Volvo 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGED

RISK-TAKING

All business operations involve risks – managed risk-taking is a condition

of maintaining a sustained favorable profitability.

Risks may be due to events in the world and can

affect a given industry or market and can have

an impact on the Volvo Group’s objectives.

At the Volvo Group, work is carried out daily

to identify, assess and respond to risks – in

some cases the Group can influence the likeli-

hood that a risk-related event will occur. In cases in which such

events are beyond the Group’s control, the Group strives to mini-

mize the consequences.

AB Volvo has, for a number of years, worked with enterprise risk

management (ERM), which is a systematic and structured pro-

cess to identify, understand, aggregate, report and mitigate the

risks that might threaten the Group’s objectives.

The goal of ERM is to improve business performance and opti-

mize the costs of managing risk; i.e. protecting and enhancing the

Volvo Group’s enterprise value. ERM contributes to meeting the

high standards of corporate governance expected from the

Group’s stakeholders and is looked upon as an integral part of

good corporate governance as reflected in the Swedish Corpo-

rate Governance Code.

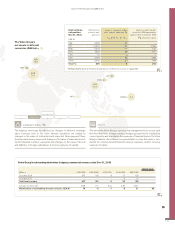

The risks to which the Volvo Group are exposed are classified

into four main categories:

• Strategic risks – such as the cyclical nature of the commer-

cial vehicles business, intense competition, political risks, also

connected to the internal events on the long term horizon like

strategies and long term planning.

• Operational risks – such as product related events, market

reception of new products, reliance on suppliers, supply chain

management, operation of production sites and risks related to

human capital.

• Compliance risks – such as government regulations, com-

plaints and legal actions by customers and other third parties.

• Financial risks – such as financial reporting, currency fluctu-

ations, interest rate fluctuations, market value of shares or sim-

ilar instruments, credit risk and liquidity risk.

STRATEGIC RISKS

For a large global company such as Volvo Group, navigating through

the political, economic and societal trends is important and crucial

to define our place in the global context of markets and competitors.

From a Volvo Group perspective, there are a number of trends

and challenges driving our work to develop and deliver sustainable

transport and infrastructure solutions today and tomorrow.

GROUP PERFORMANCE BOARD OF DIRECTORS’ REPORT 2015

RISKS AND UNCERTAINTIES

The commercial vehicles industry is cyclical

The Volvo Group’s markets undergo significant changes in demand

as the general economic en vironment fluctuates. Investments in

infrastructure, major industrial projects, mining and housing con-

struction all impact the Group’s operations as its products are

central to these sectors. Adverse changes in the economic condi-

tions for the Volvo Group’s customers may also impact ex isting

order books through cancellations of previously placed orders.

The cyclical demand for the Group’s products makes the financial

result of the operations dependable on the Group’s ability to react

quickly to changes in demand, in particular to the ability to adapt

production levels and operating expenses.

Intense competition

Continued consolidation in the industry is expected to create fewer

but stronger competitors. The major competitors are Daimler, Iveco,

MAN, Navistar, Paccar, Scania, Sinotruk, Brunswick, Caterpillar,

CNH, Cummins, Deere, Hitachi, Komatsu and Terex. In recent years,

new competitors have emerged in Asia, particularly in China. These

new competitors are mainly active in their domestic markets, but are

expected to increase their presence in other parts of the world.

Extensive government regulation

Regulations regarding exhaust emission levels, noise, safety and

levels of pollutants from production plants are extensive within the

industry.

Most of the regulatory challenges regarding products relate to

reduced engine emissions. The Volvo Group is a leading company

in the commercial vehicle industry and one of the world’s largest

producers of heavy-duty diesel engines. The product develop-

ment capacity within the Volvo Group is well consolidated to be

able to focus resources for research and development to meet

tougher emission regulations. Future product regulations are well

known, and the product development strategy is well tuned to the

introduction of new regulations.

Local protectionism leading to changes to local content

requirements can put the Volvo Group at a disadvantage com-

pared to local competitors, cause increased sourcing costs or

require Volvo to make significant investments not necessary from

an operational point of view.

Geopolitical uncertainty

Volvo is active in more than 190 countries and political instability,

armed conflicts and civil unrest may impact Volvo’s ability to trade

in affected areas. Rapid change in inflation, devaluations or regu-

lations can sustain Volvo significant losses, impairment of assets

or costs due to underutilized assets.

107