Volvo 2015 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

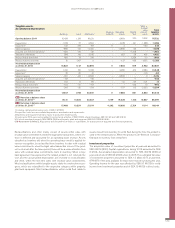

ACCOUNTING POLICY

Credit loss reserves

The assessment of credit loss reserves on customer-financing receiva-

bles is dependent on estimates including assumptions regarding past

dues, repossession rates and the recovery rate on the underlying collater-

als. The impairment requirement is primarily evaluated for each respective

asset. If, based on objective grounds, it cannot be determined that one or

more assets are subject to an impairment loss, the assets are grouped in

units based, for example, on similar credit risks to evaluate the impairment

loss requirement collectively. This is in order to cover credit losses incurred

but not yet individually identified in a larger population. Individually

impaired assets or assets impaired during previous periods are not

included when grouping assets for collective assessment. If the condi-

tions that gave rise to the recognition of an impairment loss later prove to

no longer be valid the impairment loss is reversed in the income statement

as long as the carrying amount does not exceed the amortized cost at the

time of the reversal.

As of December 31, 2015, the total credit loss reserves in the Cus-

tomer Finance segment amounted to 1.41% (1.33) of the total credit port-

folio in the segment. This reserve ratio, which is used as an important

measure for the Customer Finance segment, includes operating leases

and inventory, whereas this note specifies the balance sheet item Cus-

tomer Finance receivables for the Volvo Group and thereby excludes

operating leases and inventory as they are recognized elsewhere in the

balance sheet.

Read more in Note 4 for a description of the credit risk, interest and currency

risks and in Note 30 for further information regarding customer-financing

receivables.

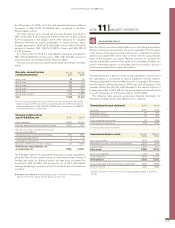

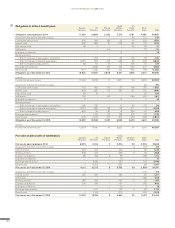

Non-current customer-financing

receivables Dec 31,

2015 Dec 31,

2014

Installment credits 29,580 28,055

Financial leasing 21,325 21,820

Other receivables 57 1,455

B/S Non-current customer-

financing receivables 50,962 51,331

The effective interest rate for non-current customer-financing

receivables amounted to 4.65% (4.96) as of December 31, 2015.

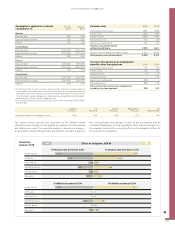

15:1

SOURCES OF ESTIMATION UNCERTAINTY

!

Interest income on the customer- financing receivables is recognized

within Net sales. Changes to the credit loss reserves are recognized in

Other operating income and expense.

