Volvo 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

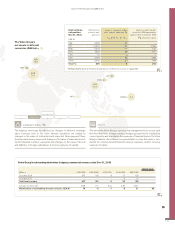

Subsidiaries

The Volvo Group has production facilities in 18 countries and sales of prod-

ucts in more than 190 markets which means that the Volvo Group has

subsidiaries in many parts of the world. A subsidiary is defined as an entity

that is controlled by the Volvo Group. A subsidiary is controlled by a parent

company when it has power over the investee, exposure, or rights, to varia-

ble returns from its involvement with the investee and the ability to use its

power over the investee to affect the amount of the investor’s return. Most

of the Volvo Group’s subsidiaries are owned to 100% by the Volvo Group

and are therefore considered to be controlled by the Volvo Group. For some

subsidiaries there are restrictions on the Volvo Group’s ability to access or

use cash from these subsidiaries.

Read more in Note 18 Marketable securities and liquid funds about cash

that is not available for use, or where other limitations exists, in Note 11 Minor-

ity interests, in Note 13 Investments in shares and participations for the parent

company about composition of the Volvo Group.

Joint ventures

Joint ventures are companies over which the Volvo Group has controlling

influence together with one or more external parties. Joint ventures are

recognized by applying equity method accounting. The investment in VE

Commercial Vehicles Ltd., (VECV) is of a business related nature and

aims at strengthening the Volvo Group’s position in India. The other two

joint ventures owned by the Volvo Group are also of business related

nature.

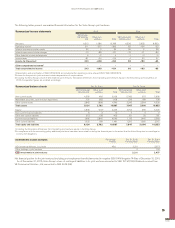

Associated companies

Associated companies are companies in which the Volvo Group has a

significant influence. A strong indication of such influence is when the

Group’s holdings equal at least 20% but less than 50% of the voting

rights. Holdings in associated companies are recognized in accordance

with the equity method. Deutz AG is a German manufacturer and is a

strategic supplier to the Volvo Group of medium-duty engines. The invest-

ment in Deutz AG is of a business related nature and aims at expanding

our commercial co-operation in medium-duty engines.

In the beginning of January 2015 Volvo Group completed the acquisi-

tion of 45% of the Chinese automotive manufacturer Dongfeng Commer-

cial Vehicles Co., Ltd (DFCV). The purchase consideration amounted to

SEK 7.0 billion. The ownership is classified as an associated company and

consolidated with the equity method. It is included in the Trucks segment.

The acquisition significantly strengthens the Volvo Group’s position in

medium-duty and heavy-duty trucks.

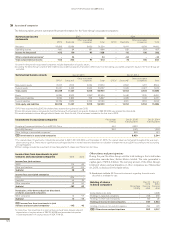

Equity method

The Volvo Group’s share of income in companies recognized according to

the equity method is included in the consolidated income statement under

Income/loss from investments in joint ventures and associated compa-

nies, less, where appropriate, depreciation of surplus values and the effect

of applying different accounting policies. Income from companies recog-

nized in accordance with the equity method is included in operating income

since the Volvo Group’s investments are of business related nature. For

practical reasons, some of the associated companies are included in the

consolidated financial statements with a certain time lag, normally one

quarter. Dividends from joint ventures and associated companies are not

included in the consolidated income. In the consolidated balance sheet,

investments in joint ventures and associated companies are affected by the

Volvo Group’s share of the company’s net income, less depreciation of

surplus values and dividends received. Investments in joint ventures and

associated companies are also affected by Volvo Group’s share of the

company’s other comprehensive income and by the translation difference

from translating the company’s equity in the Volvo Group.

When applying the equity method, including recognizing the associ-

ate’s or joint venture’s losses, additional impairment losses might be rec-

ognized given any indication of impairment. A significant or prolonged

decline in the fair value of the shares is an indication of impairment.

Investments accounted for in accordance with the equity method cannot

be of a negative carrying value and therefore losses are not provided for

if the holding is of a negative amount. Additional losses are provided for to

the extent that the Volvo Group has incurred legal or constructive obliga-

tions or made payments on behalf of the joint venture or of the associated

company.

Other shares and participations

Holding of shares that do not provide the Volvo Group with significant in-

fluence, which generally means that Volvo Group’s holding of shares cor-

responds to less than 20% of the votes, are recognized as other shares

and participations. For listed shares, the carrying amount is equivalent to the

market value. Unlisted shares and participations, for which a fair value can-

not reasonably be determined, are measured at acquisition cost less any

impairment.

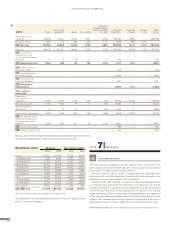

Any change in value is recognized directly in other comprehensive

income, unless the decline is significant or prolonged. Then the impair-

ment is recognized in the income statement. The cumulative gain or loss

recognized in other comprehensive income is recycled in the income

statement on the sale of the asset.

Earned or paid interest attributable to these assets is recognized in the

income statement as part of net financial items in accordance with the

effective interest method. Dividends received attributable to these assets

are recognized in the income statement as Income from other investments.

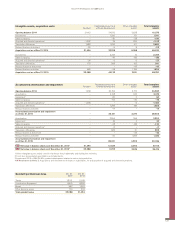

Joint ventures

The Volvo Group’s investments in joint ventures are listed below.

Shares in joint ventures Dec 31, 2015 Dec 31, 2014

Holding percentage Holding percentage

Shanghai Sunwin Bus Corp., China 50.0 50.0

DONGVO Truck Co., Ltd. (DVT)

China 50.0 50.0

VE Commercial Vehicles, Ltd., India145.6 45.6

1 VE Commercial Vehicles Ltd., is considered to be a joint venture as Volvo Group

and Eicher Motors Ltd have signed an agreement which states that common

agreement is needed for important matters related to the governance of VECV.

ACCOUNTING POLICY

INVESTMENTS IN JOINT VENTURES, ASSOCIATED

COMPANIES AND OTHER SHARES AND PARTICIPATIONS

NOTE 5

122

GROUP PERFORMANCE 2015 NOTES