Volvo 2015 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150

GROUP PERFORMANCE 2015 NOTES

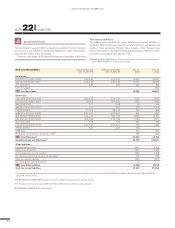

Share-based payments

The Volvo Group has share-based incentive programs including both a

cash-settled and an equity-settled part. The fair value of the equity-settled pay-

ments is determined at the grant date, recognized as an expense during the

vesting period and offset in equity. The fair value is based on the share price

reduced by dividends connected with the share during the vesting period.

Additional social costs are reported as a liability, revalued at each balance sheet

date in accordance with UFR 7, issued by the Swedish Financial Reporting Board.

The cash-settled payment is revalued at each balance sheet date and is recog-

nized as an expense during the vesting period and as a short term liability. An

assessment whether the terms for allotment will be fulfilled is made continuously.

Based on such assessment, expense might be adjusted.

Remuneration policy decided at the Annual General

Meeting in 2015

The Annual General Meeting of 2015 decided upon a policy on remuneration

and other employment terms for the members of the Volvo Group Executive

Team. The decided principles can be summarized as follows:

The guiding principle is that remuneration and other employment terms for

the Group Executive Team, shall be competitive to ensure that the Volvo Group

can attract and retain skilled persons to the Group Executive Team. The fixed

salary shall be competitive and shall reflect the individual’s area of responsibil-

ity and performance. In addition to the fixed salary a variable salary may be

paid. The variable salary may for the CEO amount to a maximum of 75 percent

of the fixed salary and for the other members of the Group Executive Team, a

maximum of 60 percent of the fixed salary. The variable salary shall be based

on the fulfilment of improvement targets or certain financial targets for the

Volvo Group and/or the organizational unit where the member of Group Exec-

utive Team is employed. These targets are decided by the Board of AB Volvo

and can be related, for example, to operating income, operating margin and/or

cash flow. The Board may under certain conditions decide to reclaim variable

salary already paid or to cancel or limit variable salary to be paid.

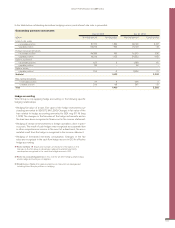

The Annual General Meeting can also decide on a share, or share-based,

incentive program. At the Annual General Meeting 2011, as proposed by the

Board of AB Volvo, it was decided to implement a long-term share-based

incentive program for Group Executive Team members and other senior exec-

utives in the Volvo Group consisting of three annual programs covering each

of the financial years 2011, 2012 and 2013. During 2015, a part of the shares

granted under the programs during 2011 and 2012 have been allotted to the

participants. At the Annual General Meeting 2014, as proposed by the Board

of AB Volvo, it was decided to implement a new long-term share-based incen-

tive program for Group Executive Team members and other senior executives

in the Volvo Group consisting of three annual programs covering each of the

financial years 2014, 2015 and 2016.

In addition to fixed and variable salary, normally other customary benefits,

such as company car and company healthcare are provided. In individual

cases, accommodation benefits and other benefits may be provided.

During 2015 all Group Executive Team members were domiciled in Sweden.

In addition to pension benefits provided by law and collective bargain agree-

ments, members of the Group Executive Team can be offered two different

defined-contribution plans with annual premiums whereby the amount of the

individual’s pensions comprises the premium paid and any return, without any

guaranteed level of pension. No defined retirement date is set in the two plans

but premiums will be paid for the employee until his or her 65th birthday.

With regard to notice of termination of employment for Group Executive

Team members, the notification period is 12 months if the company terminates

the employment and six months if the individual terminates the employment. In

addition, the employee is entitled to a severance pay of 12 months’ salary if the

employment is terminated by the company.

The board of AB Volvo may deviate from the remuneration policy if there are

specific reasons to do so in an individual case.

