ICICI Bank 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

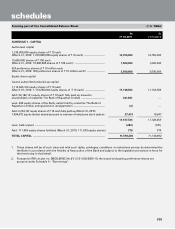

F55

The schedules referred to above form an integral part of the Profit and Loss Account

As per our Report of even date. For and on behalf of the Board of Directors

For S.R. BATLIBOI & CO.

Firm’s Registration no.: 301003E

Chartered Accountants

K. V. KAMATH SRIDAR IYENGAR CHANDA KOCHHAR

Chairman Director Managing Director & CEO

SHRAWAN JALAN

Partner

Membership no.: 102102

N. S. KANNAN K. RAMKUMAR RAJIV SABHARWAL

Executive Director & CFO Executive Director Executive Director

SANDEEP BATRA RAKESH JHA

Place : Mumbai Group Compliance Officer &

Company Secretary

Deputy Chief

Financial Officer

Date : April 28, 2011

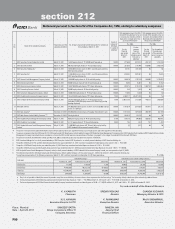

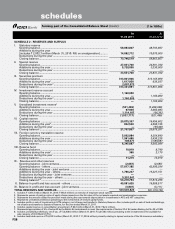

consolidated profit and loss account

for the year ended March 31, 2011 (` in ‘000s)

Schedule Year ended

31.03.2011

Year ended

31.03.2010

I. INCOME

Interest earned ....................................................................... 13 300,814,041 301,537,078

Other income ......................................................................... 14 315,133,003 294,460,648

TOTAL INCOME ..................................................................... 615,947,044 595,997,726

II. EXPENDITURE

Interest expended .................................................................. 15 193,425,685 207,291,861

Operating expenses ............................................................... 16 313,024,545 277,332,381

Provisions and contingencies ............................................... 46,314,873 62,939,335

TOTAL EXPENDITURE ........................................................... 552,765,103 547,563,577

III. PROFIT/LOSS

Net profit for the year ............................................................ 63,181,941 48,434,149

Less: Minority interest ........................................................... 2,249,269 1,731,204

Net profit/(loss) after minority interest ............................... 60,932,672 46,702,945

Profit/(loss) brought forward ................................................. 16,886,406 5,371,720

TOTAL PROFIT/(LOSS) .......................................................... 77,819,078 52,074,665

I V. APPROPRIATIONS/TRANSFERS

Transfer to Statutory Reserve ................................................ 12,880,000 10,070,000

Transfer to Reserve Fund ....................................................... 360 2,170

Transfer to Capital Reserve ................................................... 832,500 4,440,000

Transfer to/(from) Investment Reserve Account .................. (1,160,000) 1,160,000

Transfer to Special Reserve ................................................... 5,720,000 3,330,000

Transfer to Revenue and other reserves ............................... 679,371 521,833

Dividend (including corporate dividend tax) for the

previous year paid during the year ....................................... 21,658 929

Proposed equity share dividend ........................................... 16,125,811 13,378,604

Proposed preference share dividend .................................... 35 35

Corporate dividend tax .......................................................... 2,641,730 2,284,688

Balance carried over to balance sheet .................................. 40,077,613 16,886,406

TOTAL ..................................................................................... 77,819,078 52,074,665

Significant accounting policies and notes to accounts ................ 17 & 18

Earnings per share (refer note 18.2)

Basic (`) .................................................................................. 53.54 41.93

Diluted (`) ............................................................................... 53.25 41.72

Face value per share (`) ................................................................... 10.00 10.00