ICICI Bank 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to be linked to BPLR till their maturity, the existing borrowers have an option to migrate to the Base Rate system

before the expiry of existing contracts on mutually agreed terms. Except certain categories of loans as specified by

RBI, banks are not allowed to lend below the Base Rate. Under the regulation, banks must review their base rates at

least once every quarter.

The Asset Liability Management Committee (ALCO) of the Bank at its meeting on June 30, 2010, set the Base Rate of

ICICI Bank, called “I-Base”, at 7.50% p.a. with effect from July 1, 2010. I-Base was increased by 175 basis points, in

four phases, the last such increase being to 9.25% p.a. with effect from May 7, 2011.

Change in Methodology for Computing Interest Payable on Savings Deposits

RBI had prescribed an interest rate of 3.50% on savings deposits and upto March 31, 2010 banks were required to pay

this interest on the minimum outstanding balance in a savings deposit account between the tenth day and the end of

the month. Effective April 1, 2010, RBI changed the methodology of computation of the interest payable and banks

were required to pay interest on the daily average balance maintained in a savings deposit account. The change in

methodology resulted in increase in cost of savings account deposits for banks. RBI has increased the interest rate on

savings account deposits to 4.00% with effect from May 3, 2011.

Amalgamation of The Bank of Rajasthan

On May 23, 2010, the Board of Directors of ICICI Bank and the Board of Directors of The Bank of Rajasthan Limited

(Bank of Rajasthan), an old private sector bank, at their respective meetings approved an all-stock amalgamation

of Bank of Rajasthan with ICICI Bank at a share exchange ratio of 25 shares of ICICI Bank for 118 shares of Bank of

Rajasthan. The shareholders of ICICI Bank and Bank of Rajasthan approved the scheme of amalgamation at their

respective extra-ordinary general meetings. RBI approved the scheme of amalgamation with effect from close of

business on August 12, 2010.

We have issued 31.3 million shares in August 2010 and 2.9 million shares in November 2010 to shareholders of Bank

of Rajasthan. The total assets of Bank of Rajasthan represented 4.0% of total assets of ICICI Bank at August 12, 2010.

At August 12, 2010, Bank of Rajasthan had total assets of ` 155.96 billion, deposits of ` 134.83 billion, loans of ` 65.28

billion and investments of ` 70.96 billion. It incurred a loss of ` 1.02 billion in fiscal 2010. The results for fiscal 2011

include results of Bank of Rajasthan for the period from August 13, 2010 to March 31, 2011. The assets and liabilities of

Bank of Rajasthan have been accounted at the values at which they were appearing in the books of Bank of Rajasthan

at August 12, 2010 and provisions were made for the difference between the book values appearing in the books of

Bank of Rajasthan and the fair value as determined by ICICI Bank.

The amalgamation was part of our strategy to expand our branch network with a view to growing our deposit base.

We believe that the combination of Bank of Rajasthan’s branch franchise with our strong capital base would enhance

the ability of the combined entity to capitalise on the growth opportunities in the Indian economy.

STANDALONE FINANCIALS AS PER INDIAN GAAP

Summary

During fiscal 2011, we focused on leveraging our rebalanced funding mix and strong capital position to grow our loan

portfolio, while substantially reducing our provisions for loan losses to improve our profitability.

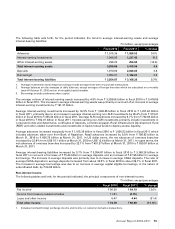

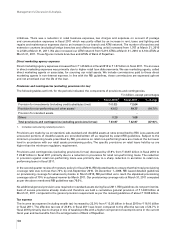

Our profit after tax increased by 28.0% from ` 40.25 billion in fiscal 2010 to ` 51.51 billion in fiscal 2011. The increase

in profit after tax was mainly due to a 47.9% decrease in provisions and contingencies (excluding provisions for tax)

from ` 43.87 billion in fiscal 2010 to ` 22.87 billion in the fiscal 2011. The decrease in provisions and contingencies

(excluding provisions for tax) was primarily due to a reduction in provisions for retail non-performing loans, as

accretion to retail non-performing loans declined sharply in fiscal 2011. Net interest income increased by 11.1% from

` 81.14 billion in fiscal 2010 to ` 90.17 billion in fiscal 2011.

The decrease in provisions and contingencies and increase in net interest income was partly offset by an 11.1%

decrease in non-interest income from ` 74.78 billion in fiscal 2010 to ` 66.48 billion in fiscal 2011. The decrease in

non-interest income was primarily due to a decrease in income from treasury-related activities by ` 13.96 billion from

a gain of ` 11.81 billion in fiscal 2010 to a loss of ` 2.15 billion in fiscal 2011. The higher income from treasury-related

activities in fiscal 2010 included reversal of provision against credit derivatives due to softening of credit spreads and

Annual Report 2010-2011 51