Volvo 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VFS financial solutions are offered with the sales

of Volvo Group vehicles and equipment, and are

available with other service and aftermarket

products such as service contracts, repair and

maintenance contracts, and insurance, etc.

through seamless integration at the point-of-

sale with Volvo Group dealers. This approach delivers a conven-

ient one stop-shopping experience for the customer.

To ensure successful business execution, VFS continued its

focus on 1) Strengthening customer and dealer partnerships

throughout the product lifecycle, 2) Capturing profitable growth

opportunities, 3) Driving operational excellence in support of inte-

grated point-of-sale customer offerings, 4) Attracting, developing

and retaining high-performing employees, and 5) Optimizing

shareholder return on equity.

VFS’ mission is to be the best captive in industry. To achieve

this mission, VFS aims to be the provider of choice, the employer

of choice, and to deliver strong shareholder value. In 2016, a con-

tinued focus will be on delivering dealer and customer value by

working with our product companies to deliver superior products.

Ease of doing business, outstanding service levels, building rela-

tionships, and unsurpassed expertise in our industries are at the

forefront of achieving this value.

Strong profitability

Despite growing competition and liquidity in our markets, execu-

tion of our commercial strategy resulted in record new business

volume levels and strong portfolio growth. This growth, along with

pricing controls, cost controls and risk management contributed

to record profitability levels for customer finance. During 2015,

STRONG GROWTH, PROFITABILITY

AND PORTFOLIO PERFORMANCE

Volvo Financial Services (VFS) offers competitive financial solutions which strengthen

long-term relationships with Volvo Group customers and dealers. As the number one

provider of financial solutions for Volvo Group product sales, VFS consistently delivers

value to customers and builds loyalty to the Volvo Group brands through our ease of

doing business and our knowledge and expertise of the industry.

VFS achieved its best operational efficiency in its history. Scala-

ble business platforms and higher service levels delivered signifi-

cant operating leverage for VFS by enabling growth without com-

mensurate cost increases.

Strong portfolio performance

During 2015, managed assets in VFS grew to record levels. Over-

all, customer overdues, repossessions, inventories, and write off

levels remained low and supported strong profitability.

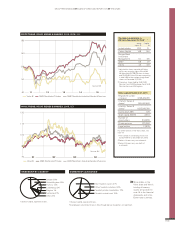

North America continued to perform extremely well while the

majority of our European markets also returned to good levels

during 2015. Downturns in Brazil, China and Russia negatively

impacted portfolio performance during the year, but activities to

drive sales and deliver profitability were executed very well.

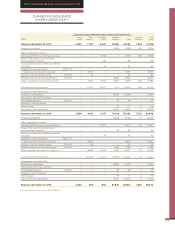

Customer finance operations

The Customer Finance operations recorded strong levels of new

business volume during the year despite weak demand in Brazil

and the other BRIC markets. Total new financing volume in 2015

amounted to SEK 54.8 billion (54.7). Excluding the BRIC markets,

the new business volume increased by 3.9% compared to 2014,

adjusted for changes in exchange rates, driven primarily by strong

performance in North America.

Financing penetration was stable in served markets, but overall

penetration was lower than the prior year mainly due to changes

in market delivery mix. In total, 49,038 new Volvo Group vehicles

and machines (54,819) were financed during the year. In the mar-

kets where financing is offered, the average penetration rate was

25% (28).

The net credit portfolio of SEK 122,606 M (117,101) increased

by 6.5% on a currency adjusted basis when compared to 2014

and reached a new year-end high. The funding of the credit port-

folio is matched in terms of maturity, interest rates and currencies

in accordance with Volvo Group policy. For further information,

see note 4 to the Consolidated financial statements.

