Volvo 2015 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP PERFORMANCE 2015 NOTES

151

the pensionable salary over 30 income base amounts and the premium for

VEP is 10 percent of pensionable salary. There are no commitments other than

the payment of the premiums. In addition to the collective bargain agreement

the disability pension is 40% of pensionable salary between 30–50 income

base amounts. The right to disability pension is conditional to employment and

will cease upon termination of duty.

The President and CEO of AB Volvo is also covered by Volvo Företags pension,

a defined contribution plan for additional retirement benefit. The premium is

negotiated each year. For 2015 the premium amounted to SEK 571 a month.

Total pension premiums 2015 amounted to SEK 1,587,189 for Olof Persson

for the period until April 21st, and amounted to SEK 722,287 for Martin Lund-

stedt for the period from October 22nd.

Severance payments

Olof Persson was President and CEO of the Volvo group until April 21st, 2015.

He has been entitled to twelve months’ notice of termination from AB Volvo

and receives under this period a total salary of SEK 12,613,200. Olof Persson

is finally entitled to pension benefits during his notice period Total pension

premium during the notice period will amount to approximately SEK 4,761,567.

Olof Persson has also been entitled to a severance payment equivalent to

twelve months’ salary amounting to SEK 12,613,200 that will be paid from the

end of his notice period. In the event he gains employment during the sever-

ance period, severance pay is reduced with an amount equal to 100 percent of

the income from the new employment.

Martin Lundstedt has a 6 months notice of termination on his own initiative

and 12 months’ notice of termination from AB Volvo. If terminated by the com-

pany, Martin Lundstedt is entitled to a severance payment equivalent to 12

months’ salary. In the event he gains employment during the severance period,

severance pay is reduced with an amount equal to 100 percent of the income

from the new employment.

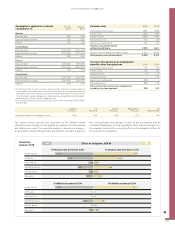

Remuneration to the Group Executive Team

Fixed and variable salaries

Members of Group Executive Team receive variable salaries in addition to fixed

salaries. Variable salaries are based on the fulfilment of certain improvement

targets or financial targets. The targets are decided by the Board of Directors

in AB Volvo and can, for example, relate to operating income, operating margin

and/or cash flow. During 2015, a variable salary, for Group Executive Team

members excluding CEO, could amount to a maximum of 60 percent of the

fixed annual salary.

For the financial year 2015, fixed salaries amounted to SEK 37,890,560

and variable salaries amounted to SEK 16,530,086 for Group Executive Team

members excluding the CEO. Group Executive Team comprised, excluding the

CEO, of 9 members at the beginning and at the end of the year. Other benefits,

mainly pertaining to car and housing, amounted to SEK 783,478 in 2015.

Group Executive Team members, excluding the CEO, also participate in the

long-term share-based incentive programs decided by the Annual General

Meetings 2011 and 2014. Return on equity for 2015 amounted to 18.4 per-

cent, which result in an allotment of approximately 240,086 shares that they

will receive during 2018/2019 related to 2015 if all other program conditions

are met (see further information under Long-term incentive program below).

During 2015, 110,224 shares granted under the 2011 and 2012 programs

corresponding to a taxable value of SEK 10,656,884 have been allotted to

Group Executive team members.

Severance payments

The employment contracts for Group Executive Team members contain rules

governing severance payments when the company terminates the employ-

ment. During the financial year 2015 the members of the Group Executive

Team were all domiciled in Sweden. The termination period from the company

is 12 months and 6 months at the initiative of the Group Executive Team mem-

bers. The rules provide that, when the company terminates the employment, an

employee is entitled to severance payment equivalent to twelve months’ salary.

In the event the employee gains employment during the severance period,

severance pay is reduced with an amount equal to 100 percent of the income

from the new employment.

