Volvo 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Environmental

The Volvo Group takes pride in being a leader in the area of envi-

ronmental care. The Volvo Group could be at risk for complaints

and legal actions initiated by customers, employees and other

third parties alleging environmental related issues. Environmental

legislation is fast changing and there are increased demands in

many areas, for instance chemical management as well as on

emission standards for the vehicles themselves. The Group

invests a great deal of resources to adhere to different legislation

throughout the entire value chain. Recent developments in inter-

national standards in environmental and quality management are

further emphasizing the need for risk management in these areas.

Even if potential issues in these areas are resolved and handled

without adverse financial impacts they could have a negative

impact on Group reputation and diverting resources that would

have come to better use in the Group’s development.

FINANCIAL RISKS

The Volvo Group is exposed to various types of financial risks.

Group-wide policies, which are updated and decided upon annu-

ally, form the basis of each Group company’s management of

these risks. The objectives of the Group’s policies for manage-

ment of financial risks are to optimize the Group’s capital costs by

utilizing economies of scale, to minimize negative effects on

income as a result of changes in currency or interest rates, to

optimize risk exposure and to clarify areas of responsibility. Moni-

toring and control that established policies are adhered to is con-

tinuously conducted. Information about key aspects of the Group’s

system for internal controls in conjunction with the financial

reporting is provided in the Corporate Governance Report on

page 168. Most of the Volvo Group’s financial transactions are

carried out through the in-house bank, Volvo Treasury, which con-

ducts its operations within established risk mandates and limits.

Customer credit risks are mainly managed by the different busi-

ness areas. The nature of the various financial risks and objec-

tives and the policies for the management of these risks are

described in detail in notes 4 and 30. Various aspects of financial

risk are described briefly in the following paragraphs.

Interest-related risk

Interest-related risk includes risks that changes in interest rates

will impact the Group’s income and cash flow (cash-flow risks) or

the fair value of financial assets and liabilities (price risks).

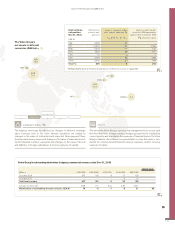

Currency-related risk

More than 90% of the net sales of the Volvo Group are generated

in countries other than Sweden. A majority of the Group’s costs

also stems from other countries than Sweden. To reduce currency

exposure, the Volvo Group strives to have manufacturing located

in the major markets. However, changes in exchange rates have a

direct impact on the Volvo Group’s operating income, balance

sheet and cash flow, as well as an indirect impact on Volvo’s com-

petitiveness, which over time affects the Group’s earnings.

Credit-related risk

There are three main areas of credit risks for the Volvo Group.

Firstly, within its Industrial Operations the Group sells products with

open credits to customers and issues credit guarantees for cus-

tomers’ commercial vehicles and equipment. The majority of the

outstanding credit guarantees at year-end relates to Chinese retail

customers within Construction Equipment. Secondly, the customer

finance activity in Volvo Financial Services manages a significant

credit portfolio, equivalent to SEK 123 billion at year-end 2015. The

portfolio is largely secured by the title to the financed commercial

vehicles and equipment. However, in the case of customer default,

the value of the repossessed commercial vehicles and equipment

may not necessarily cover the outstanding financed amount. Lastly,

a part of the Group’s credit risk is related to the investment of the

financial assets of the Group. The majority has been invested in

interest-bearing securities issued by Swedish real estate financing

institutions or deposited with the Group’s core banks.

Liquidity risk

The Volvo Group strives to have a sound preparedness by always

having liquid funds and committed facilities to cover the Group’s

expected liquidity needs for a period of 12–18 months in a sce-

nario with no access to capital markets.

Market risk from investments in shares or similar

instruments

The Volvo Group has invested in listed shares with a direct expo-

sure to the capital markets. The majority of this exposure is relat-

ing to the investments in Deutz AG and Inner Mongolia North

Hauler Joint Stock Co., Ltd. Please see note 5 for further informa-

tion. Furthermore, the Volvo Group is indirectly exposed to market

risks from shares and other similar instruments as a result of cap-

ital in independent pension plans with asset management with

exposure to these types of instruments. Please see note 20 for

further information.

Impairment

The Volvo Group verifies annually, or more frequently if necessary,

the goodwill value and other intangible assets upon indication for

possible impairment. The size of the overvalue differs between the

business areas and they are, to a varying degree, sensitive to

changes in the business environment. Instability in the business

recovery and volatility in interest and currency rates may lead to

indications of impairment. For further information on intangible

assets, see note 12.

GROUP PERFORMANCE BOARD OF DIRECTORS’ REPORT 2015 RISKS AND UNCERTAINTIES

Further information

Note 27 Personnel contains information concerning rules

on severance payments applicable for the Group Executive

Team and certain other senior executives.

Note 4 and 30 contain information regarding financial risks as

well as goals and policies in financial risk management.

Further risk information is provided in note 24.

Information about licensable facilities in Sweden is provided

on page 33.

109