Volvo 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

IMPROVEMENTS FROM

LAST YEAR

INDUSTRIAL OPERATIONS

CONSTRUCTION EQUIPMENT AND VOLVO PENTA

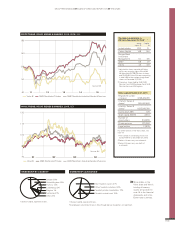

Target Comparison group Preliminary outcome*

The annual organic sales growth for the

construction equipment operations and Volvo

Penta, shall be equal to or exceed a weighted-

average for comparable competitors.

Each year, the operating margin for the

construction equipment operations and Volvo

Penta, shall be ranked among the top two

companies when benchmarked against relevant

competitors.

Brunswick, Caterpillar, CNH Industrial,

Cummins, Deere, Hitachi, Komatsu and

Terex.*

* Deere’s and Terex’s figures are based on rolling

four quarters as of the third quarter of 2015.

The organic sales decreased by 11.8% for the

Volvo Group’s construction equipment opera-

tions and Volvo Penta which was more than the

weighted average of a decrease of 3.8% for the

competitors.

The operating margin of 4.4% for the Volvo

Group’s construction equipment operations

and Volvo Penta was ranked number five in

comparison with the competitors.

Target Comparison group Preliminary outcome*

The annual organic sales growth for the truck

and bus operations shall be equal to or exceed

a weighted-average for comparable competitors.

Each year, the operating margin for the truck

and bus operations shall be ranked among the

top two companies when benchmarked against

relevant competitors.

Daimler, Iveco, MAN, Navistar, Paccar,

Scania and Sinotruk.*

* Daimler’s, Iveco’s, MAN’s and Navistar’s fig-

ures are based on rolling four quarters as of the

third quarter of 2015 and Sinotruk’s figures are

based on rolling four quarters as of the second

quarter of 2015.

The organic sales increased by 3.4% for the

Volvo Group’s truck and bus operations and was

above the weighted average of 1.7% for

the competitors.

The operating margin of 7.7% for the Group’s

truck and bus operations was ranked number

three in comparison with the competitors.

TRUCKS AND BUSES

29.0

13

–0.5

15

14.2

14

0

–

20

25.2

11

29.3

12

40

20

80

60

Net cash Net debt

Target below:

35%

40%

Net financial debt as a percentage

of shareholders’ equity, %

Target and outcome

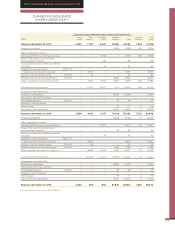

The Industrial Operations’ net financial debt,

excluding pension obligations, shall be below

35% of shareholders’ equity under normal

conditions. At the end of 2015, the Volvo Group

had a financial net cash position of 0.5% of

shareholders’ equity compared with a financial

net debt position of 14.2% at the end of 2014.

INDUSTRIAL OPERATIONS

On January 1, 2013, new accounting

rules for employee benefits came into

effect. As a consequence, AB Volvo’s

Board of Directors decided to exclude

pension obligations from the target. The

new target of 35% corresponds to the

previous financial target of 40% in which

pension obligations were included.

Since 2012 the financial targets for the Volvo Group comprises

growth and profitability of the Group’s various operations measured

and benchmarked annually against competitors. This creates a clear

picture of how the operations are developing compared to the indus-

try. Information on how the comparison with competitors is made is

available under the heading Investors on www.volvogroup.com.

GROUP PERFORMANCE BOARD OF DIRECTORS’ REPORT 2015

FINANCIAL TARGETS

12.1

13

13.4

15

12.5

14

0

7.3

11

12.5

12

15

10

5

Target: 12−15%

Return on shareholders’ equity, %

CUSTOMER FINANCE OPERATIONS

Target and outcome

The target for Customer Finance is a return on shareholders’ equity of 12–15% and an

equity ratio not less than 8%. The return on shareholders’ equity for 2015 amounted to

13.4% (12.5). At year end 2015 the equity ratio was 8.0% (8.0).

101