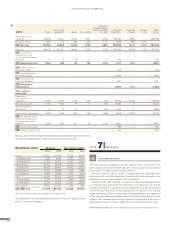

Volvo 2015 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

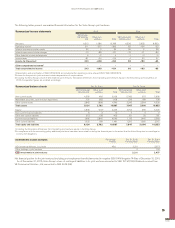

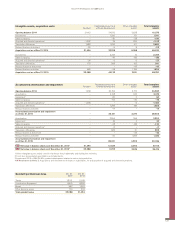

Specification of income tax rate 2015, % 2014, %

Swedish corporate income tax rate 22 22

Difference in tax rate in various countries 3 8

Other non-taxable income –6 –12

Other non-deductible expenses 1 27

Current taxes attributable to prior years –1 –4

Remeasurementof deferred tax assets 6 10

Otherdifferences 1 5

Income tax rate for the Volvo Group126 56

1 The income tax rate for the Volvo Group, as of December 31 2015, was mainly a

result of the non-taxable capital gain from the divestment of shares in Eicher Motors

Ltd of SEK 4,608 M which gave rise to a permanent tax difference of SEK 1,014 M.

The positive effect from the capital gain was partly offset by the impact of the valua-

tion allowance and the revaluation of deferred tax assets in Japan of SEK –1,107 M

as a result of changed corporate tax rate, stricter conditions for utilization of tax-loss

carryforwards and review of business performance.

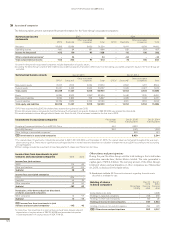

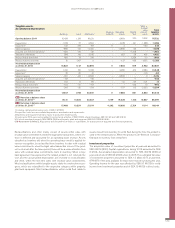

Specification of deferred tax assets

and tax liabilities Dec 31,

2015 Dec 31,

2014

Deferred tax assets:

Unused tax-loss carryforwards 3,724 5,911

Other unused tax credits 192 152

Intercompany profitin inventories 1,339 1,299

Allowance for inventory obsolescence 639 615

Valuation allowance for doubtful receivables 1,211 802

Provisions for warranties 4,111 3,726

Provisions for residual value risks 247 249

Provisions for post-employmentbenefits 4,408 4,974

Provisions for restructuring measures 262 223

Market value of derivative instruments 25 27

Land 1,160 1,226

Other deductible temporary differences 4,930 4,936

Deferred tax assets before deduction

for valuation allowance 22,248 24,140

Valuation allowance –1,181 –336

Deferred tax assets after deduction

for valuation allowance 21,067 23,804

Netting of deferred tax assets/liabilities –7,617 –7,973

B/S Deferred tax assets, net 13,450 15,831

Deferred tax liabilities:

Accelerated depreciation on property,

plant and equipment 2,163 2,156

Accelerated depreciation on leasing assets 3,174 2,836

LIFO valuation of inventories 557 558

Capitalized product and software development 2,384 2,472

Adjustment to fair valueat corporate

acquisitions/divestitures 30 34

Untaxed reserves 87 84

Provisions for post-employment benefits 69 39

Other taxable temporary differences 2,648 2,590

Deferred tax liabilities 11,112 10,769

Netting of deferred tax assets/liabilities –7,617 –7,973

B/S Deferred tax liabilities, net 3,495 2,796

Deferred tax assets/liabilities, net19,955 13,035

1 The deferred tax assets and liabilities above are partially recognized in the balance

sheet on a net basis after taking into account offsetting possibilities. Deferred

tax assets and liabilities have been measured at the tax rates that are expected

to apply during the period when the asset is realized or the liability is settled,

according to the tax rates and tax regulations that have been resolved or enacted at

the balance-sheet date.

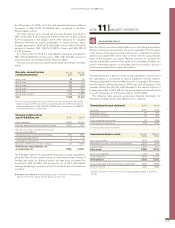

Income tax for the period includes current and deferred taxes. Current

taxes are calculated on the basis of the tax regulations prevailing in the

countries where the Group companies have operations.

Deferred taxes are recognized on differences that arise between the

taxable value and carrying value of assets and liabilities as well as on tax-

loss carryforwards. Furthermore deferred taxes are recognized to the

extent it is probable that they will be utilized against taxable income.

Deferred tax liabilities on temporary differences on participations in

subsidiaries and associated companies are recognized in the balance

sheet except when the Volvo Group control the timing of the reversal of

the temporary difference related to accumulated undistributed earnings

and it is probable that a reversal will not be done in the foreseeable future.

Tax laws in Sweden and certain other countries allow companies to defer

payment of taxes through allocations to untaxed reserves. However, in the

consolidated financial statements untaxed reserves are reclassified to

deferred tax liability and equity. In the consolidated income statements a

provision to, or reversal of, untaxed reserves is split between deferred

taxes and net income for the year.

Provisions have been made for estimated tax charges that are probable

as a result of identified tax risks. Tax processes are evaluated on a regular

basis and provisions are made for possible outcome when it is probable that

the Volvo Group will have to pay more taxes and when it is possible to make

a reasonably assessment of the possible outcome. Tax claims for which no

provision is deemed necessary are generally recognized as contingent lia-

bilities.

Read more about contingent liabilities in Note 24.

SOURCES OF ESTIMATION UNCERTAINTY

!

The Volvo Group recognizes valuation allowances for deferred tax assets

where management does not expect such assets to be realized based

upon current forecasts. In the event that actual results differ from these

estimates or adjustments are made to future periods in these estimates,

changes in the valuation allowance may be required. This could have sig-

nificant impact on the financial position and the income for the period.

The Volvo Group has substantial tax-loss carryforwards that are

assessed as being probable to be utilized due to sufficient income gener-

ated in the coming years. The base for this assessment is possibilities to

offset tax assets and tax liabilities and that a significant part of tax-loss

carryforwards is related to countries with long or indefinite periods of

utilization. Ensuring the probability of utilization is based upon business

plans when relevant.

Income taxes were distributed as follows:

Distribution of Income taxes 2015 2014

Current taxes relating to the period –3,207 –3,383

Adjustment of current taxes for prior periods 197 198

Deferred taxes originated or reversed during the

period –965 362

Remeasurementsof deferred tax assets –1,345 –31

I/S Total income taxes –5,320 –2,854

The Swedish corporate income tax rate amounted to 22% in 2015. The table

at the top of the next column discloses the principal reasons for the differ-

ence between this rate and the Volvo Group’s income tax rate, based on

income after financial items.

ACCOUNTING POLICY

NOTE 10 INCOME TAXES

128

GROUP PERFORMANCE 2015 NOTES