Volvo 2015 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204

|

|

GROUP PERFORMANCE 2015 NOTES

157

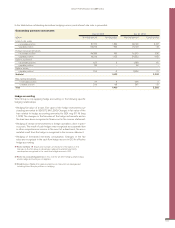

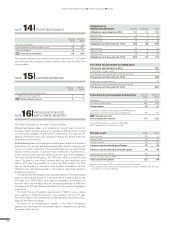

In the table below outstanding derivatives hedging currency and interest rate risks is presented.

Outstanding derivative instruments

Dec 31, 2015 Dec 31, 2014

SEK M Nominal amount Carrying value Nominal amount Carrying value

Interest-rate swaps

– receivable position 87,712 1,824 86,136 2,137

– payable position 66,793 –763 70,109 –72

Foreign exchange derivatives

– receivable position 44,386 793 16,272 675

– payable position 16,019 –333 24,332 –432

Options purchased

– receivable position 627 5 1,788 65

– payable position 84 – 36 –

Options written

– payable position 755 –3 2,636 –71

Subtotal 1,522 2,302

Raw material derivatives

– receivable position 27 6 208 3

– payable position 236 –68 267 –23

Total 1,460 2,282

Hedge accounting

Volvo Group is only applying hedge accounting on the following specific

hedging relationships:

• Hedging fair value of a loan. Fair value of the hedge instruments out-

standing amounted to SEK 872 M (1,290). Changes in fair value of the

loan related to hedge accounting amounted to SEK neg 611 M (neg

1,022). The changes in the fair value of the hedge instruments and on

the loan have been recognized in finance net in the income statement.

• Hedging of certain net investments in foreign operations done in previ-

ous years. The result of such hedges was recognized as a separate item

in other comprehensive income. In the event of a divestment, the accu-

mulated result from the hedge is recognized in the income statement.

• Hedging of forecasted electricity consumption. Changes in the fair

value are recognized in the cash flow hedge reserve in OCI for effective

hedge accounting.

Refer to Note 19 Equity and numbers of shares for information on the

changes in the fair value on derivatives hedging forecasted electricity

consumption recognized in the cash flow hedge reserve in OCI.

Refer to accounting policies in this note for all other hedging relationships

where hedge accounting is not applied.

Read more in Note 4 for goals and policies in financial risk management

including Volvo Group’s policies on hedging.