Pensions

Group Executive Team members are covered by a defined-contribution plan,

Volvo Executive Pension plan with pension premium payments at the longest

to the age of 65 years. The premium constitutes 10 percent of the pensionable

salary. As complement to the collective bargain agreement regarding occupa-

tional pension employees born before 1979 are covered by a defined contribu-

tion pension plan, Volvo Management Pension. The premium constitutes of

SEK 30,000 plus 20 percent of the pensionable salary over 30 income base

amounts. The pensionable salary consists of twelve times the current monthly

salary and the average of the variable salary for the previous five years. Pen-

sion premiums for the Group Executive Team excluding CEO amounted to SEK

14,103,790 in 2015.

Volvo Group’s total costs for remuneration and benefits to the

Group Executive Team

The total costs for remuneration and benefits to the Group Executive Team

amounted to SEK 159 M (191) and pertained to fixed salary, variable salary,

other benefits, pensions and severance compensations. It also included social

fees on salaries and benefits, special pension tax and additional costs for

other benefits. The cost related to the long-term share-based incentive pro-

gram is reflected over the vesting period and amounted to SEK 14 M (21) for

2015. The remuneration model of the Volvo Group is to a main part designed

to follow changes in the profitability of the Group.

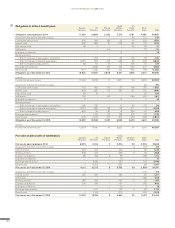

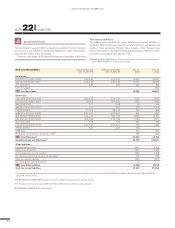

Long-term incentive programs

Long-term share-based incentive program 2011–2013

The Annual General Meeting held in 2011 approved a long-term share-based

incentive program for up to 300 Group and senior executives and comprising

the years 2011 to 2013. During 2015, a part of the shares granted under the

programs during 2011 and 2012 have been allotted to the participants (see

further information in the table Long term incentive program on the next page).

Long-term share-based incentive program 2014–2016

The Annual General Meeting held in 2014 approved a long-term share-based

incentive program for up to 300 Group and senior executives and comprising

the years 2014 to 2016. The LTI-program is proposed to be replaced by a new

program as from 2016 with the effect of terminating the program approved by

the Annual General Meeting in 2014 one year in advance (read more in “Pro-

posed Remuneration Policy”).

The 2014 LTI-program consists of three annual programs for which the

measurement periods are each of the respective financial years. A prerequisite

for participation in the program is that the participants invest a portion of their

salary in Volvo shares with a maximum of 15% of their salary for the Group

Executive Team members and a maximum of 10% of their salary for the other

participants and retain these shares and continue to be employed by the Volvo

Group for at least three years after the investment has been made. Under

special circumstances, it is possible to make exceptions to the requirement of

continued employment (so called “good leaver” situations). The AB Volvo

Board is, in the event of exceptional conditions, entitled to limit or omit allot-

ment of performance shares. In addition, if the Annual General meeting of AB

Volvo resolves that no dividend shall be paid to the shareholders for a specific

financial year, no matching shares are allotted for the year in question.

Shares are granted under the program during the respective financial year.

At the end of the vesting period, the main rule is that the participants will be

allotted one matching share per invested share and, assuming that the Volvo

Group’s return on equity for the particular financial year amounts to at least 10

percent in 2014, 11 percent in 2015 and 12 percent in 2016, a number of

performance shares. Maximum allotment of performance shares corresponds

to seven shares for the CEO, six shares for other members of Group Executive

Team and five shares for other participants in the program for each invested

share, subject to return on equity reaching 25 percent in 2014, 26 percent in

2015 and 27 percent in 2016. Return on equity for 2015 amounted to 18.4

percent, which means that the number of performance shares reached about

59% of the maximum grant. Return on equity for 2014 amounted to 2.8 per-

cent, i.e. no performance shares have been allotted for 2014. Allotments of

shares are made through Volvo owned, earlier re-purchased, Volvo shares.

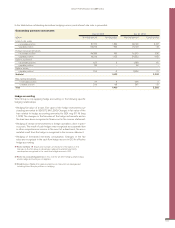

Participants in certain countries are offered a cash-settled version of the

incentive program. For participants in these countries, no investment is

required by the participant and the program does not comprise an element of

matching shares. Allotment of shares in this version is replaced by a cash

allotment at the end of the vesting period. Other program conditions are similar

between the programs.