Volvo 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

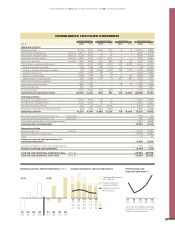

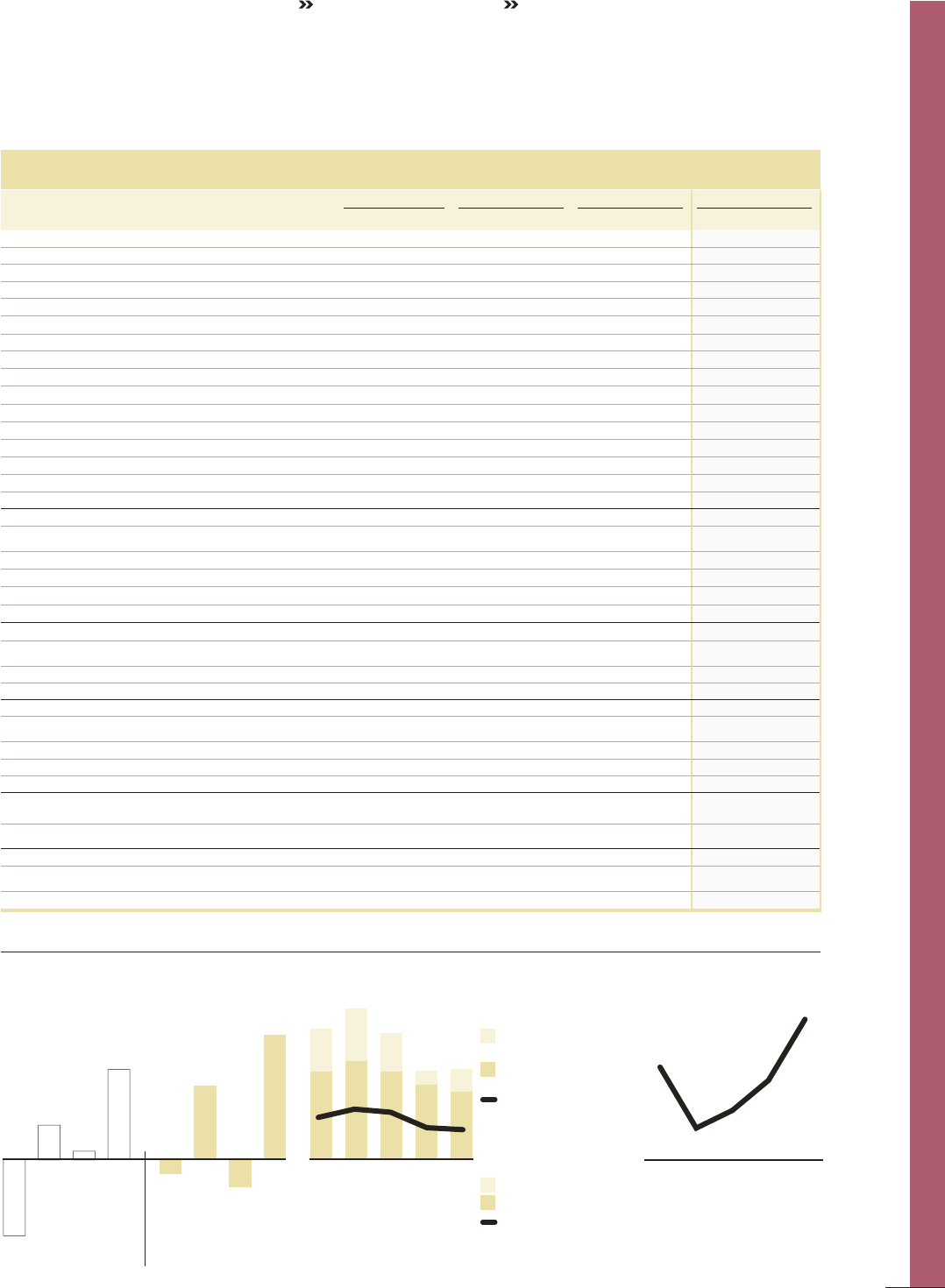

CONSOLIDATED CASH FLOW STATEMENTS

Industrial operations Customer Finance Eliminations Volvo Group Total

SEK M 2015 2014 2015 2014 2015 2014 2015 2014

Operating activities

Operating income 21,313 4,103 2,006 1,712 2 8 23,321 5,823

Depreciation tangible assets Note 13 6,431 6,701 13 15 – – 6,443 6,716

Amortization intangible assets Note 12 3,314 3,503 31 31 – – 3,344 3,534

Depreciation leasing vehicles Note 13 2,830 2,470 4,190 3,211 0 –1 7,020 5,680

Other non-cash items Note 29 –1,083 5,288 796 888 –165 –35 –452 6,141

Total change in working capital whereof –1,979 –3,272 –7,485 –4,772 315 –6,059 –9,149 –14,103

Change in accounts receivable 642 1,346 –126 –133 –2 – 514 1,213

Change in customer-financing receivables 140 –144 –8,346 –4,740 –108 –5,756 –8,313 –10,640

Change in inventories –2,234 –1,594 –90 –28 0––2,324–1,622

Change in trade payables –1,210 –995 114 65 –2 131 –1,098 –799

Other changes in working capital 683 –1,884 963 64 427 –435 2,073 –2,255

Interest and similar items received 374317––1–375317

Interest and similar items paid –1,665 –1,879 – – –18 33 –1,683 –1,846

Other financial items –252–221–––––252–221

Income taxes paid –2,573 –2,680 –531 –624 –5 – –3,110 –3,304

Cash flow from operating activities 26,709 14,331 –981 461 129 –6,055 25,858 8,737

Investing activities

Investments in tangible assets –6,539 –7,079 –22 –14 – – –6,561 –7,093

Investments in intangible assets –2,241 –1,523 –16 –18 – – –2,257 –1,541

