Volvo 2015 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204

|

|

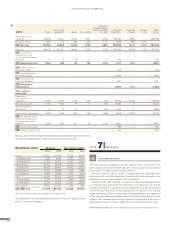

GROUP PERFORMANCE 2015 NOTES

SEK

15.6

GBP 3.0

CNY

11. 4

INR 1.1

EUR

21.1

KRW 3.0

OTHER 11.0

INTEREST-RATE RISKS VALUTARISK ER CREDIT RISKS

FINANCIAL RISKS

OTHER PRICE RISKSLIQUIDITY RISKS

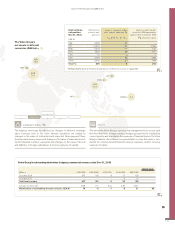

The Volvo Group’s

net assets in different

currencies (SEK bn) =

Market value

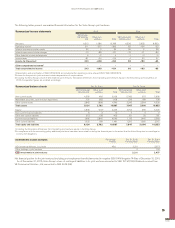

Millions USD/SEK USD/KRW USD/CNY AUD/SEK GBP/SEK

Due date 2016 477 124 9 17 126

Due date 2017 – – – 9 10

Total local currency 477 124 9 25 136

Average contract rate 8.48 1.17 6.41 5.84 12.57

Market value of outstanding forward contracts, SEK M 74 –6 –1 –3 31 95

Volvo Group’s outstanding derivatives hedging commercial currency risks Dec 31, 2015

CURRENCY RISKS B

The balance sheet may be affected by changes in different exchange

rates. Currency risks in the Volvo Group’s operations are related to

changes in the value of contracted and expected future payment flows

(commercial currency exposure), changes in the value of loans and invest-

ments (financial currency exposure) and changes in the value of assets

and liabilities in foreign subsidiaries (currency exposure of equity).

4:2

POLICY

The aim of the Volvo Group’s currency risk management is to secure cash

flow from firm flows through currency hedges pursuant to the established

currency policy, and to minimize the exposure of financial items in the Volvo

Group’s balance sheet. Below is a presentation on how this work is con-

ducted for commercial and financial currency exposure, and for currency

exposure of equity.

INTEREST-RATE RISKS CURRENCY RISKS CREDIT RISKS

FINANCIAL RISKS

OTHER PRICE RISKSLIQUIDITY RISKS

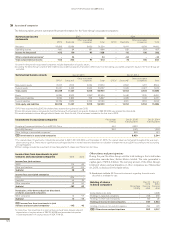

4:1

Risk net finan-

c i a l p o s i t i o n

Dec 31, 2015

SEK M

Net financial

position excl.

pensions

Impact onearnings before

tax if interest rate rises 1%

A (Interest-rate risks)

Impact on Net financial

position if SEK appreciates

against other currencies 10%

B

(Currency risks)

SEK 2,485 22 –

JPY –14,935 –131 1,494

RUB –1,303 –11 130

EUR 7,907 69 –791

CNY –41 0 4

USD 9,676 85 –968

Other –3,440 –30 344

Total C 349 3 214

Read more about the Industrial Operations net financial position on page 83.

JPY 2.9

117