Volvo 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

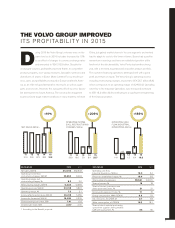

A GLOBAL GROUP CEO COMMENT

Improved

profitability

and cash flow

How would you summarize 2015 in terms of market

development?

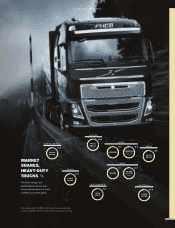

Jan Gurander (JG): If we start in North America, the market was

incredibly strong and we have a very solid business. Around 90%

of the Volvo trucks are now delivered with our own engines and for

gearboxes that figure is 85%. Naturally, this development is very

positive for our dealer network in terms of share of business with

the customer during the entire life cycle. The North American

market is slowing down, but in a controlled way, and we believe

that 2016 will be a good year as well, albeit not as good as last

year.

And what about Latin America?

JG: For Brazil, which is by far our biggest market in Latin America,

it was a different story. Compared to the peak years, the drop in

demand has been dramatic. We are keeping our market shares and

have adjusted production and our organization to this much lower

level – which we believe will be with us for the rest of 2016, at least.

Turning to Europe, it seems that we are seeing a positive

trend when it comes to Renault Trucks?

JG: Yes, our new range is very well received by the customers and

has also to some extent opened the door to new segments. Over-

all, demand in Europe has been gaining momentum, slowly but

steadily. Some of the factors behind this development are low

interest rates, low fuel prices and a need to invest in new trucks,

as the fleet in Europe is rather old.

And if we look to the East?

JG: The market in Japan in 2015 was basically flat and rather

undramatic. For the rest of Asia, the picture was rather mixed.

India was the only emerging market where we had growth. As for

China, the total market was down 25% in 2015. Our strategic

partner Dongfeng Commercial Vehicles (DFCV) is making adjust-

ments to manage this lower volume.

How is the cooperation between the Volvo Group and

DFCV developing?

JG: Very well. In June we signed a license agreement granting DFCV

the right to develop an 11-liter engine based on the Volvo Group

engine currently used in the UD Trucks models Quester and KuTeng.

Speaking of China: how is Construction Equipment

coping with the downturn?

JG: The market for construction equipment in China today is

about one fourth of what it was when the market peaked. Last

year we continued to adapt our organization to manage the lower

volumes in China. A lot of work has also been put into managing

credit risks linked to dealers and customers in China. On the

global level we focused more on our bigger machines where the

margins are better. We have done quite well in these segments

and increased our market shares. Overall, a tremendous job done

by Volvo Construction Equipment. In fact, all our Business Areas

performed well in 2015. Volvo Financial Services had a record

year, with a result breaking the SEK 2 billion ceiling, and Volvo

Penta also had reason to celebrate since their result exceeded

SEK 1 billion. It is really good to see that our colleagues at Volvo

Penta continue to turn innovation into sales and profitability. One

example is the new Forward Drive propulsion system that pulls the

boat through the water rather than pushing it, which is great if you

are into wakeboarding or wakesurfing.

And Volvo Buses?

JG: Buses are looking good. We are seeing a gradual improve-

ment in profitability, as an effect of a large number of activities

carried out over the years. In addition to the financial result, Volvo

Buses also had a milestone year when Gothenburg’s first route for

electric buses was opened in June. The electric bus is now ready

for serial production. It is quiet, does not have any exhaust emis-

sions, and is about 80% more energy efficient than a conven-

tional diesel bus.

“ We are now gradually moving

away from major restructuring

programs to more continuous

improvement work”.

Martin Lundstedt

2