Volvo 2015 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4:3

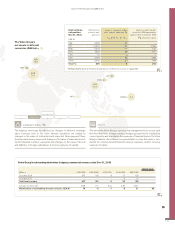

Commercial currency exposure

Transaction exposure from commercial flows

The Volvo Group conducts manufacturing in 18 countries around the

globe and more than 90% of net sales are generated in countries other

than Sweden. Transaction exposure from commercial flows in foreign

currency is generated from internal purchases and sales between manu-

facturing units and market companies and external sales and purchases

in foreign currency around the globe. As the predominant parts of the

operations in the Volvo Group are situated outside Sweden, the fluctua-

tions in currency rates affecting the transaction flows in foreign currency

are in many cases not against SEK. Industrial Operations transaction

exposure in key currencies is presented in table 4:5. The graph repre-

sents the transaction exposure from commercial operating net cash flows

in foreign currency, expressed as net surpluses or deficits in key curren-

cies. The deficit in SEK and KRW is mainly an effect of expenses for

manufacturing plants in Sweden and Korea, but limited external revenues

in those currencies. The EUR deficit on the other hand, is the net of sig-

nificant gross volumes of sales and purchases made by many entities

around the globe in EUR. The surplus in USD is mainly generated from

external sales to entities within the US and emerging markets.

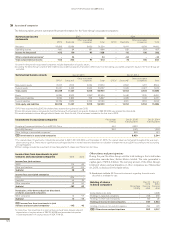

The hedging of the Volvo Group’s commercial currency exposure is

decided centrally. The Volvo Group’s consolidated currency portfolio

exposure is the value of forecasted flows in foreign currency. The Volvo

Group only hedge the part of the forecasted portfolio that is considered

highly probable to occur, i.e. firm flows, where the main parts will be real-

ized within six months. The Volvo Group uses forward contracts and cur-

rency options to hedge the portion of the value of forecasted future pay-

ment flows in foreign currency. The hedged amount of firm flows for all

periods fall within the framework of the Volvo Group’s currency policy. The

table 4:2 shows outstanding forward and option contracts for the hedg-

ing of commercial currency risks.

Translation exposure from the consolidation of operating income in

foreign subsidiaries

In conjunction with the translation of operating income in foreign subsidiaries,

the Volvo Group’s earnings are impacted if currency rates change. The Volvo

Group does not hedge this risk. The table 4:7 shows the translation effect

when consolidating operating income for 2015 in foreign subsidiaries in

key currencies for Industrial Operations.

Read more in section currency exposure of equity below regarding currency

hedging of equity.

