ICICI Bank 2011 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

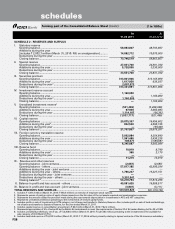

F59

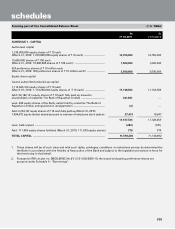

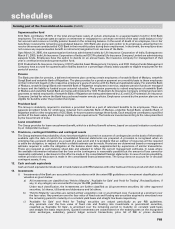

forming part of the Consolidated Balance Sheet (Contd.) (` in ‘000s)

At

31.03.2011

At

31.03.2010

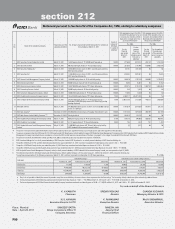

SCHEDULE 2A - MINORITY INTEREST

Opening minority interest .................................................................................... 12,704,046 9,105,054

Subsequent increase/(decrease) ......................................................................... 878,172 3,598,992

CLOSING MINORITY INTEREST ......................................................................... 13,582,218 12,704,046

SCHEDULE 3 - DEPOSITS

A. I. Demand deposits

i) From banks ..................................................................................... 20,176,015 14,856,747

ii) From others ..................................................................................... 334,537,779 300,667,768

II. Savings bank deposits ........................................................................... 732,637,812 622,221,663

III. Term deposits

i) From banks ...................................................................................... 153,559,266 88,149,385

ii) From others .................................................................................... 1,350,149,177 1,389,827,397

TOTAL DEPOSITS ................................................................................................. 2,591,060,049 2,415,722,960

B. I. Deposits of branches in India ............................................................... 2,132,983,708 1,911,271,065

II. Deposits of branches/subsidiaries outside India ................................. 458,076,341 504,451,895

TOTAL DEPOSITS ................................................................................................. 2,591,060,049 2,415,722,960

SCHEDULE 4 - BORROWINGS

I. Borrowings in India

i) Reserve Bank of India ........................................................................... 5,000,000 —

ii) Other banks ........................................................................................... 63,186,638 60,072,566

iii) Other institutions and agencies

a) Government of India ................................................................... 299,581 687,491

b) Financial institutions/others ......................................................... 89,874,799 73,843,875

iv) Borrowings in the form of

a) Deposits ....................................................................................... 18,959,593 35,459,265

b) Commercial paper ....................................................................... 7,019,749 16,976,284

c) Bonds and debentures (excluding subordinated debt)1 ............ 21,331,106 41,656,724

v) Application money-bonds2 ................................................................... —25,000,000

vi) Capital instruments

– Innovative Perpetual Debt Instruments (IPDI)

(qualifying as Tier I capital) ......................................................... 13,010,000 13,010,000

– Hybrid debt capital instruments issued as bonds/debentures

(qualifying as upper Tier II capital) ............................................. 98,188,633 97,502,000

– Redeemable Non-Cumulative Preference Shares (RNCPS)

(Redeemable Non-Cumulative Preference Shares of ` 10

million each issued to preference share holders of erstwhile

ICICI Limited on amalgamation redeemable at par on April 20,

2018) ............................................................................................ 3,500,000 3,500,000

– Unsecured redeemable debentures/bonds

(subordinated debt included in Tier II capital) ........................... 201,316,236 145,090,481

TOTAL BORROWINGS IN INDIA 521,686,335 512,798,686

II. Borrowings outside India

i) Capital instruments

– Innovative Perpetual Debt Instruments (IPDI)

(qualifying as Tier I capital) ......................................................... 15,106,107 15,199,979

– Hybrid debt capital instruments issued as bonds/debentures

(qualifying as upper Tier II capital) ............................................. 43,926,075 40,410,000

– Unsecured redeemable debentures/bonds

(subordinated debt included in Tier II capital) ........................... 14,553,006 11,817,445

ii) Bonds and notes ................................................................................... 294,843,311 285,560,180

iii) Other borrowings3 ................................................................................ 368,273,768 291,196,929

TOTAL BORROWINGS OUTSIDE INDIA ............................................................. 736,702,267 644,184,533

TOTAL BORROWINGS ......................................................................................... 1,258,388,602 1,156,983,219

1. Includes borrowings guaranteed by Government of India of ` 4,367.5 million (March 31, 2010: ` 8,355.0 million).

2. Application money received towards subordinated debt.

3. Includes borrowings guaranteed by Government of India for the equivalent of ` 16,515.0 million (March 31, 2010: ` 17,252.7 million).

4. Secured borrowings in I and II above are ` 15,403.1 million (March 31, 2010: ` 17,811.2 million) excluding borrowings under Collateralised Borrowing

and Lending Obligation and/or repurchase transactions with banks and financial institutions.

schedules