Volvo 2015 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

140

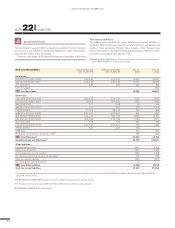

GROUP PERFORMANCE 2015 NOTES

USA

In the US, the Volvo Group has tax-qualified pension plans, post-retire-

ment medical plans and non-qualified pension plans. The tax-qualified

pension plans are funded while the other plans are generally unfunded.

The Volvo Group’s subsidiaries in the United States mainly secure their

pension obligations through transfer of funds to pension plans. At the end

of 2015, the total value of pension obligations secured by pension plans

of this type amounted to SEK 17,386 M (16,238). At the same point in

time, the total value of the plan assets in these plans amounted to SEK

15,774 M (15,215), of which 48% (54) was invested in equity instruments.

The regulations for securing pension obligations stipulate certain mini-

mum levels concerning the ratio between the value of the plan assets and

the value of the obligations. During 2015, the Volvo Group contributed

SEK 397 M (736) to the American pension plans.

France

In France, the Volvo Group has two types of defined benefit plans, Indem-

nité de Fin de Carrière (IFC) and jubilee award plan. The plans are

unfunded. The retirement indemnities plan is compulsory in France. The

benefits are based on the Collective Bargaining Agreement applicable in

the company, on the employee’s seniority at retirement date and on the

final pay. The benefit payment is due only if employees are working for the

company when they retire. The jubilee awards plan is an internal agree-

ment. The benefit is based on the employee’s seniority career at 20, 30,

35 and 40 years. As of December 31, 2015 the total value of pension

obligations amounted to SEK 2,574 M (2,849).

Great Britain

The Volvo Group has five defined benefit pension plans in Great Britain.

The plans are funded. The defined benefit pension plans provides bene-

fits which are linked to each member’s final pay at the earlier of their date

of leaving or retirement. All plans are closed to new entrants and two of

the plans are closed to future accrual. Members of the plan also have the

option to commute an amount of their pension benefit as cash at retire-

ment as permitted by UK legislation.

The pension funds are set up as separate legal entities, which are gov-

erned by trustees who are responsible for the governance of the plan. The

trustee boards are composed of representatives from the employer, the

employees and independent trustees. The strategic allocation of plan assets

must comply with the investment guidelines agreed by the trustees of the

respective schemes. If a net surplus is recognized in the balance sheet when

the pension scheme runs-off the Volvo Goup has an unconditional right to

the surplus of that plan or plans.

At the end of 2015, the total value of pension obligations secured by

pension plans amounted to SEK 6,820 M (6,671). The total value of the plan

assets in these plans amounted to SEK 6,847 M (6,772).

During 2015, the Volvo Group has made extra contributions to the pen-

sion plans in Great Britain in the amount of SEK 107 M (98).

Sweden

The main defined benefit plan in Sweden is the ITP2 plan and it is based

on final salary. The plan is semi-closed, meaning that only new employees

born before 1979 have the possibility to choose the ITP2 solution. The

Volvo Group’s pension foundation in Sweden was formed in 1996 to

secure obligations relating to retirement pensions for white-collar workers

in Sweden in accordance with the ITP plan. Plan assets amounting to SEK

2,456 M were contributed to the foundation at its formation, correspond-

ing to the value of the pension obligations at that time. Since its formation,

net contributions of SEK 3,167 M, whereof SEK 216 M during 2015, have

been made to the foundation. The plan assets in the Volvo Group’s Swed-

ish pension foundation are invested in Swedish and foreign stocks and

mutual funds, and in interest-bearing securities, in accordance with a dis-

tribution that is determined by the foundation’s Board of Directors. As of

December 31, 2015, the fair value of the foundation’s plan assets

amounted to SEK 10,249 M (9,490), of which 47% (49) was invested in

equity instruments. At the same date, retirement pension obligations

attributable to the ITP plan amounted to SEK 12,915 M (15,369).

Swedish companies can secure new pension obligations through

balance-sheet provisions or pension-fund contributions. Furthermore, a

credit insurance policy must be taken out for the value of the obligations.

In addition to benefits relating to retirement pensions, the ITP plan also

includes, for example, a collective family pension, which the Volvo Group

finances through an insurance policy with the Alecta insurance company.

According to an interpretation from the Swedish Financial Reporting

Board, this is a multi-employer defined-benefit plan. For fiscal year 2015,

the Volvo Group did not have access to information from Alecta that would

have enabled this plan to be recognized as a defined-benefit plan. Accord-

ingly, the plan has been recognized as a defined-contribution plan. The

Volvo Group estimates it will pay premiums of about SEK 297 M to Alecta

in 2016. The collective consolidation level measures the apportionable

assets in relation to the insurance commitment. According to Alecta’s

consolidation policy for defined-benefit pension insurance, the collective

consolidation level is normally allowed to vary between 125% and 155%.

Alecta’s consolidation ratio amounts to 153% (143). If the consolidation

level falls short or exceeds the normal interval one measure may be to

increase the contract price for new subscription and expanding existing

benefits or introduce premium reductions.

The Volvo Group’s share of the total saving premiums for ITP2 in Alecta

as at December 31, 2015 amounted to 0.29% (0.47) and the share of the

total number of active policy holders amounted to 1.82% (1.85).

During 2015 the Volvo Group reviewed all the assumptions regarding

the Swedish pension plan where the consequence was a lower pension

obligation, excluding any variation in the discount rate, and a future lower

service cost in the income statement.

All employees in Sweden benefit from a jubilee awards plan according

to which they receive a certain number of shares after they have rendered

25, 35 and 45 years of services. This plan is accounted for as a share-

based payments.

Read more in Note 27 Personnel about accounting policy on share-based

payments.