Volvo 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Demand continued to good in North America for

most of the year as a result of the economy

developing well. The European market also

showed good growth while South America’s

largest market, Brazil, declined sharply as a

consequence of the economy slipping into

recession. The Japanese market was stable. The Indian heavy-

duty truck market continued the positive development that started

in 2014. The Chinese market, on the other hand, declined for the

second year in a row.

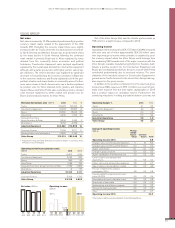

Varying market conditions

During 2015 registrations in Europe increased by 19% to 270,000

(227,612) heavy-duty trucks as a consequence of increased

freight activity, resulting in good capacity utilization and good cus-

tomer profitability, as well as a need for fleet renewal. The total

market for heavy-duty trucks in Europe is forecasted to a level of

280,000 trucks in 2016, based on the expectation of continued

economic recovery in Europe.

The total North American retail market for heavy-duty trucks

increased by 12% to 301,740 vehicles in 2015 as a result of fleet

renewal and fleet expansion combined with good customer profita-

bility thanks to good freight environment, low fuel prices and low

interest rates. Demand weakened during the fourth quarter with a

correction mainly in the long-haul segment. The heavy-duty truck

market forecast for 2016 is 260,000 vehicles as freight activity

weakened towards the end of the year and the need for fleet

expansion and renewal will be lower in 2016.

In 2015, the Brazilian market declined by 55% to 41,603 vehicles

as a consequence of the contracting economy combined with over-

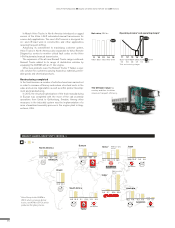

In addition to helping Volvo and Mack deliver the optimized performance

and fuel efficiency demanded by customers and regulators, proprietary

powertrains represent an important ongoing source of revenue for the Volvo

Group and its dealers. Increased service business has led dealers to invest

in more service bays, which supports customers’ uptime and strengthens

brand perception and loyalty. While Mack has always offered proprietary

engines, the push for increased Volvo power penetration is more recent.

From representing only about a third of Volvo sales a decade ago, Volvo

engines powered 92% of the trucks sold in 2015. The impact of the Group’s

automated manual transmission has been even more impressive, and it

could be argued that in this area, Volvo innovation has changed an entire

market. Automated manual transmissions were mostly absent from North

America in 2007 when Volvo’s I-Shift became

the first integrated solution to enter the market,

and many in the industry thought the market would

remain committed to manual gear boxes. But penetration

of the I-Shift has skyrocketed – to the point that in 2015 itrepresented

85% of Volvo trucks sold. The Mack brand has experienced similarly rapid

growth with its mDRIVE transmission, which in 2015 represented 73% of

highway vehicle sales, only five years after its introduction.

CONTINUED CAPTIVE COMPONENT

GROWTH IN NORTH AMERICA

IMPROVED PROFITABILITY

ON FLAT VOLUMES

During 2015 market conditions varied significantly between different parts of the world.

Volvo Group’s deliveries of trucks increased by 2% compared to 2014.

all low business confidence. The heavy-duty market forecast for

Brazil in 2016 is 35,000 trucks.

The total medium- and heavy-duty truck market in India

increased by 28% to 278,139 vehicles in 2015 and is forecasted to

increase to 315,000 vehicles in 2016 based on good business

confidence and increased economic activity.

The Chinese total market for medium- and heavy-duty trucks

declined by 24% to 751,130 vehicles in 2015 primarily as a conse-

quence of lower demand in the construction segment. The market

is forecasted to be at about 750,000 trucks also in 2016.

In Japan, demand remained healthy. Registrations of medium-

and heavy-duty trucks increased by 1% to 89,644 vehicles in 2015

and the market forecast is 90,000 trucks for 2016.

In general the Volvo Group maintained its strong positions in the

main markets even though the market shares declined somewhat.

In Europe the combined market share for heavy-duty trucks

amounted to 23.8% (24.4) and in North America it amounted to

19.6% (20.1). In Brazil the market share in heavy-duty trucks

GROUP PERFORMANCE BOARD OF DIRECTORS’ REPORT 2015

TRUCKS

ame

m

ar

ket

t

t

t

t

,

et wou

ld

But

pe

net

rat

ion

The truck operation’s product offer stretches from heavy-duty

trucks for long-haulage and construction work to light-duty trucks

for distribution. The offering also includes maintenance and repair

services, financing and leasing.

Position on world market Volvo Group is the world’s second

largest manufacturer of heavy-duty trucks.

Brands Volvo, UD, Renault Trucks, Mack, Eicher and Dongfeng

Trucks.

Number of regular employees 54,668 (58,067)

Share of Group net sales,

68% (67)

88