Volvo 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACCOUNTING POLICY

Recognition of business combinations

All business combinations are recognized in accordance with the pur-

chase method. Volvo Group measures acquired identifiable assets, tangi-

ble and intangible, and liabilities at fair value. Any surplus amount from the

purchase price, possible minority interests and fair value of previously

held equity interests at the acquisition date compared to the Volvo Group’s

share of acquired net assets is recognized as goodwill. Any deficit amount,

known as negative goodwill, is recognized in the income statement.

In step acquisitions, a business combination occurs only on the date

control is achieved, which is also the time when goodwill is calculated.

Transactions with the minority are recognized as equity as long as control

of the subsidiary is retained. For each business combination, the Volvo Group

decides whether the minority interest shall be valued at fair value or at the

minority interest’s proportionate share of the net assets of the acquiree. All

acquisition-related costs are expensed. Companies acquired during the

year are consolidated as of the date of acquisition. Companies that have

been divested are included in the consolidated financial statements up to

and including the date of the divestment.

Non-current assets held for sale and discontinued operations

In a global group like the Volvo Group, processes are continuously ongoing

regarding the sale of assets or groups of assets at minor values. When the

criteria for being classified as a non-current asset held for sale are fulfilled

and the asset or group of assets are of significant value, the asset or group

of assets, both current and non-current, and the related liabilities are rec-

ognized on a separate line in the balance sheet. The asset or group of

assets are measured at the lower of it’s carrying amount and fair value

after deductions for selling expenses. The balance sheet items and the

potential income effect resulting from the revaluation to fair value less sell-

ing expenses are normally recognized in the segment Corporate functions,

Group functions and Other, until the sale is completed and the result is

distributed to the relevant segments.

AB Volvo’s holding of shares in subsidiaries as of December 31, 2015

is disclosed in note 13 for the Parent Company. Significant acquisitions,

formations and divestments within the Group are listed below.

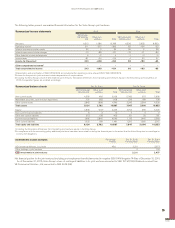

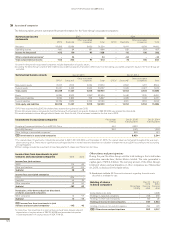

Business combinations during the period

The Volvo Group has not made any acquisitions of subsidiaries during

2015.

Comparative figures for 2014 include the acquisition of the hauler man-

ufacturing business from Terex Inc. On May 30 2014, Volvo Group

acquired 100% of Terex Equipment LTD. The purchase price adjustment

did not lead to any significant impact on the Volvo Group’s financial state-

ments in 2015.

The impact on the Volvo Group’s balance sheet and cash-flow state-

ment in connection with the acquisitions of subsidiaries and other busi-

ness units are specified in the following table:

Acquisitions 2015 2014

Intangible assets – 280

Property, plant and equipment – 124

Assets under operating lease – –

Shares and participations – 233

Inventories – 385

Current receivables – 436

Cash and cash equivalents – 67

Other assets – 7

Provisions – –84

Loans – –55

Current liabilities – –368

Acquired net assets – 1,025

Goodwill – 75

Total –1,100

Cash and cash equivalents paid – –1,170

Cash and cash equivalents according

to acquisition analysis – 67

Effect on Volvo Group cash and

cash equivalents ––1,103

Cash to be paid –68

Effect on Volvo Group net financial

position ––1,158

NOTE 3 ACQUISITIONS AND DIVESTMENTS OF SHARES IN SUBSIDIARIES

GROUP PERFORMANCE 2015 NOTES

114