Volvo 2015 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net sales, SEK M 312,515 282,948

Operating income excl.

restructuring charges, SEK M 25,652 8,393

Operating margin excl.

restructuring charges, % 8.2 3.0

Restructuring charges,SEK M –2,333 –2,569

Operating income, SEK M 23,318 5,824

Operating margin, % 7.5 2.1

Income after financial items, SEK M 20,418 5,089

Income for the period, SEK M 15,099 2,235

Diluted earnings per share, SEK 7.41 1.03

Dividend per share, SEK 3.0013.00

1 According to the Board’s proposal.

Operating cash flow,

Industrial Operations, SEK bn 18.3 6.4

Return on shareholders’ equity, % 18.4 2.8

Total number of employees 99,501 104,571

Share of women, % 18 18

Share of women,presidents and

other senior executives, % 21 21

Employee Engagement Index, % 71 72

Energy consumption, MWh/SEK M 6.9 7.9

CO2 emissions, tons/SEK M 0.7 0.8

Water consumption, m3/SEK M 16.2 18.1

Share of direct material purchasing

spend from suppliers having made a

CSR self- assessment, % 86 80

KEY RATIOS 2015 2014 KEY RATIOS 2015 2014

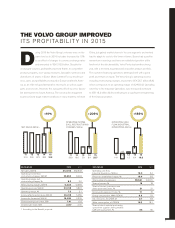

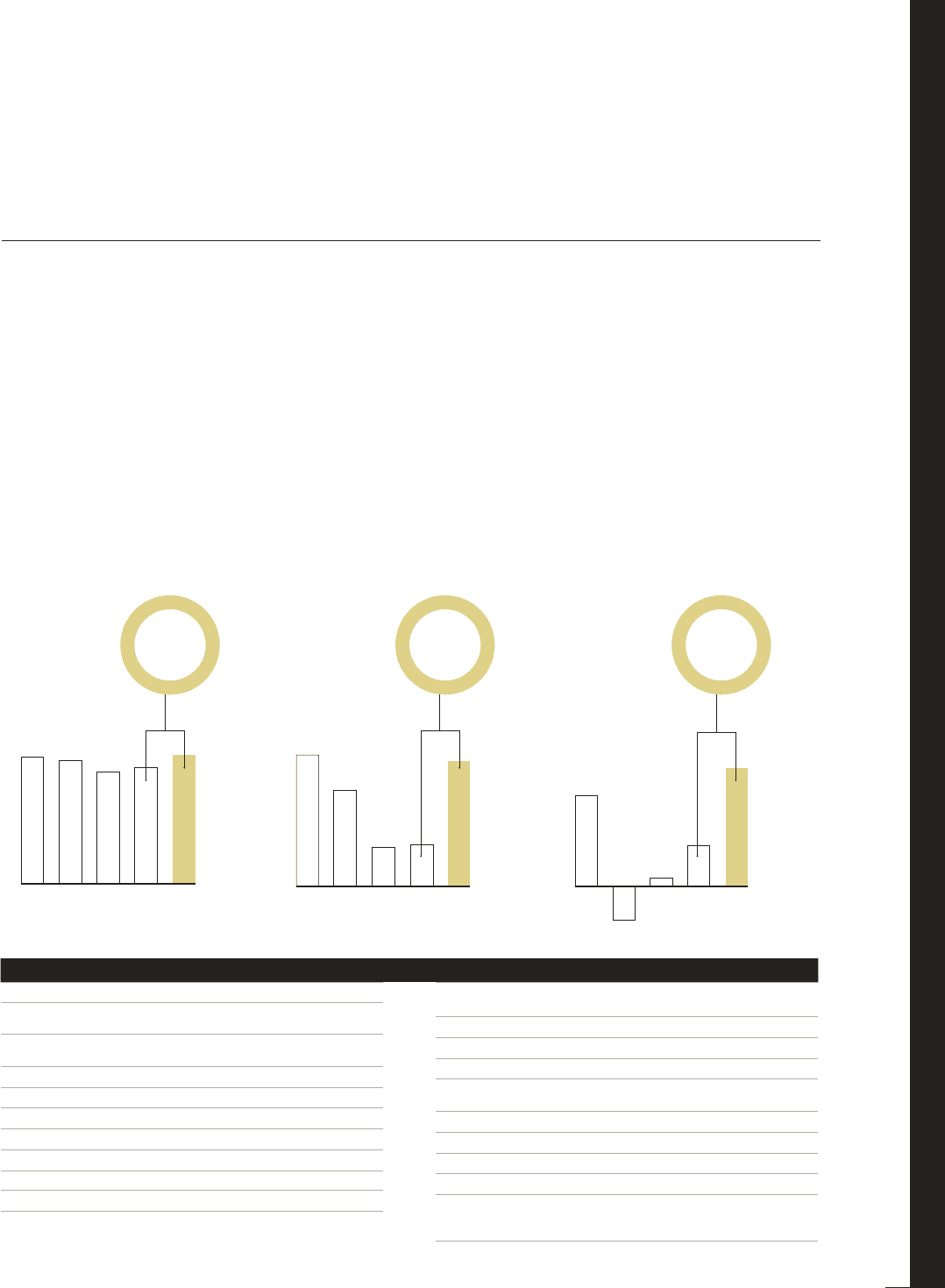

THE VOLVO GROUP IMPROVED

ITS PROFITABILITY IN 2015

NET SALES, SEK bn

13 141211

273 283300310

15

313

OPERATING INCOME

EXCL. RESTRUCTURING

CHARGES, SEK bn

11

26.9

13

7.9

14

8.4

15

25.7

12

19.6

OPERATING CASH

FLOW, INDUSTRIAL

OPERATIONS, SEK bn

14 15131211

6.4 18.31.5

–4.9

14.1

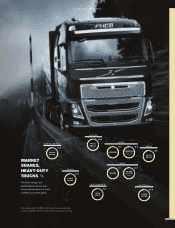

During 2015 the Volvo Group’s volumes were on the

same level as in 2014, but sales increased by 10%

as an effect of changes in currency exchange rates

and amounted to SEK 312.5 billion. Despite the

unchanged volumes, profitability improved thanks to competitive

product programs, cost-saving measures, favorable currencies and

divestitures of shares in Eicher Motor Limited. For our truck busi-

ness, sales and profitability increased in Europe and North Amer-

ica as an effect of good demand for new trucks as well as spare

parts and services. However, this was partly offset by a less favora-

ble development in South America. The construction equipment

business faced tough market conditions in many markets, not least

China, but gained market shares in its core segments and worked

hardto adapt its costs to the lower volumes. Buses had a positive

momentum in earnings and have an established position at the

forefront of theelectromobility. Volvo Penta had another strong

year, with a renewed, expanded and innovative product portfolio.

Thecustomer financing operations developed well with a good

profit and return on equity. The Volvo Group’s operating income,

excluding restructuring charges, improved to SEK 25.7 billion (8.4),

which corresponds to an operating margin of 8.2% (3.0). Operating

cashflow in the Industrial Operations was strong and increased

toSEK 18.3 billion (6.4) contributing to a significant strengthening

of the financial position.

+10% +206% +186%

1