Volvo 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP PERFORMANCE 2015 NOTES

4:4

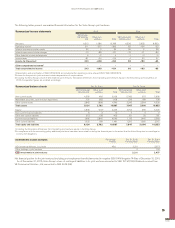

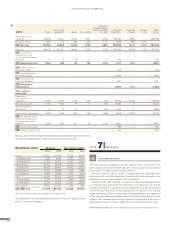

Currency impact on operating income, Industrial Operations, SEK billion 2015 2014 Change

Net flows in foreign currency 4.3

Gains and losses on hedging contracts –0.0 –0.0 0.0

Unrealized gains and losses on receivables and liabilities in foreign currency –0.4 –0.2 –0.3

Currency effect from devaluation in Argentina and Venezuela –0.3 0.0 –0.3

Translation effect on operating income in foreign subsidiaries 1.3

Total currency impact on operating income 5.1

Currency impact on Net flows in foreign currency is detailed in table 4:6 and Translation effect on operating income in foreign subsidiaries is

detailed in table 4:7 in key currencies.

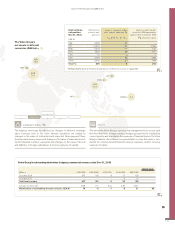

The Volvo Group’s currency review

When the Volvo Group communicates the currency impact on operating income for Industrial operations, the following factors are included:

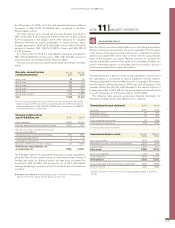

4:8

Currency effect on Net sales in 2015 versus 2014

18

15

12

–3

3

0

9

6

BRL

–1.3

EUR

2.0

GBP

2.2

JPY

1.1

USD

18.6

Other

4.3

Changes in currency rates compared to 2014 (Total SEK 27.0 bn).

Currency effect on Net sales from inflows in foreign currency and

translation effect when consolidating Net sales in foreign subsidiaries

for Industrial Operations is presented in the graph above.

SEK bn

4:5

Transaction exposure from operating net flows in 2015 and 2014

4:6

Currency effect from Net flows in foreign currency

2015 versus 2014

4.0

3.5

2.5

2.0

3.0

1.5

1.0

–0.5

–1.0

0.5

0.0

GBP

1.1

USD

3.4

BRL

0.3

ZAR

0.2

EUR

–0.2

CAD

0.4

KRW

–1.0

Other

0

Changes in currency rates compared to 2014 (Total SEK 4.3 bn).

Currency effect on operating income from Net flows in foreign

currency in Industrial Operations is presented in the graph above.

SEK bn

4:7

Translation effect on operating income in foreign

subsidiaries in 2015 versus 2014

1.5

2.0

1.0

–0.5

0.5

0

BRL

–0.2

CNY

–0.2

EUR

0.0

GBP

–0.1

KRW

0.3

USD

1.6

Other

–0.1

Changes in currency rates compared to 2014 (Total SEK 1.3 bn).

Translation effect when consolidating operating income in foreign

subsidiaries for Industrial Operations is presented in the graph above.

SEK bn

SEK bn

–40

–30

–20

–10

0

10

20

9

Other

–39

SEK

–8

KRW

–2

EUR

–1

BRL

4

ZAR

5

CAD

9

GBP

19

11–33

–9

–4

33

4

NOK

43

6

16

USD

Currency flow 2015 Currency flow 2014

The graph above represents the transaction exposure from commercial

operating net cash flows in foreign currency, expressed as net surpluses or

deficits in key currencies. For further information read more in the section

Commercial currency exposure.

119