Volvo 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated financial statements

Principles for consolidation

The consolidated financial statements comprise the parent company, sub-

sidiaries, joint ventures and associated companies. Intra-group transac-

tions as well as gains on transactions with joint ventures and associated

companies are eliminated in the consolidated financial statements.

Read more in note 5 about definitions of subsidiaries, joint ventures, and

associated companies.

Translation to Swedish kronor when consolidating companies have other

functional currencies

The functional currency of each Volvo Group company is determined

based on the currency in which the company primarily generates and

expends cash, normally the currency of the country where the company is

located. AB Volvo’s and the Volvo Group’s presentation currency is SEK. In

preparing the consolidated financial statements, items in the income

statements of foreign subsidiaries (except for subsidiaries in hyperinflation-

ary economies) are translated to SEK using monthly average exchange

rates. Balance-sheet items are translated into SEK using exchange rates

at year-end (closing rate). Exchange differences are recognized in other

comprehensive income and accumulated in equity.

The accumulated translation differences related to a certain subsidiary,

joint venture or associated company are reversed to the income statement

as a part of the gain/loss arising from disposal of such a company or

repayment of capital contribution from such a company.

Receivables and liabilities in foreign currency

Receivables and liabilities in currencies other than the functional currency

of the reporting entity (foreign currencies) are translated to the functional

currency using the closing rate. Translation differences on operating

assets and liabilities are recognized in operating income, while translation

differences arising in financial assets and liabilities are recognized in

financial income and expenses. Interest-bearing financial assets and lia-

bilities are defined as items included in the net financial position of the

Volvo Group (see Definitions at the end of this report). Exchange rate

differences on loans and other financial instruments in foreign currency,

which are used to hedge net assets in foreign subsidiaries and associated

companies, are offset against translation differences in the shareholders’

equity of the respective companies. Exchange-rate gains and losses on

assets and liabilities in foreign currencies, both on payments during the

year and on measurements at year-end, impact profit or loss in the year in

which they are incurred.

Read more in note 4 about currency exposure and currency risk management.

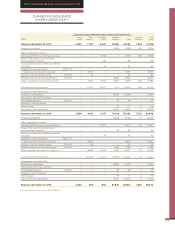

The most important exchange rates applied in the consolidated financial

statements are shown in the table.

Exchange rates Average rate Closing rate

as of Dec 31

Country Currency 2015 2014 2015 2014

Australia AUD 6.3377 6.1801 6.0861 6.3746

Brazil BRL 2.5643 2.9202 2.1596 2.8903

Euro Zone EUR 9.3638 9.1059 9.1443 9.5248

Japan JPY 0.0697 0.0649 0.0694 0.0654

Canada CAD 6.6054 6.2122 6.0293 6.7231

China CNY 1.3424 1.1134 1.2868 1.2595

Norway NOK 1.0469 1.0904 0.9567 1.0526

Great Britain GBP 12.9042 11.2976 12.3848 12.1451

South Africa ZAR 0.6641 0.6320 0.5433 0.6722

South Korea KRW 0.0075 0.0065 0.0071 0.0071

United States USD 8.4370 6.8582 8.3537 7.8130

New accounting policies for 2015

There are no new accounting principles and interpretations that came into

effect as of January 1, 2015 that significantly effects the Volvo Group’s

financial statements.

New accounting policies for 2016 and later

A number of accounting standards and interpretations have been pub-

lished, but have not yet become effective.

IFRS 9 Financial instruments

IFRS 9 is divided in three parts: Classification and Measurement, Im -

pairment and Hedge Accounting, and will replace the current IAS 39

Financial instruments: recognition and measurement. The Volvo Group is

currently assessing the effect of IFRS 9 and are expecting the greatest

impact from the transition to the new expected credit loss model, however

the impact is not yet quantifiable. The mandatory effective date is January

1, 2018, with earlier application allowed.

IFRS 15 Revenue from Contracts with Customers

IFRS 15 represent a new framework for recognising revenue with addi-

tional disclosure requirements. The framework establishes principles

about the nature, amount, timing and uncertainty of revenue and cash

flow arising from an entity’s contracts with customers. IFRS 15 will replace

current IAS 11 Construction contracts and IAS 18 Revenue. The Volvo

Group is assessing the impact of the IFRS 15 and monitors any state-

ments from the IASB and FASB Joint transition resource group for reve-

nue recognition as well as amendments to the standard. Areas in focus

for the Volvo Group are for example accounting for repurchase commit-

ments and service contracts, where the guidance in IFRS 15 is more

explicit than under IAS 18. The mandatory effective date is January 1,

2018, with earlier application allowed.

IFRS 16 Leases

IFRS 16 Leases was published in January 2016 and are replacing the

former IAS 17 Leases and the related interpretations IFRIC 4, SIC-15 and

SIC-27. The accounting for lessors will in all material aspects be

unchanged, however the accounting for lessees will change. There will no

longer be a distinction between operating and finance lease, all leases

will be recognized on the balance sheet except for short-term leases and

those of minor value. The model reflects that, at the start of a lease, the

lessee obtains the right to use an asset for a period of time and has an

obligation to pay for that right. The standard is effective for annual periods

beginning on or after 1 January 2019. Early adoption is permitted. Volvo

Group will assess the impact of IFRS 16, however it can already now be

concluded that the balance sheet for Volvo Group will increase.

IFRS 9, IFRS 15 and IFRS 16 has not yet been adopted by the EU when

this Annual Report is published.

Other new or revised accounting standards are not considered to have

a material impact on the Volvo Group’s financial statements.

GROUP PERFORMANCE 2015 NOTES

112