Volvo 2015 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

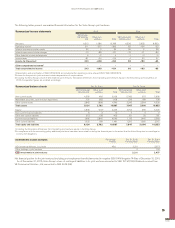

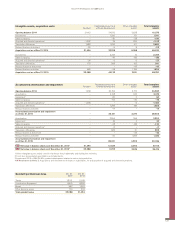

Reclassifications and other mainly consist of assets within sales with

residual value commitments related to legal sales transactions, where rev-

enue is deferred and accounted for as operating lease revenue. Assets

classified as inventory will, when the operating lease model is applied for

revenue recognition, be reclassified from inventory to sales with residual

value commitments, when the legal sales transaction occurs. If the prod-

uct is returned after the lease period, there will be a reclassification from

sales with residual value commitments back to inventory. When a buy-

back agreement has expired, but the related product is not returned, the

cost and the accumulated depreciation are reversed in reclassification

and other, within the line item sales with residual value commitments.

Most reclassifications within tangible assets relate to construction in pro-

gress, which are reclassified to the respective category within property,

plant and equipment. Most reclassifications within rental fleet relate to

assets moved from inventory to rental fleet during the time the product is

used in the rental business. When the product is de-fleeted it is reclassi-

fied back to inventory from rental fleet.

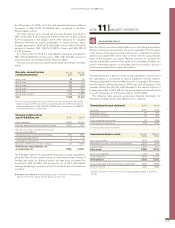

Investment properties

The acquisition value of investment properties at year-end amounted to

SEK 692 M (600). Capital expenditures during 2015 amounted to SEK

6 M (3). Accumulated depreciation amounted to SEK 409 M (335) at

year-end, of which SEK 26 M (23) refers to 2015. The estimated fair value

of investment properties amounted to SEK 1.0 billion (0.7) at year-end.

97% (97) of the area available for lease were leased out during the year.

Operating income for the year was affected by SEK 97 M (78) in rental

income from investment properties and of SEK 19 M (13) in direct costs.

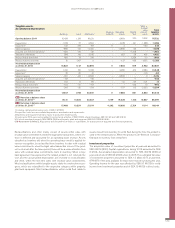

Tangible assets,

Accumulated depreciation

Buildings Land Machinery3Ongoing

projects Operating

leases Rental

fleet

Sales w.

residual

value

commit-

ments

Total

tangible

assets

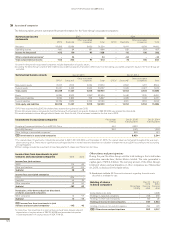

Opening balance 2014 15,428 1,124 49,129 – 6,469 330 3,252 75,732

Depreciation 1,168 77 4,804 – 3,478 341 1,988 11, 856

Impairment4140 318 197 11 3 – –130 540

Sales/scrapping –689 –49 –4,430 – –2,666 –43 – –7,878

Acquired and divested operations

6–622 –36 –20 – – –1,306 – –1,984

Translation differences 928 66 2,795 – 657 28 457 4,932

Reclassified at divestment 459 14 219 – – 1,224 –10 1,906

Reclassifications and other 10 –367 0 – –137 –166 –1,605 –2,266

Accumulated depreciation

as of Dec 31, 2014 16,822 1,147 52,694 11 7,803 409 3,952 82,839

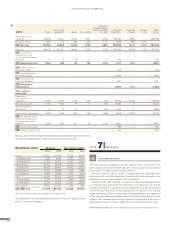

Depreciation 1,310 85 5,008 – 4,386 470 2,289 13,548

Impairment425 26 –10 – – – –124 –84

Sales/scrapping –391 –26 –3,523 – –3,536 – 0 –7,476

Acquired and divested operations

6–147 – –56 – – –1 – –203

Translation differences 103 6 99 – –41 –37 –121 10

Reclassified at divestment –133 –21 –717 – – –132 10 –994

Reclassifications and other –243 –20 –214 – –727 113 –2,203 –3,294

Accumulated depreciation

as of Dec 31, 2015 17,347 1,198 53,281 11 7,884 821 3,802 84,345

B/S Net value in balance sheet

as of Dec 31, 20142, 5 17,131 10,535 23,337 4 ,179 19,228 1,153 10,837 86, 399

B/S Net value in balance sheet

as of Dec 31, 20152, 5 17,488 10,324 21,514 4,292 18,693 2,724 11,114 86,149

1 Including capitalized borrowing costs of SEK 0 M (160).

2 Acquisition costs less accumulated depreciation, amortization and impairments.

3 Machinery and equipment pertains mainly to production related assets.

4 Impairments 2014 were mainly related to restructuring activities of SEK 459 M, whereof buildings SEK 140 M, land SEK 319 M.

5 Of which investment property SEK 283 M (266) and property, plant and equipment SEK 53,335 M (54,915).

6 Read more in Note 3, Acquisitions and divestments of shares in subsidiaries, for a description of acquired and divested operations.

GROUP PERFORMANCE 2015 NOTES

133