Volvo 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

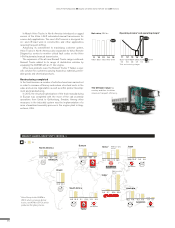

Net sales

Net sales increased by 10.4% explained predominantly by positive

currency impact mainly related to the appreciation of the USD

towards SEK. Excluding the currency impact there were slightly

increased sales for Trucks where the increased volumes in primar-

ily North America and Western Europe was to great extent offset

by the sharp decline in South America following the continued

weak market in primarily Brazil and in Africa explained by lower

demand from the commodity driven economies and political

turbulence. Construction Equipment sales declined significantly

explained by the overall weak demand for construction equipment

although with a better product mix with higher portion sale of big-

ger machines. The volume decrease was explained by significant

decrease in China following the economic slowdown in Brazil due

to the economic weakness and Russia explained by both the geo-

political situation and sharp decline in commodity prices. Further-

more sales volume in North America also saw a decline explained

by product exits for Volvo branded motor graders and backhoe

loaders. Buses and Volvo Penta sales excluding currency showed

solid increase explained by better market and product mix for

Buses and increased volumes for Volvo Penta.

Out of the Volvo Group total sale the Vehicle portion made up

75% which is a slight increase compared to 2014.

Operating income

Operating income increased by SEK 17.5 billion (300%) compared

with prior year out of which approximately SEK 8.9 billion came

from improved gross income which primarily is explained by posi-

tive currency impact where the Volvo Group could leverage from

the weakening SEK towards most of the major currencies with the

Volvo Group’s sizeable manufacturing footprint in Sweden. Addi-

tionally a positive product mix for Construction Equipment and

Buses also contributed positively to the gross income while Penta

contributed predominantly due to increased volumes. The lower

utilization of the industrial system for Construction Equipment in

general and in South America for the whole Volvo Group had neg-

ative impact on the gross income.

In addition to the positive contribution from the improved gross

income lower R&D expenses of SEK 1.3 billion as a result of gen-

erally lower expense level but also higher capitalization in 2015

had a positive impact on operating income. Furthermore the

underlying reductions in selling and administration costs was not

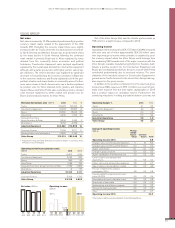

Net sales by business area, SEK M 2015 2014 %

Trucks 213,978 190,904 12

Construction Equipment 51,008 52,855 –3

Buses 23,580 18,645 26

Volvo Penta 9,406 7,790 21

Corporate Functions,

Group Functions & Other 8,346 8,162 2

Eliminations –2,736 –2,356 –

Industrial Operations1303,582 275,999 10

Customer Finance 11,199 10,111 11

Reclassifications and eliminations –2,265 –3,162 –

Volvo Group 312,515 282,948 10

1 Adjusted for acquired and divested units and changes in currency rates,

net sales was unchanged.

Operating income/loss by business area,

SEK M 2015 2014

Trucks 19,517 4,157

Construction Equipment 2,044 652

Buses 860 92

Volvo Penta 1,086 724

Corporate Functions, Group Functions & Other –2,189 –1,689

Eliminations –6 176

Industrial Operations 21,312 4,111

Customer Finance 2,006 1,712

Volvo Group 23,318 5,824

Change in operating income,

SEK bn

Change

(exclud-

ing cur-

rency)

Currency

impact Total

Operating income 2014 5.8

Change in gross income Industrial Operations 1.1 7.4 8.5

Change in gross income Customer Finance 0.4 0.0 0.4

Higher credit losses

1–0.1 –0.1 –0.2

Change in group structure 0.0 0.0 0.0

Higher capitalization of development cost 0.9 0.0 0.9

Lower research and development

expenditures 1.0 –0.6 0.4

Higherselling and administrative expenses 0.8 –1.5 –0.7

Sale of shares in Eicher Motors Limited 4.6 0.0 4.6

Provision related to EU antitrust

investigation 2014 3.8 0.0 3.8

Provision related to engine emission case

in the U.S 2014 0.4 0.0 0.4

Favourable outcome in arbitration case 0.8 0.0 0.8

Divestment of real estate –0.4 0.0 –0.4

Restructuringand efficiency program 0.2 0.0 0.2

Volvo profit sharing program –0.5 0.0 –0.5

Other –0.6 –0.1 –0.7

Operating income 2015 23,3

1 The higher credit losses are related to Industrial Operations.

Operating margin, % 2015 2014

Trucks 9.1 2.2

Construction Equipment 4.0 1.2

Buses 3.6 0.5

Volvo Penta 11.5 9.3

Industrial Operations 7.0 1.5

Volvo Group 7.5 2.1

Net sales, SEK bn

1211

310 300

13

273

14

283

15

313

Operating income,

SEK M

2014

Q3

2,250

Q2

3,563

Q1

2,269

Q4

–2,258

Q3 Q4

4,653 4,511

Q2

7,317

Q1

6,837

2015

GROUP PERFORMANCE BOARD OF DIRECTORS’ REPORT 2015 FINANCIAL PERFORMANCE

VOLVO GROUP

81