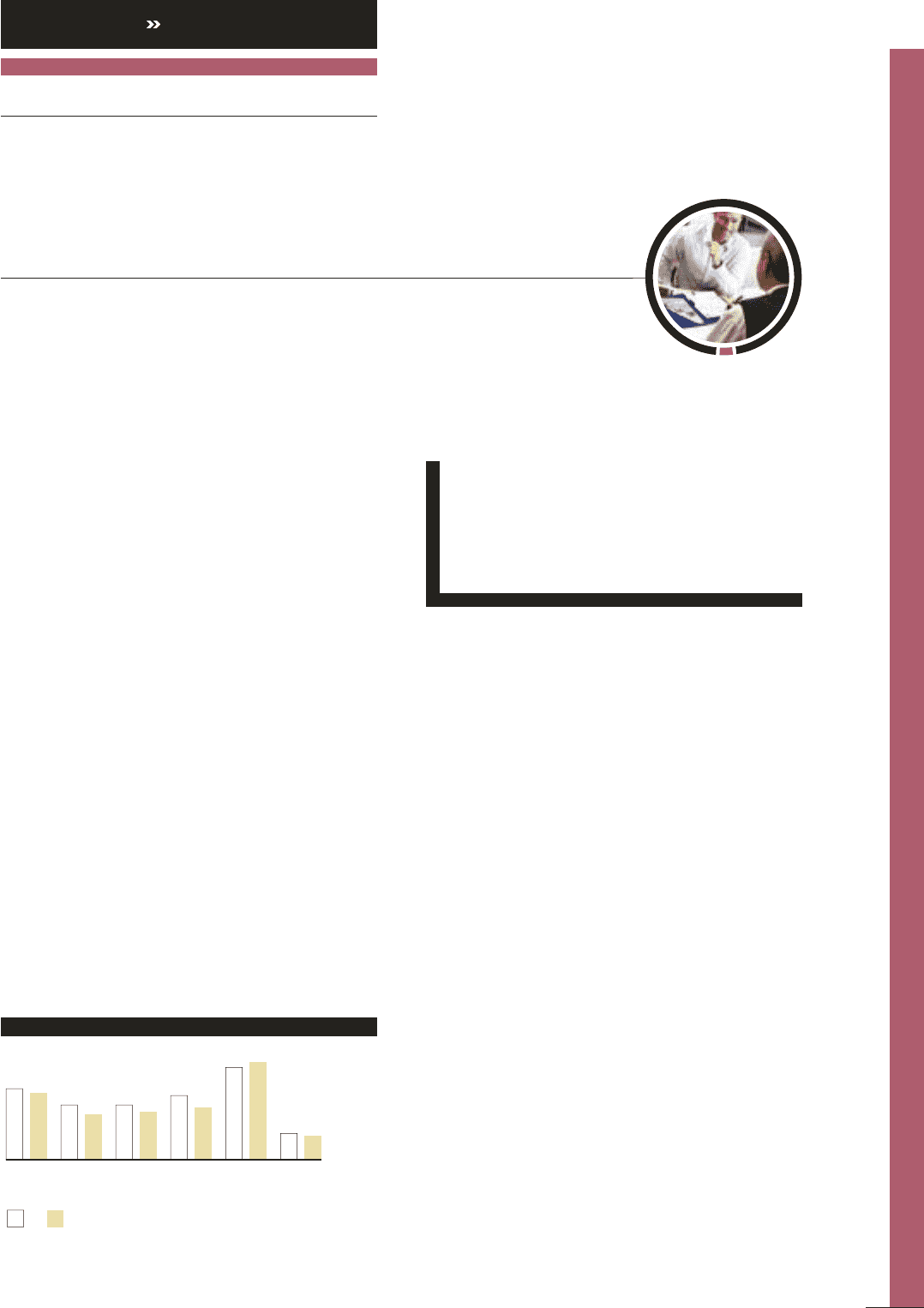

PENETRATION RATE*, %

Volvo

Trucks

Renault

Trucks

Mack

Trucks

Buses Volvo

CE

UD

Trucks

14 15

2830 1923 2023 2227 4139 1011

* Share of unit sales financed by Volvo Financial Services in relation to total number

of units sold by the Volvo Group in markets where financial services are offered.

GROUP PERFORMANCE BOARD OF DIRECTORS’ REPORT 2015

VOLVO FINANCIAL SERVICES

VFS conducts customer financing in 44 countries in the world.

Position on world market Volvo Financial Services operates

exclusively to support the sales of vehicles and equipment which

are produced by the Volvo Group. In doing so, VFS enhances the

competitiveness of Volvo Group products and helps secure loyalty

to the Volvo Group brands.

Number of regular employees 1,340 (1,339)

Share of Group net sales,

3% (3)

99