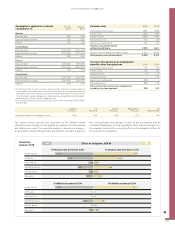

Fee paid to the Board of Directors

According to a resolution adopted at the Annual General Meeting 2015, the

fee to the Board of Directors appointed at the Annual General Meeting for the

period until the close of the Annual General Meeting 2016 shall be paid as

follows: The Chairman of the Board should be awarded SEK 3,250,000 and

each of the other members SEK 950,000 with exception of the President and

Chief Executive Officer of AB Volvo. In addition, SEK 300,000 should be

awarded to the chairman of the audit committee and SEK 150,000 to each of

the other members of the audit committee, and SEK 125,000 to the chairman

of the remuneration committee and SEK 100,000 to each of the members of

the remuneration committee.

Terms of employment and remuneration to the CEO

During 2015 Olof Persson was President and CEO of the Volvo Group up to

April 21st. Martin Lundstedt has been appointed President and CEO of the

Volvo Group and assumed his position on October 22nd. Jan Gurander, the

Group Chief Financial Officer, has been acting as President and CEO during

the interim period.

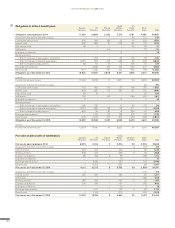

Fixed and variable salaries

The President and CEO is entitled to a remuneration consisting of a fixed

annual salary and a variable salary. During the financial year 2015, the variable

salary is based on operating margin and six months moving cash flow. The

variable salary amounts to a maximum of 75 percent of the fixed annual salary.

For the financial year 2015 up to April 21st, Olof Persson received a fixed

salary of SEK 3,924,107 and a variable salary of SEK 2,207,299. The variable

salary corresponded to 56.2 percent of the fixed salary. Other benefits, mainly

pertaining to car and housing, amounted to SEK 272,788 in 2015. Olof Pers-

son was also participating in the long-term share-based incentive programs

decided by the Annual General Meetings 2011 and 2014. During the financial

year 2015 up to April 21st, 43,534 shares granted under the 2011 program

corresponding to a taxable value of SEK 4,103,950 have been allotted to Olof

Persson. Olof Persson has been determined to be a “good leaver” and is there-

fore entitled to accumulated allotments of shares under the program compris-

ing the years 2011 to 2013 and under the 2014 program. 43,367 shares

granted under the 2012 program corresponding to a taxable value of SEK

4,251,727 have been allotted during the financial year and an additional

59,049 shares will be allotted to Olof Persson during 2016.

During the financial year 2015 from October 22nd, Martin Lundstedt

received a fixed salary of SEK 2,447,683 and a variable salary of SEK 945,958.

The variable salary corresponded to 38.6 percent of the fixed salary. Other

benefits, mainly pertaining to car and housing, amounted to SEK 37,312 in

2015. Martin Lundstedt is also participating in the long-term share-based

incentive program decided by the Annual General Meetings 2014. Return on

equity for 2015 amounted to 18.4 percent, which result in an allotment to

Martin Lundstedt of approximately 16,766 shares during 2018/2019 related

to 2015 if all other program conditions are met (see further information under

Long-term incentive program below). The amount of taxable benefit related to

these shares is determined at the time of allotment. Martin Lundstedt also

received a fixed one-off sign-on sum of SEK 5,000,000 for his appointment as

President and CEO of the Volvo Group. The sum shall not entitle to any pen-

sion premiums.

Jan Gurander, the Group Chief Financial Officer, has been acting as Presi-

dent and CEO during the interim period between April 22nd and October 21st

and has therefore been entitled to a fixed one-off salary adjustment sum of

SEK 3,000,000 out of which SEK 2,000,000 has been paid during the finan-

cial year 2015.

Pensions

The President and CEO of the Volvo Group is covered both by pension benefits

provided under collective bargain agreements and by the Volvo Management

Pension (VMP) and Volvo Executive Pension (VEP) plans. The retirement ben-

efit under the Volvo executive pension plans is a defined-contribution plan. The

pensionable salary consists of the annual salary and a calculated variable sal-

ary component. The premium for the VMP is SEK 30,000 plus 20 percent of

ACCOUNTING POLICY

NOTE 27 PERSONNEL