Volvo 2015 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Parent Company has two types of pension plans:

Defined-contribution plans: post-employment benefit plans where the

Company makes regular payments to separate entities and has no legal

or constructive obligation to pay further contributions. The expenses for

defined contribution plans are recognized during the period when the

employee provides service.

Defined-benefit plans: post-employment benefit plans where the Company’s

undertaking is to provide predetermined benefits that the employee will

receive on or after retirement. These benefit plans are secured through

balance-sheet provisions or pension-fund contributions. Furthermore, a

credit insurance policy has been taken out for the value of the obligations.

The main defined-benefit plan is the ITP2 plan which is based on final

salary. The plan is semi-closed, meaning that only new employees born

before 1979 have the possibility to choose the ITP2 solution. The ITP2

plan for the Company is funded in Volvo Pension Foundation. Pension

obligations are calculated annually, on the balance sheet date, based on

actuarial assumptions.

The defined-benefit obligations are calculated based on the actual salary

levels at year-end and based on a discount rate of 3.84% (3.84) for the

ITP2 plan and 1.9% (2.6) for other pension obligations. Assumptions for

discount rates and mortality rates are determined annually by PRI Pen-

sionsgaranti for ITP2 and Finansinspektionen for other pension obligations,

respectively.

The Volvo Pension Foundation was formed in 1996 to secure obliga-

tions relating to retirement pensions in accordance with the ITP plan.

Since its formation, net contributions of 249 have been made to the foun-

dation by the Parent Company.

Provisions for post-employment benefits in the Parent Company’s

balance sheet correspond to the present value of obligations at year-end,

less value of plan assets.

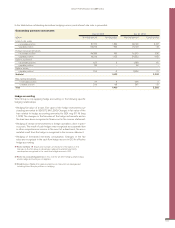

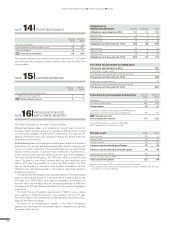

PROVISIONS FOR POST-

EMPLOYMENT BENEFITS

NOTE

16

Dec 31,

2015 Dec 31,

2014

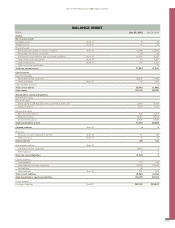

Accumulated additional depreciation

Machinery and equipment 4 4

B/S Total untaxed reserves 4 4

NOTE 15 UNTAXED RESERVES

Dec 31,

2015 Dec 31,

2014

Accounts receivable 9 25

Prepaid expenses and accrued income 62 221

Other receivables 45 54

B/S Total other receivables 116 300

The valuation allowance for doubtful receivables amounted to 1 (2) at the

end of the year. The company considers that fair value does not differ from

carrying value.

NOTE 14 OTHER RECEIVABLES

Obligations in

defined-benefit plans Funded Unfunded Total

Obligations opening balance 2014 556 132 688

Service costs 4 6 10

Interest costs 32 3 35

Pensionspaid –17 –19 –36

Obligations as of December 31, 2014 575 122 697

Service costs 15 11 26

Interest costs 21 2 23

Pensionspaid –18 –18 –36

Obligations as of December 31, 2015 593 117 710

Fair value of plan assets in funded plans

Plan assets opening balance 2014 591

Actual return on plan assets 65

Contributions and compensation to/from the fund –

Plan assets as of December 31, 2014 656

Actual return on plan assets 36

Contributions and compensation to/from the fund –

Plan assets as of December 31, 2015 692

Provisions for post-employment benefits Dec 31,

2015

Dec 31,

2014

Obligations1–710 –697

Fair value of plan assets 692 656

Funded status –18 –41

Limitation on assets in accordance with RFR2 (when

plan assets exceed corresponding obligations) –99 –81

B/S Net provisions for

post-employment benefits2–117 –122

1 The ITP2 obligations amount to 573 (556).

2 ITP2 obligations, net, amount to 0 (0).

Pension costs 2015 2014

Service costs 26 10

Interest costs323 35

Interest income3–18 –20

Pension costs for defined-benefit plans 31 25

Pension costs for defined-contribution plans 46 54

Special payroll tax/yield tax446 3

Cost for credit insurance FPG 0 2

Total costs for the period 123 84

3 Interest cost, net of 2 (3) is included in the financial items

4 Special payroll tax / yield tax are calculated according to Swedish Tax law and

accrued for in Current liabilities

166

GROUP PERFORMANCE 2015 PARENT COMPANY NOTES