Volvo 2015 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

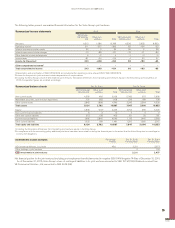

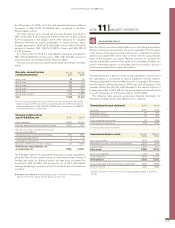

As of December 31, 2015, net of the total valuation allowance, deferred

tax assets of SEK 21,067 M (23,804) were recognized in the Volvo

Group’s balance sheet.

The Volvo Group’s gross unused tax-loss carryforwards amounted to

SEK 11,979 M (21,310) pertaining to a deferred tax asset of SEK 3,724 M

(5,911) recognized in the balance sheet. After deduction for valuation

allowance deferred tax assets attributable to unused tax-loss carry-

forwards amounted to SEK 2,673 M (5,638) of which SEK 5 M (2,081)

pertains to Sweden, SEK 1,346 M (1,568) to France and SEK 405 M

(1,115) to Japan.

As of December 31, 2015 the total valuation allowance amounted to

SEK 1,181 M (336). Most of the reserve, SEK 1,051 M (273), consists of

unused tax-loss carryforwards mainly related to Japan.

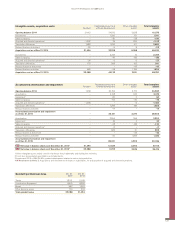

The gross unused tax-loss carryforwards expire according to the table

below:

Due date, unused tax-loss

carryforwards gross Dec 31,

2015 Dec 31,

2014

after 1 year 68 45

after 2 years 584 173

after 3 years 857 479

after 4 years 335 1,013

after 5 years 2,206 305

after 6 years or more

17,929 19,295

Total 11,979 21,310

1 Tax-loss carryforwards with long or indefinite periods of utilization were mainly

related to Japan and France. Tax-loss carryforwards with indefinite periods of

utilization amounted to SEK 4,994 M (16,364) which corresponds to 42% (77)

of the total tax-losses carryforward.

Changes in deferred tax

assets/liabilities, net 2015 2014

Opening balance 13,035 10,760

Deferred taxes recognised in the year’s income –2,310 331

Recognised in Other comprehensive income,

changes attributable to:

Remeasurements of defined-benefitplans –725 853

Cash flow hedge reserve 9 6

Available-for-sale reserve –17 4

Translation differences and other changes –37 1,081

Deferred tax assets/liabilities, net,

as of December 31 9,955 13,035

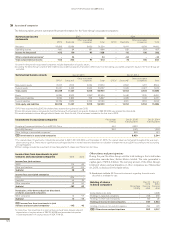

The cumulative amount of undistributed earnings in foreign subsidiaries,

which the Volvo Group currently intends to indefinitely reinvest outside of

Sweden and which no deferred income tax have been accounted for,

amounted to SEK 23 billion (24) at year end. As of 2015 undistributed

earnings pertaining to countries where the dividends are not taxable are

excluded.

Read more in Note 4 for Goals and policies in financial risk management

about how the Volvo Group handles equity currency risk.

Minority interests are interest attributable to non-controlling shareholders.

Minority interests are presented in the equity, separately from the equity

of the owners of the parent company. At business combinations minority

interests are valued either at fair value or at the minority’s proportionate

share of the acquiree’s net assets. Minority interests are assigned the

minority shareholder’s portion of the equity of the subsidiary. Changes in a

parent’s ownership interest in a subsidiary that do not result in a loss of

control are accounted for as equity transactions.

The Volvo Group has a few non-wholly owned subsidiaries of which one of

the subsidiaries is considered to have a significant minority interest.

Shandong Lingong Construction Machinery Co., (Lingong), in China has a

minority interest holding amounting to 30% share and voting rights in the

company. During the year, the profit allocated to the minority interest of

Lingong amounted to 34 (139) and the accumulated minority interest at

the end of December 31, 2015, amounted to 1,752 (1,683).

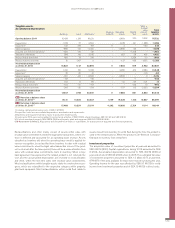

The following table presents summarized financial information for

Shandong Lingong Construction Machinery Co., Lingong:

Summarized income statement 2015 2014

Net sales 5,297 7,324

Operating income 116 559

Income for the period 113 464

Other comprehensive income1115 8 2 9

Total comprehensive income 229 1,293

Dividends paid to minority interest – –

Summarized balance sheet Dec31,

2015 Dec 31,

2014

Non-current assets 1,693 1,633

Marketable securities, cash and cash equivalents 2,236 2,584

Current assets 5,636 7,117

Total assets 9,565 11,334

Non-currentliabilities 167 187

Current liabilities 3,558 5,536

Total liabilities 3,725 5,723

Equity attributable to the Volvo Group’s shareholders 4,088 3,928

Minority interests 1,752 1,683

1 Includes translation differences from translating company equity in the Volvo

Group.

ACCOUNTING POLICY

NOTE 11 MINORITY INTERESTS

GROUP PERFORMANCE 2015 NOTES

129