ICICI Bank 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F14

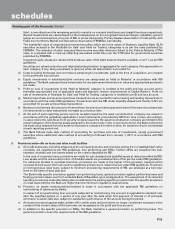

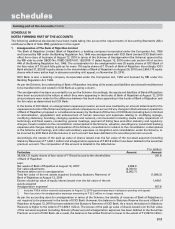

e) In addition to the provisions required to be held according to the asset classification status, provisions are held for

individual country exposures (other than for home country exposure). The countries are categorised into seven risk

categories namely insignificant, low, moderate, high, very high, restricted and off-credit and provisioning is made

on exposures exceeding 180 days on a graded scale ranging from 0.25% to 100%. For exposures with contractual

maturity of less than 180 days, provision is required to be held at 25% of the rates applicable to exposures exceeding

180 days. If the country exposure (net) of the Bank in respect of each country does not exceed 1% of the total

funded assets, no provision is required on such country exposure.

4. Transfer and servicing of assets

The Bank transfers commercial and consumer loans through securitisation transactions. The transferred loans are

de-recognised and gains/losses are accounted for only if the Bank surrenders the rights to benefits specified in the

underlying securitised loan contract. Recourse and servicing obligations are accounted for net of provisions.

In accordance with the RBI guidelines for securitisation of standard assets, with effect from February 1, 2006, the Bank

accounts for any loss arising from securitisation immediately at the time of sale and the profit/premium arising from

securitisation is amortised over the life of the securities issued or to be issued by the special purpose vehicle to which

the assets are sold. In the case of loans sold to an asset reconstruction company, the excess provision is not reversed

but is utilised to meet the shortfall/loss on account of sale of other financial assets to securitisation company (SC)/

reconstruction company (RC).

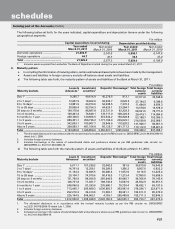

5. Fixed assets and depreciation

Premises and other fixed assets are carried at cost less accumulated depreciation. Cost includes freight, duties, taxes and

incidental expenses related to the acquisition and installation of the asset. Depreciation is charged over the estimated

useful life of a fixed asset on a straight-line basis. The rates of depreciation for fixed assets, which are not lower than the

rates prescribed in Schedule XIV of the Companies Act, 1956, are given below:

Asset Depreciation Rate

Premises owned by the Bank 1.63%

Improvements to leasehold premises 1.63% or over the lease period, whichever is higher

ATMs 12.50%

Plant and machinery like air conditioners, photo-copying

machines, etc. 10.00%

Computers 33.33%

Furniture and fixtures 15.00%

Motor vehicles 20.00%

Others (including Software and system development expenses)

25.00%

a. Depreciation on leased assets and leasehold improvements is recognised on a straight-line basis using rates

determined with reference to the primary period of lease or rates specified in Schedule XIV to the Companies Act,

1956, whichever is higher.

b. Assets purchased/sold during the year are depreciated on a pro-rata basis for the actual number of days the asset

has been put to use.

c. Items costing upto ` 5,000 are depreciated fully over a period of 12 months from the date of purchase.

d. In case of revalued/impaired assets, depreciation is provided over the remaining useful life of the assets with

reference to revised assets values.

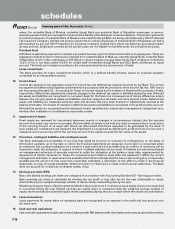

6. Transactions involving foreign exchange

Foreign currency income and expenditure items of domestic operations are translated at the exchange rates prevailing

on the date of the transaction. Income and expenditure items of integral foreign operations (representative offices) are

translated at daily closing rates, and income and expenditure items of non-integral foreign operations (foreign branches

and offshore banking units) are translated at quarterly average closing rates.

Monetary foreign currency assets and liabilities of domestic and integral foreign operations are translated at closing

exchange rates notified by Foreign Exchange Dealers’ Association of India (FEDAI) at the balance sheet date and the

resulting profits/losses are included in the profit and loss account.

Both monetary and non-monetary foreign currency assets and liabilities of non-integral foreign operations are translated

at closing exchange rates notified by FEDAI at the balance sheet date and the resulting profits/losses from exchange

differences are accumulated in the foreign currency translation reserve until the disposal of the net investment in the

non-integral foreign operations.

The premium or discount arising on inception of forward exchange contracts that are entered into to establish the

amount of reporting currency required or available at the settlement date of a transaction is amortised over the life of

the contract. All other outstanding forward exchange contracts are revalued at the exchange rates notified by FEDAI

for specified maturities and at interpolated rates for contracts of interim maturities. The contracts of longer maturities

forming part of the Accounts (Contd.)

schedules