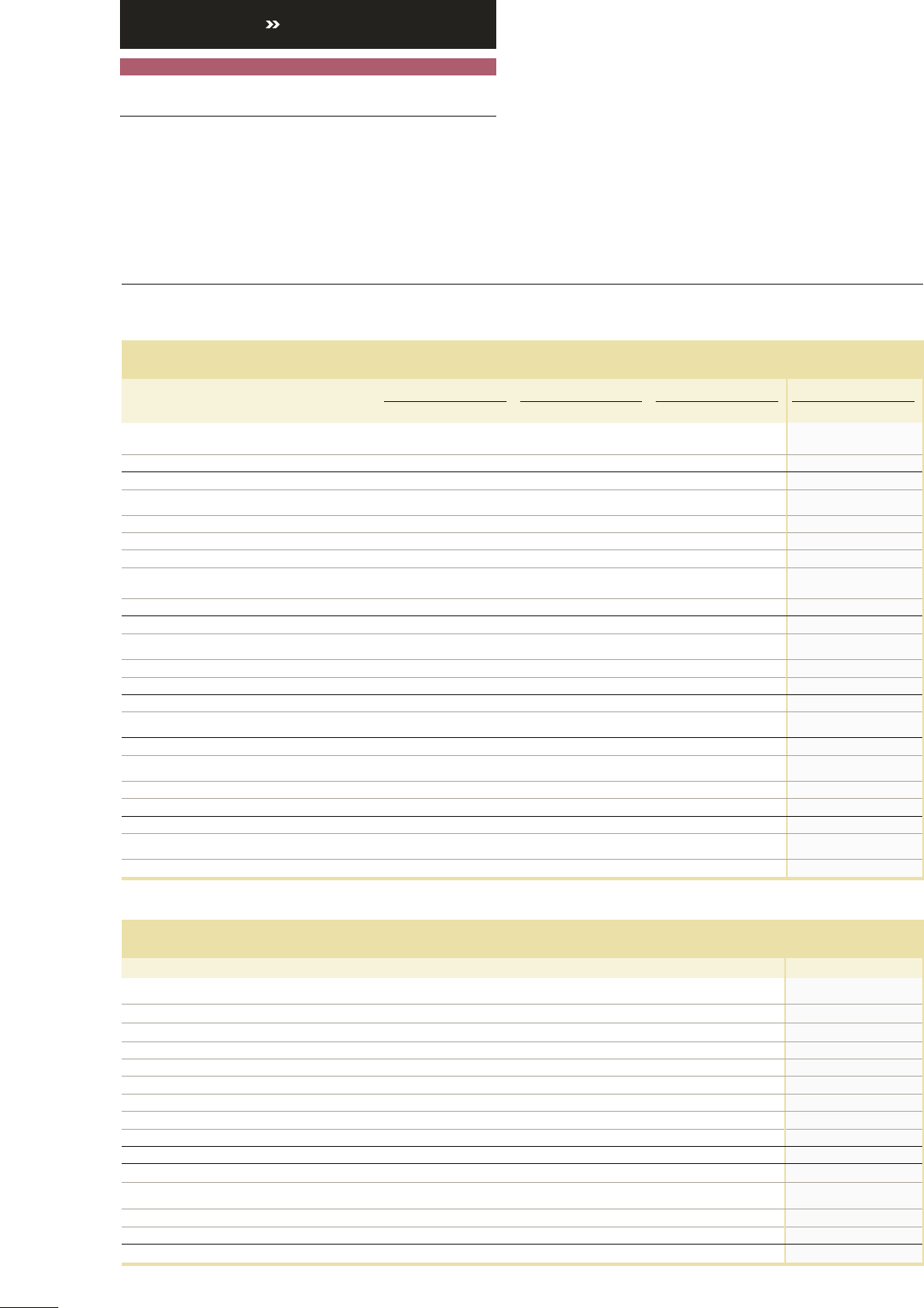

INCOME STATEMENTS VOLVO GROUP

Industrial Operations Customer Finance Eliminations Volvo Group

SEK M 2015 2014 2015 2014 2015 2014 2015 2014

Net sales

Note

6, 7 303,582 275,999 11,199 10,111 –2, 265 –3,162 312,515 282 ,948

Cost of sales –236,311 –217,251 –6,607 –5,923 2,265 3,162 –240,653 –220,012

Gross income 67,271 58,748 4,591 4,188 – – 71,862 62,937

Research and development expenses –15,368–16,656–––––15,368–16,656

Selling expenses –25,857 –25,778 –1,837 –1,670 – – –27,694 –27,448

Administrative expenses –5,728 –5,367 –41 –41 – – –5,769 –5,408

Other operating income and expenses Note 8 –3,473 –6,931 –706 –766 – – –4,179 –7,697

Income from investments in joint ventures

and associated companies

Note

5, 6–14346–––––14346

Income/lossfrom other investments Note 5 4,610 49 –2 1 – – 4,609 50

Operating income 21,312 4,111 2,006 1,712 – – 23,318 5,824

Interest income and similar credits 257328––––257328

Interest expenses and similar charges–2,366–1,9940––––2,366–1,994

Other financial income and expensesNote 9–7929310––––792931

Income after financial items 18,411 3,377 2,006 1,712 – – 20,418 5,089

Income taxes Note 10 –4,687 –2,287 –633 –568 – – –5,320 –2,854

Income for the period 13,725 1,091 1,373 1,145 – – 15,099 2,235

Attributable to:

Equity holders of the parent company 15,0582,099

Minority interests Note 11 41136

15,0992,235

Basic earnings per share, SEKNote 19 7.421.03

Diluted earnings per share, SEKNote 19 7.411.03

OTHER COMPREHENSIVE INCOME

SEK M 2015 2014

Income for the period 15,099 2,235

Items that will not be reclassified to income statement:

Remeasurements of defined benefit pension plans 2,783 –2,833

Items that may be reclassified subsequently to income statement:

Exchange differences on translation of foreign operations –2,481 5,998

Share of OCI related to joint ventures and associated companies 24 198

Accumulated translation difference reversed to income 45 33

Available-for-sale investments –3,837 3,067

Change in cash flow hedge reserve Note 19 –32 24

Other comprehensive income, net of income taxes –3,498 6,487

Total comprehensive income for the period 11,601 8,722

Attributable to:

Equity holders of the parent company 11, 52 7 8 , 3 3 4

Minority interests 74 388

11,601 8,722

GROUP PERFORMANCE BOARD OF DIRECTORS’ REPORT 2015

FINANCIAL PERFORMANCE

80