Volvo 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

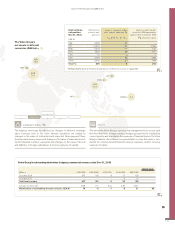

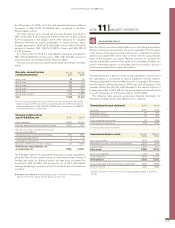

Other shares and participations

During the year the Volvo Group sold the total holding in the listed Indian

automotive manufacturer, Eicher Motors limited. The sale generated a

capital gain of SEK 4.6 billion. The carrying amount of the Volvo Group’s

holding of shares and participations in other companies as of December

31, 2015, is disclosed in the table below.

Read more in Note 30 Financial Instruments regarding financial assets

classified as available for sale.

Holding of shares

in listed companies Percentage

holding

Dec 31,

2015

Carrying

value

Dec 31,

2014

Carrying

value

Eicher Motors Ltd., India – – 4,228

Holdings in Japanese companies – 348 290

Holdings in other listed companies – 160 25

Holding of shares in listed companies 507 4,543

Holding of shares in non-listed companies 394 474

B/S Other shares and participations 902 5,017

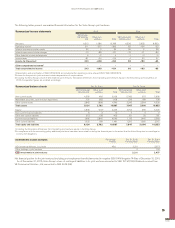

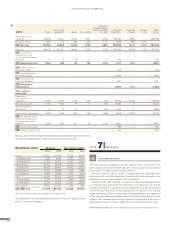

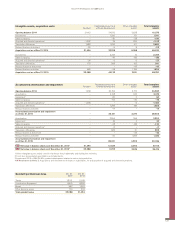

Income/loss from investments in joint

ventures and associated companies 2015 2014

Income/loss joint ventures

VECV 115 45

Other joint ventures –87 –64

Subtotal 28 –19

Income/loss associated companies

DFCV –276 –

Deutz AG 45 32

Other companies 48 50

Subtotal –183 82

Revaluation, write-down and gain on divestment

of shares associated companies

Other companies 12 –17

Subtotal 12 –17

I/S Income/loss from investments in joint

ventures and associated companies

1–143 46

1 Income/loss from investments in joint ventures include Volvo Group’s share of

depreciation of surplus values of SEK 35 M (29) and associated companies

include depreciation of surplus values of SEK 71 M (9).

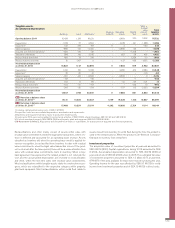

The following tables present summarized financial information for the Volvo Group’s associated companies:

Summarized income

statements

2015 2014

DFCV Deutz AG Other associated

companies Total DFCV Deutz AG Other associated

companies Total

Net sales 33,606 12,089 5,630 51,324 – 10,411 4,038 14,450

Operating income –930 84 181 –664 – 220 207 427

Income for the period1–613 179 97 –338 – 110 156 266

Other comprehensive income2– 24 – 24 ––34 ––34

Total comprehensive income –613 203 97 –313 – 76 156 232

1 Income for the period in associated companies include depreciation of surplus values.

2 Including the Volvo Group’s share of OCI related to associated companies. Translation differences from translating associated companies’ equity in the Volvo Group are

excluded.

Summarized balance sheets Dec 31, 2015 Dec 31, 2014

DFCV1Deutz AG2Other associated

companies Total DFCV1Deutz AG2Other associated

companies Total

Non-current assets 18,107 7,002 2,264 27,373 – 6,847 1,707 8,554

Current assets 20,131 4,435 4,960 29,527 – 5,305 2,027 7,332

Total assets 38,238 11,437 7,225 56,900 – 12,152 3,734 15,886

Equity 15,265 5,902 2,767323,934 – 5,446 1,035 6,481

Non-current liabilities 2,264 2,865 738 5,867 – 3,325 1,146 4,471

Current liabilities 20,709 2,670 3,720 27,099 – 3,381 1,553 4,934

Total equity and liabilities 38,238 11,437 7,225 56,900 – 12,152 3,734 15,886

1 DFCV was acquired during 2015. No dividend was received during financial year 2015.

2 Deutz AG’s equity share is recognized in the Volvo Group with a time lag of one quarter. Dividends of SEK 20 M (0) was received from Deutz AG.

3 Financial statements of Inner Mongolia North Hauler Jont Stock Co, Ltd., China has been included for the first time in 2015.

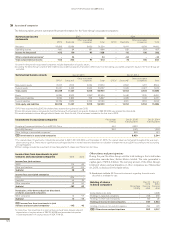

Investments in associated companies Percentage

holding Dec31, 2015

Carrying value Dec 31, 2014

Carrying value

Dongfeng Commercial Vehicles Co., Ltd (DFCV) China 45.0 6,581 –

Deutz AG, Germany

125.0 1,475 1,393

Other holdings in associated companies

2883 951

B/S Investments in associated companies 8,939 2,344

1 The market value of investments in Deutz AG amounted to SEK 1,021 M (1,236) as of December 31, 2015. The market value has fluctuated throughout the year, even

above carrying value. There was no significant or prolonged decline in market value and therefore no indication of impairment during 2015 according to the accounting

principle applied.

2 Other holdings include the investment of Inner Mongolia North Hauler Jont Stock Co, Ltd., China.

Associated companies

124

GROUP PERFORMANCE 2015 NOTES