ICICI Bank 2011 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204

|

|

F104

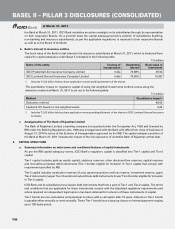

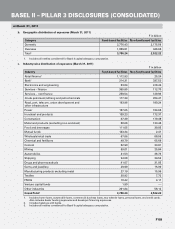

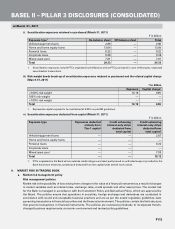

d. Maturity pattern of assets (March 31, 2011)1

The maturity pattern of assets at March 31, 2011 is detailed in the table below.

` in billion

Maturity buckets Cash &

balances

with RBI

Balances

with banks

& money

at call and

short notice

Investments Loans &

advances

Fixed

assets

Other

assets

Total

Day 1 57.54 64.21 126.57 11.32 — 25.33 284.97

2 to 7 days — 41.45 57.06 25.51 (0.00) 11.62 135.64

8 to 14 days — 28.86 29.55 17.67 — 6.10 82.18

15 to 28 days 14.03 5.51 105.17 32.10 — 11.26 168.07

29 days to 3 months 19.76 12.45 100.26 178.04 0.05 10.08 320.64

3 to 6 months 11.03 9.14 76.81 226.90 0.05 3.38 327.31

6 months to 1 year 19.97 5.80 123.78 292.44 0.04 4.06 446.09

1 to 3 years 65.45 1.22 365.09 1,017.36 0.06 10.91 1,460.09

3 to 5 years 3.18 0.00 113.05 426.58 2.44 4.96 550.21

Above 5 years 18.64 0.05 330.06 332.13 45.75 108.95 835.58

Total 209.60 168.69 1,427.40 2,560.05 48.39 196.65 4,610.78

1. Consolidated figures for the Bank and its banking subsidiaries, ICICI Home Finance Company, ICICI Securities Primary

Dealership Limited and ICICI Securities Limited and its subsidiaries. The maturity pattern of assets for the Bank is based on

methodology used for reporting positions to the RBI on asset-liability management. The maturity pattern of assets for the

subsidiaries is based on similar principles.

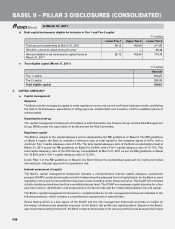

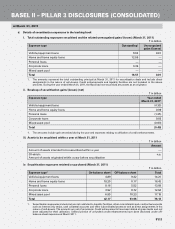

e. Amount of non-performing loans (NPLs) (March 31, 2011)

` in billion

NPL Classification Gross NPLs Net NPLs

Sub-standard 20.58 14.41

Doubtful 77.19 14.50

- Doubtful 1129.29 9.41

- Doubtful 21 25.12 5.09

- Doubtful 31 22.78 —

Loss 9.45 —

Total2, 3 107.22 28.91

NPL ratio44.06% 1.13%

1. Loans classified as NPLs for 456 to 820 days are classified as Doubtful 1, 821 to 1,550 days as Doubtful 2 and above 1,550

days as Doubtful 3.

2. Includes advances portfolio of the Bank and its banking subsidiaries and ICICI Home Finance Company.

3. Identification of loans as non-performing is as per the guidelines issued by RBI.

4. Gross NPL ratio is computed as a ratio of gross NPLs to gross advances. Net NPL ratio is computed as a ratio of net NPLs

to net advances.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2011