Volvo 2015 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

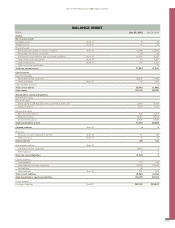

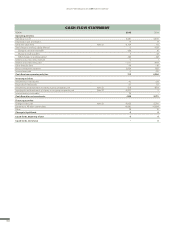

Parent Company AB Volvo

Corporate registration number 556012-5790.

Amounts in SEK M unless otherwise specified. Amounts within parentheses refer to the preceding year, 2014.

Board of Directors’ report

AB Volvo is the Parent Company of the Volvo Group and its operations

comprise of the Group’s head office with staff together with some corpo-

rate functions.

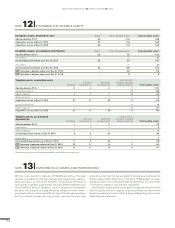

Income from investments in Group companies include dividends

amounting to 1,061 (6,826) and transfer price adjustments and royalties

amounting to an expense of 775 (1,120).

Capital gain from divestment of the holding in Eicher Motors Ltd.

amounted to 4,608. Reversal of revaluation to market value amounted to

3,995 and is recognized in other comprehensive income.

The carrying value of shares and participations in Group companies

amounted to 60,766 (61,283), of which 60,092 (60,241) pertained to

shares in wholly owned subsidiaries. The corresponding shareholders’

equity in the subsidiaries (including equity in untaxed reserves but exclud-

ing minority interests) amounted to 103,382 (101,274).

During 2015 AB Volvo acquired 45 % of the Chinese automotive manu-

facturer Dongfeng Commercial Vehicles Co., Ltd. to the value of 7,197.

The holding is recognized as an investment in associated company.

Total investments by year end in joint ventures and associated compa-

nies included 10,392 (3,317) in joint ventures and associated companies

that are recognized in accordance with the equity method in the consoli-

dated accounts. The portion of shareholders’ equity in joint ventures and

associated companies pertaining to AB Volvo amounted to 8,026 (2,781).

Financial net debt amounted to 42,933 (35,967).

AB Volvo’s risk capital (shareholders’ equity plus untaxed reserves)

amounted to 41,010 (38,290) corresponding to 41% (46%) of total assets.

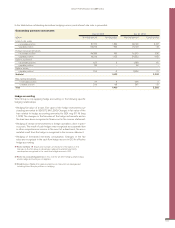

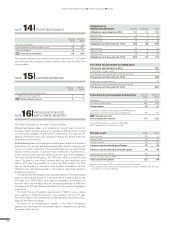

INCOME STATEMENT

SEK M 2015 2014

Net sales Note 2 884 696

Cost of sales Note 2 –884 –696

Gross income 00

Administrative expenses Note 2, 3 –1,342 –1,011

Other operating income and expenses Note 4 –161 –65

Income from investments in Group companies Note 5 288 5,572

Income from investments in joint ventures and associated companies Note 6 84 26

Income from other investments Note 7 4,612 7

Operating income 3,481 4,529

Interest income and similar credits 01

Interest expenses and similar charges Note 8 –1,195 –947

Other financial income and expenses Note 9 –9 –19

Income after financial items 2,277 3,564

Allocations Note 10 12,565 3,505

Income taxes Note 11 –2,103 –379

Income for the period 12,739 6,690

OTHER COMPREHENSIVE INCOME

Income for the period 12,739 6,690

Items that may be reclassified subsequently to income statement:

Available-for-sale investments –3,995 3,037

Other comprehensive income, net of income taxes –3,995 3,037

Total comprehensive income for the period 8,744 9,727

158

GROUP PERFORMANCE 2015 PARENT COMPANY