Volvo 2015 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

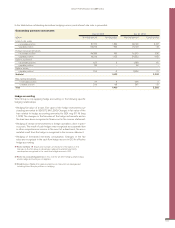

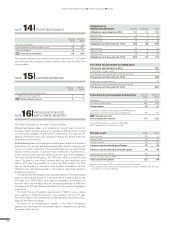

Other provisions include provisions for restructuring measures of 11 (20).

OTHER PROVISIONS

NOTE

17

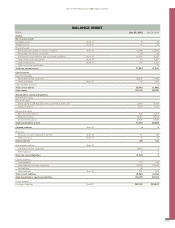

Non-current debt matures as follows:

2020 8,384

2022 or later 5,592

B/S Total non-current liabilities 13,976

NON-CURRENT LIABILITIES

NOTE

18

Dec 31,

2015 Dec 31,

2014

Wages, salaries and withholding taxes 184 150

VAT liabilities 1 –

Accrued expenses and prepaid income 162 136

Other liabilities 34 22

B/S Total other liabilities 381 308

No collateral is provided for current liabilities.

OTHER LIABILITIES

NOTE

19

Contingent liabilities as of December 31, 2015, amounted to 282,175

(279,807) of which 282,164 (279,796) pertained to Group companies.

Credit guarantees are included to an amount corresponding to the

credit limits. Credit guarantees amounted to 272,432 (270,616). The total

amount pertained to Group companies.

The utilized portion at year end amounted to 124.526 (134,504), of

which 124.514 (134,493) pertained to Group companies.

CONTINGENT LIABILITIES

NOTE 20

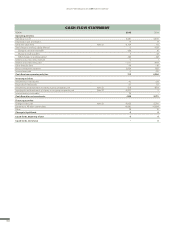

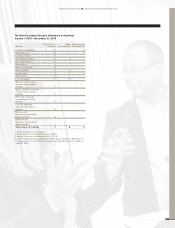

Other non-cash items 2015 2014

Revaluation of shareholdings 110 155

Gains on sale of shares –4,746 0

Transfer price adjustments, net –104 –132

Anticipated dividend –419 –

Other changes 55 90

Total Other items not affecting cash flow –5,104 113

Further information is provided in Notes 5 Income from investments in

Group companies, 6 Income from investments in joint ventures and asso-

ciated companies and 7 Income from other investments.

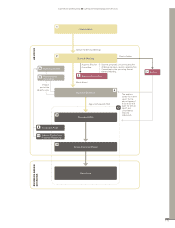

NOTE 21 CASH-FLOW

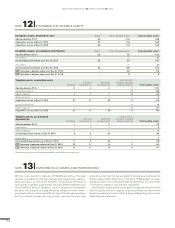

Volvo Group applies IAS 19 Employee Benefits in the consolidated finan-

cial statements. This implies differences, which may be significant, in the

accounting of defined-benefit pension plans as well as in the accounting

of plan assets invested in the Volvo Pension Foundation.

The accounting principles for defined-benefit plans differ from IAS19

mainly relating to:

• Pension liability calculated according to Swedish accounting principles

does not take into account future salary increases.

• The discount rate used in the calculations is set by PRI Pensions garanti

and Finansinspektionen, respectively.

• Changes in the discount rate, actual return on plan assets and other

actuarial assumptions are recognized directly in the income statement

and in the balance sheet.

• Deficit must be either immediately settled in cash or recognized as a

liability in the balance sheet.

• Surplus cannot be recognized as an asset, but may in some cases be

refunded to the Company to offset pensions costs.

Change in loans, net

Increase in loans is related to loans from Volvo Treasury AB by 13,973

(–) and the company’s liability in the group account at Volvo Treasury AB

which has decreased by 7,020 (increased by 2,291).

Acquired and divested shares in

non-Group companies, net 2015 2014

Acquisitions –7,047 –1

Divestments 4,840 –

Total cash flow from acquired and divested

shares in non-Group companies, net –2,207 –1

Acquisitions and divestments of participations in non-Group companies

are presented in Note 13 Investments in shares and participations.

Acquired and divested shares in

Group companies, net 2015 2014

Acquisitions – –685

Divestments 519 31

Total cash flow from acquired and divested

shares in Group companies, net 519 –654

Acquisitions and divestments of participations in Group companies are

shown in Note 13 Investments in shares and participations.

167

GROUP PERFORMANCE 2015 PARENT COMPANY NOTES