Investment in leasing vehicles –328 –470 –10,201 –9,645 – – –10,529 –10,115

Disposals of fixed assets and leasing vehicles 668 1,090 5,356 3,949 –4 –1 6,020 5,038

Operating cash flow 18,270 6,349 –5,865 –5,267 126 –6,056 12,531 –4,973

Investments and divestments of shares, net Note 5, 29 –1, 984 69

Acquired and divested operations, net Note 3, 29 408 7,398

Interest-bearing receivables incl marketable securities 3,552 –4,808

Cash flow after net investments 14,507 –2,314

Financing activities

Change in loans, net Note 29 –13,247 6,686

Dividend to AB Volvo’s shareholders –6,090 –6,084

Other 14 –57

Change in cash and cash equivalents excl.

translation differences –4,815 –1,769

Translation difference on cash and cash equivalents –378 1,044

Change in cash and cash equivalents –5,194 –725

Cash and cash equivalents, beginning of year Note 18 26,242 26,968

Cash and cash equivalents, end of year Note 18 21,048 26,242

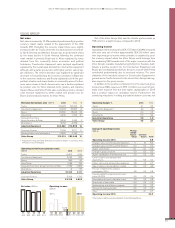

Capital expenditures, Industrial Operations

13

12

11 14

4.1

8.5

4.9

9.5

4.6 3.1

8.5

4.1 5.1 3.7

7.2

1.4

15

2.9

6.5

2.2

Capital expenditures,

% of net sales

Property, plant and

equipment, SEK bn

Capitalized development

costs, SEK bn

Self-financing ratio,

Industrial Operations %

131211

72

14

112 180210

15

316

Cash-flow from operating activities

divided by net investments in fixed

assets and leasing assets.

Operating cash flow, Industrial Operations, SEK bn

20152014

Q4

14.7

Q3

–3.3

Q2

8.6

Q1

–1.7

Q4

10.6

Q3

0.9

Q2

4.0

Q1

–9.0

GROUP PERFORMANCE BOARD OF DIRECTORS’ REPORT 2015 CASH FLOW STATEMENT

87