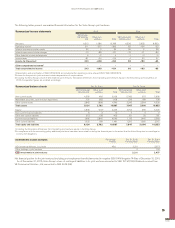

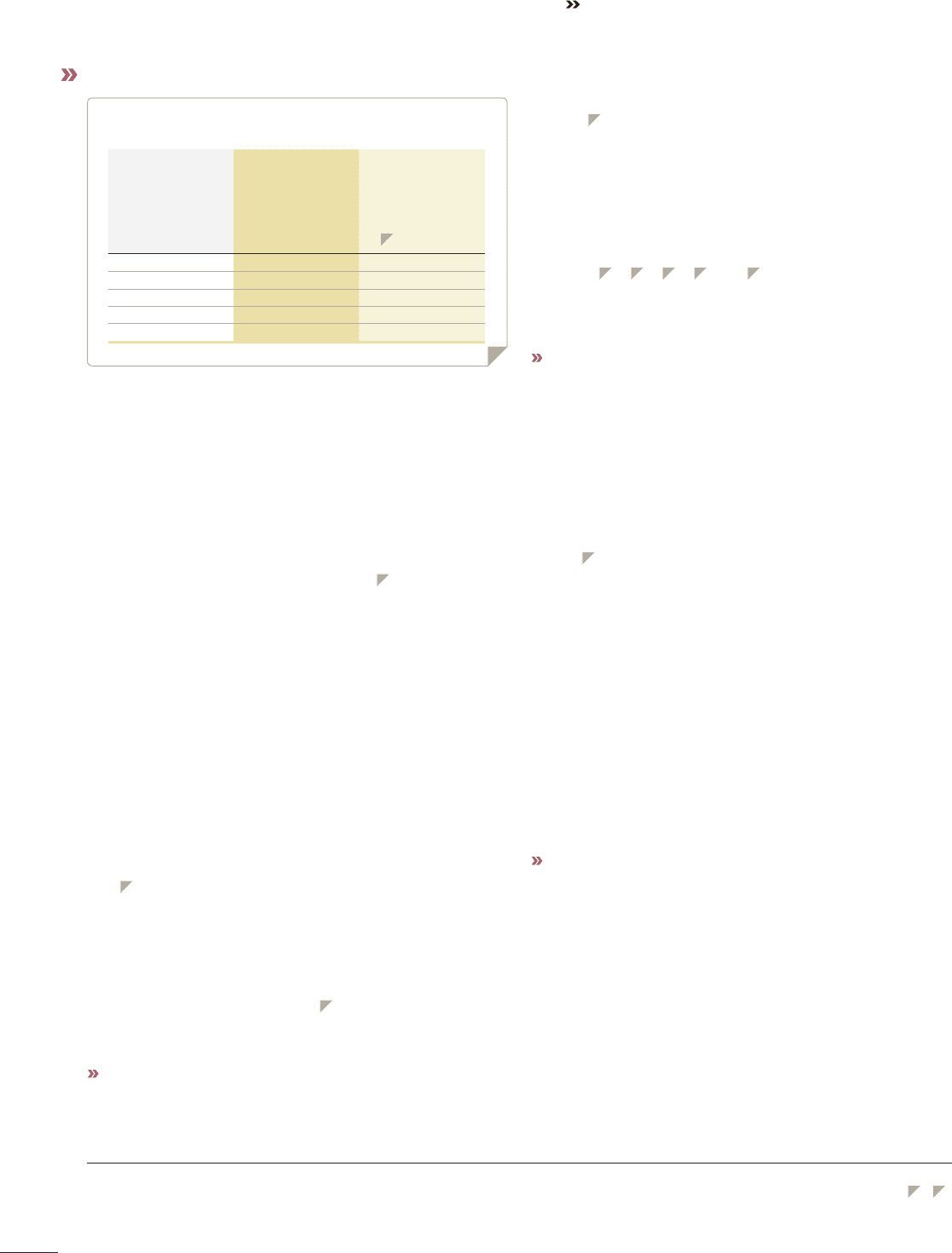

Sensitivity analysis- transactional exposure*

The table 4:3 illustrates the impact on operating income if key currencies for

Industrial Operations appreciate by 10% against all other currencies. Hedge

accounting is not applied on derivatives hedging cash flows in foreign cur-

rency. As a consequence the impact on equity equals the impact on operating

income before tax.

The deficit in transaction exposure in SEK is mainly generated from

flows in USD, GBP, CAD and EUR against SEK.

Industrial Operations currency review

The tables 4:4 4:5 4:6 4:7 and 4:8 on the next page illustrate the

currency impact on sales and operating income in key currencies. The

effect arises from translation during the consolidation of foreign curren-

cies and from commercial net flows in foreign currency.

Read more about Industrial Operations transactional exposure in section

Commercial currency exposure above.

Financial currency exposure

Loans and investments in the Volvo Group’s subsidiaries are performed

mainly in local currencies through Volvo Treasury, which minimizes indi-

vidual companies’ financial currency exposure. Volvo Treasury uses vari-

ous derivatives to facilitate lending and borrowing in different currencies

without increasing the risk for the Volvo Group. The net financial position

of the Volvo Group is affected by currency fluctuations since financial

assets and liabilities are distributed among the Volvo Group companies

that conduct their operations using different currencies.

Table 4:1 discloses the impact on earnings before tax on Industrial

Operations net financial position, excluding pensions and similar net obliga-

tions, if SEK were to strengthen by 10%.

Currency exposure of equity

The carrying amount of assets and liabilities in foreign subsidiaries are

affected by current exchange rates in conjunction with the translation of

assets and liabilities to SEK. To minimize currency exposure of equity, the

size of equity in foreign subsidiaries is continuously optimized with respect

to commercial and legal conditions. Currency hedging of equity may occur

in cases where a foreign subsidiary is considered overcapitalized. Net

assets in foreign subsidiaries, associated companies and joint ventures

amounted at year-end 2015 to SEK 68 billion (70). The need to undertake

currency hedging relating to investments in associated companies, joint

ventures and other companies is assessed on a case-by-case basis.

On the map on page 116–117 the Volvo Group’s net assets in different

currencies (SEK bn) are displayed.

Read more in Note 30 Financial Instruments about Volvo Group’s policy

choice on hedge accounting.

Goals and policies in financial risk management (cont.)

* The sensitivity analysis on currency rate risks is based on simplified assumptions.

It is not improbable for the value in a currency rate to appreciate by 10% in rela-

tion to other currencies. In reality however, currencies usually do not change in

the same direction at any given time, so the actual effect of exchange-rate

changes may differ from the sensitivity analysis. Please refer to tables 4:1 4:3

Risk currency

exposure 2015

Transaction exposure

from operating

net flows

Impact on operating

income if currency

rate appreciates

against all other

currencies by 10%

B (Currency risks) SEK bn

SEK –39.1 -3.9

KRW –8.0 –0.8

EUR –2.4 –0.2

GBP 9.3 0.9

USD 18.9 1.9

Sensitivity analysis*

GROUP PERFORMANCE 2015 NOTES

118