Volvo 2015 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

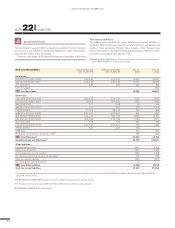

GROUP PERFORMANCE 2015 NOTES

147

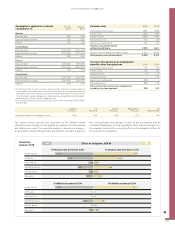

M a t u r i t y

Year Bond loans and

other loans

Not utilized

non-current credit

facilities1

2017 35,608 6,140

2018 9,171 10,973

2019 12,392 –

2020 1,643 21,032

2021 96 –

2022 or later 16,365 –

Total175,275 38,145

1 Current not utilized credit facilities amounted to SEK 1,576 M (500).

Read more in Note 15 table 15:2 Maturities of non-current receivables in the

Customer Finance operations.

AB Volvo issued a hybrid bond in 2014, amounting to EUR 1.5 bn with a

maturity of 61,6 years, in order to further strengthen the Volvo Group’s

balance sheet and prolong the maturity structure of the debt portfolio.

The predominant part of non-current loans that mature in 2017 is an

effect of the Volvo Group’s normal business cycle, with shorter duration in

the Customer Finance portfolio compared to Industrial Operations.

Granted but not unutilized credit facilities consists of stand-by facilities

for loans. A fee is charged for granted credit facilities, this is recognized in

profit or loss within other financial income and expenses.

Read more in Note 9 Other financial income and expenses.

Current liabilities

Loans Dec 31,

2015 Dec 31,

2014

Bank loans 14,495 13,705

Other loans 42,836 26,249

B/S Loans1, 2 57,331 39,953

1 Of which loans raised to finance the Customer Finance credit portfolio

amounted to SEK 48,786 M (29,672) and outstanding derivatives, at fair value,

amounted to SEK 811 M (455).

2 Current loans amounting to SEK 3,299 M (2,862) were secured by assets

pledged.

Assets pledged Dec 31,

2015 Dec 31,

2014

Property, plant and equipment – mortgages 65 88

Assets under operating leases – 209

Receivables 9,323 7,343

Cash, loans andmarketable securities 40 40

Total 9,428 7,680

Non-current and current loans of SEK 9,225 M (7,340) were secured by

assets pledged.

Under the terms of asset-backed securitizations, SEK 9,064 M (7,088)

of securities have been issued tied to US-based loans, secured by cus-

tomer financing-receivables, SEK 9,323 M (7,343), recognized on the

balance-sheet with trucks and construction equipment assets as collaterals,

whereof SEK 6,819 M (4,410) were signed in 2015.

Read more in Note 22 Liabilities.

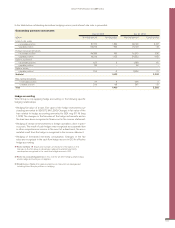

NOTE 23 ASSETS PLEDGED

Bank loans include current maturities of non-current loans SEK 6,066 M

(6,695). Other loans include current maturities of non-current loans, SEK

32,753 M (22,458), and commercial papers, SEK 5,845 M (0).

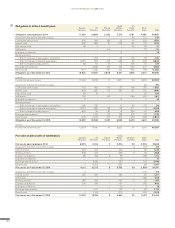

Non-interest-bearing current liabilities amounted to SEK 98,529 M

(96,440), or 63% (71) of the Volvo Group’s total current liabilities

The table below presents the Volvo Group’s other current liabilities.

Other current liabilities also includes trade payables of SEK 55,648 M

(56,647), current tax liabilities of SEK 1,322 M (2,693) and non-interest-

bearing liabilities held for sale of SEK 573 M (130).

Other current liabilities Dec 31,

2015 Dec 31,

2014

Advances from customers 4,026 4,784

Wages, salaries and withholding taxes 8,551 9,088

VAT liabilities 2,401 1,875

Accrued expenses for dealer bonuses and rebates13,696 –

Other accrued expenses and prepaid income 12,728 11,029

Deferred leasing income 1,992 2,022

Residual value liability 2,825 2,950

Other financial liabilities 295 192

Other liabilities 4,287 4,682

Outstanding interest and currency risk derivatives 2 134 331

Outstanding raw material derivatives 50 18

B/S Other current liabilities 40,986 36,970

1 Read more in Note 21 Other provisions, section Provision for finished products

2 Read more in Note 30 Financial Instruments, regarding current part of

Outstanding interest and currency risk derivatives included in table carrying

amounts and fair value.

Read more in Note 3 Acquisitions and divestments of shares in subsidiaries,

table Assets and liabilities held for sale.

Read more in Note 23 Assets pledged.