15:2

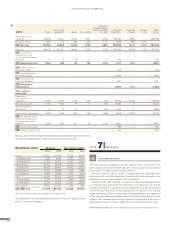

2019

8,929

2020

3,645

2018

15,173

2017

21,803

2021 or later

1,412

Non-current customer- financing

receivables maturities

SEK M

NOTE 15 CUSTOMER-FINANCING RECEIVABLES

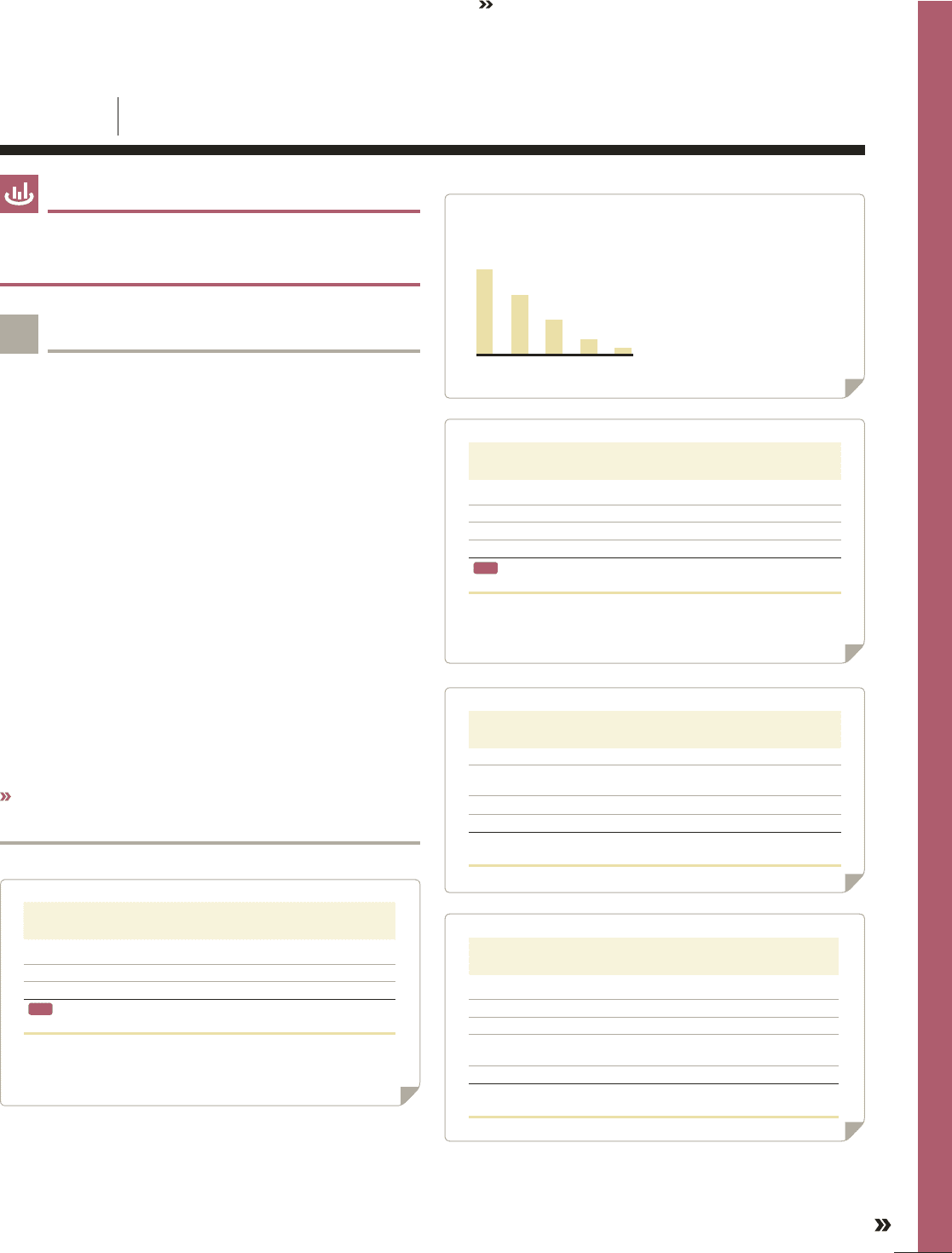

15:3

Current customer-financing

receivables Dec 31,

2015 Dec 31,

2014

Installment credits 16,053 14,611

Financial leasing 12,948 14,617

Dealerfinancing 21,989 17,562

Other receivables 631 1,046

B/S Current customer financing

receivables 51,621 47,836

The effective interest rate for current customer-financing receiv-

ables amounted to 4.74% (5.31) as of December 31, 2015.

15:4

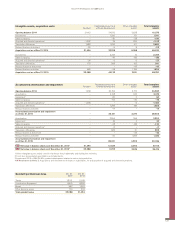

Credit risk in customer-financing

receivables Dec 31,

2015 Dec 31,

2014

Customer-financing receivables gross 104,096 100,616

Valuation allowance for doubtful

customer-financing receivables –1,514 –1,450

Whereof specific reserve –365 –364

Whereof other reserve –1,149 –1,086

Customer-financing receivables,

net of allowance 102,583 99,166

15:5

Change of valuation allowance for doubt-

ful customer-financing receivables 2015 2014

Opening balance 1,450 1,179

New valuation allowance charged to income 745 1,081

Reversal of valuation allowance charged to income –56 –161

Utilization of valuation allowance related to

actual losses –549 –752

Translation differences –76 103

Valuation allowance for doubtful customer-

financing receivables as of December 31 1,514 1,450

GROUP PERFORMANCE 2015 NOTES

135