ICICI Bank 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

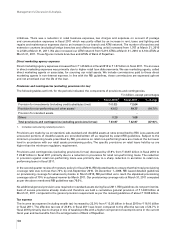

payments during the nine months of fiscal 2011. The rupee appreciated by 1.1% against the US dollar from ` 45.14 per

US dollar at March 31, 2010 to ` 44.65 per US dollar at March 31, 2011.

Tight liquidity and the rising interest rate environment combined with the impact of regulatory changes, led to lower

mobilisation under savings and investment products during fiscal 2011. First year retail premium underwritten in the

life insurance sector decreased by 8.5% (on weighted received premium basis) to ` 503.68 billion in fiscal 2011 from

` 550.24 billion in fiscal 2010. The average assets under management of mutual funds decreased by 6.3% from `

7,475.25 billion in March 2010 to ` 7,005.38 billion in March 2011. However, gross premium of the non-life insurance

sector (excluding specialised insurance institutions) grew by 21.7% to ` 425.69 billion in fiscal 2011.

There were a number of key regulatory developments in the Indian financial sector during fiscal 2011:

•In December 2010, RBI imposed a regulatory ceiling on the loan-to-value ratio in respect of housing loans at 80%.

However, small value loans of less than ` 2.0 million were permitted to have a loan to value ratio not exceeding

90%. Further, the risk weight for residential loans of ` 7.5 million and above was set at 125% irrespective of the

loan to value ratio, as against the earlier mandated 100% for a loan to value ratio of above 75%. With respect to

loans outstanding under special housing loan products with lower interest rates in initial years, the standard asset

provisioning was increased from 0.4% to 2.0%.

•In February 2011, RBI issued guidelines declassifying loans sanctioned to non-banking finance companies

(NBFCs) for on-lending to individuals and entities against gold jewellery as direct agriculture lending under priority

sector requirements. Similarly, investments made by banks in securitised assets originated by NBFCs, where the

underlying assets were loans against gold jewellery and purchase/assignment of gold loan portfolio from NBFCs

were also made ineligible for classification under agriculture sector lending.

•RBI advised banks to henceforth not issue Tier-1 and Tier-2 capital instruments with step-up options so that these

instruments remain eligible for inclusion in the new definition of regulatory capital under the Basel III framework.

•In the Union Budget for fiscal 2012, the government enhanced priority sector eligibility ceiling for housing loans for

dwelling units from ` 2.0 million to ` 2.5 million.

•In May 2010, RBI permitted infrastructure NBFCs to avail of external commercial borrowings for on-lending to

the infrastructure sector. Further, in July 2010, guidelines were issued to permit take-out financing arrangement

through the external commercial borrowing route for refinancing of rupee loans availed for financing infrastructure

projects particularly in the areas of seaports, airports, roads and power. In the Union Budget for fiscal 2012, the

limit for investment by Foreign Institutional Investors (FIIs) in corporate bonds with residual maturity of over five

years issued by companies in infrastructure sector, was raised by US$ 20 billion, taking the limit to US$ 25 billion.

Further, it was also proposed to create special vehicles in the form of notified infrastructure debt funds with lower

withholding tax on their interest payments and tax exemptions on their incomes.

•In August 2010, the RBI issued a discussion paper on entry of new banks in the private sector. In January 2011, RBI

also released a discussion paper on the presence of foreign banks in India.

•In June 2010, the Insurance Regulatory and Development Authority (IRDA) introduced revisions to the regulations

governing unit linked insurance products such as increase in the lock-in period from three years to five years,

increase in minimum mortality cover, cap on surrender and other charges and minimum guaranteed return on

pension annuity products.

•In March 2011, IRDA conducted an audit of the third party motor insurance pool and concluded that the

pool reserves needed to be enhanced significantly. Accordingly, IRDA stipulated that all general insurance

companies should increase these reserves based on a provisional loss ratio of 153% for the pool for all years

commencing from the year ended March 31, 2008, with the final loss ratio to be determined through a further

review in fiscal 2012.

Introduction of Base Rate system

Historically, interest rates on loans extended by banks were linked to the prime lending rate (PLR) of each bank. With

effect from July 1, 2010, RBI implemented a new base rate mechanism, requiring each bank to set and publicly disclose

its minimum rate or “Base Rate” for all new loans and advances and renewal of existing facilities, subject to certain

limited exceptions. While existing loans based on the Benchmark Prime Lending Rate (BPLR) system would continue

Management’s Discussion & Analysis

50