Volvo 2015 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP PERFORMANCE 2015 NOTES

139

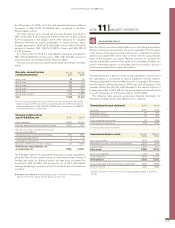

Information regarding shares 2015 2014

Number of outstanding shares,

December 31, in millions 2,031 2,029

Average number of shares

before dilution in millions 2,030 2,028

Average number of shares

after dilution in millions 2,032 2,031

Average share price, SEK 96.57 89.54

Net income attributable to Parent

Company shareholders 15,058 2,099

Basic earnings per share, SEK 7.42 1.03

Diluted earnings per share, SEK 7.41 1.03

The Volvo Group’s post-employment benefits, such as pensions, health-

care and other benefits are mainly settled by means of regular payments

to independent authorities or bodies that assume pension obligations and

administer pensions through defined-contribution plans.

The remaining post-employment benefits are defined-benefit plans;

that is, the obligations remain within the Volvo Group or are secured by

proprietary pension foundations. The Volvo Group’s defined-benefit plans

relate mainly to subsidiaries in the U.S. and comprise both pensions and

other benefits, such as healthcare. Other large-scale defined-benefit

plans apply to white-collar employees in Sweden (mainly through the

Swedish ITP pension plan) and employees in France and Great Britain.

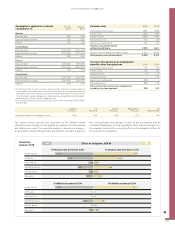

SOURCES OF ESTIMATION UNCERTAINTY

!

Assumptions when calculating pensions and other

post-employment benefits

Provisions and costs for post-employment benefits, mainly pensions and

health-care benefits, are dependent on assumptions used by actuaries

when calculating such amounts. The appropriate assumptions and actu-

arial calculations are made separately for the respective countries of the

Volvo Group’s operations which result in obligations for post-employment

benefits. The assumptions include discount rates, health care cost trends

rates, inflation, salary growth, retirement rates, mortality rates and other

factors. Health care cost trend assumptions are based on historical cost

data, the near-term outlook and an assessment of likely long-term trends.

Inflation assumptions are based on an evaluation of external market indi-

cators. The salary growth assumptions reflect the historical trend, the

near-term outlook and assumed inflation. Retirement and mortality rates

are based primarily on officially available mortality statistics. The actuarial

assumptions are reviewed annually by the Volvo Group and modified when

deemed appropriate.

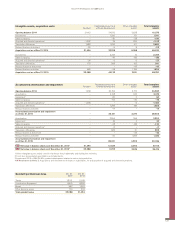

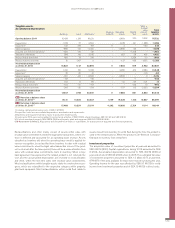

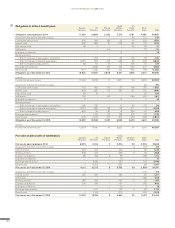

The following tables disclose information about defined-benefit plans.

The Volvo Group recognizes the difference between the obligations and

the plan assets in the balance sheet. The disclosures refer to assumptions

applied for actuarial calculations, recognized costs during the financial

year and the value of obligations and plan assets at year-end. The tables

also include a reconciliation of obligations and plan assets during the year.

Summary of provision for

post–employment benefits Dec 31,

2015 Dec 31,

2014

Obligations –49,038 –50,948

Fair value of plan assets 35,400 34,391

Net provision for post-employment benefits –13,638 –16,557

ACCOUNTING POLICY

Actuarial calculations shall be made for all defined-benefit plans in order

to determine the present value of obligation for benefits vested by its

current and former employees. The actuarial calculations are prepared

annually and are based upon actuarial assumptions that are determined

at the balance-sheet date each year. Changes in the present value of

obligations due to revised actuarial assumptions and experience adjust-

ments constitute remeasurements.

Provisions for post-employment benefits in the Volvo Group’s balance

sheet correspond to the present value of obligations at year-end, less fair

value of plan assets. Discount rate is used when calculating the net inter-

est income or expense on the net defined benefit liability (asset). All

changes in the net defined liability (asset) are recognized when they

occur. Service cost and net interest income or expense are recognized in

the income statement, while remeasurements such as actuarial gains and

losses are recognized in other comprehensive income. Special payroll tax

is included in the pension liability. Special payroll tax is applicable for

pension plans in Sweden and Belgium.

For defined contribution plans, premiums are recognized in the income

statement as incurred according to function.

NOTE 20 PROVISIONS FOR POST-EMPLOYMENT BENEFITS

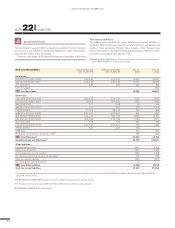

Change in other reserves Hedge

reserve

Available-

for-sale

reserve Total

Opening balance 2015 –16 4,144 4,128

Other changes –32 – –32

Fair value adjustments regarding

holdings in Japanese companies – 25 25

Fair value adjustments regarding

Eicher Motors Ltd. – –3,995 –3,995

Fair value adjustments regarding

other companies – 133 133

Balance as of December 31, 2015 –48 307 259

The Volvo Group’s accumulated amount of exchange difference recog-

nized in equity relating to assets held for sale amounted to SEK 11 M (10).