ICICI Bank 2011 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Committee for borrowers identified as Wilful Defaulters, Committee of Senior Management (comprising

certain wholetime Directors and executives) and Committee of Executives, Compliance Committee, Product

& Process Approval Committee, Regional Committees for India and overseas operations, Outsourcing

Committee, Operational Risk Management Committee and other Committees (all comprising executives).

These committees are responsible for specific operational areas like asset-liability management, approval

of credit proposals, approval of products and processes and management of operational risk, under

authorisation/supervision of the Board and its Committees.

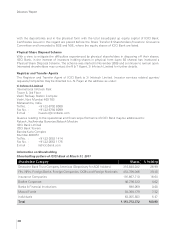

XII. General Body Meetings

The details of General Body Meetings held in the last three years are given below:

General Body Meeting Day, Date Time Venue

Fourteenth AGM Saturday, July 26, 2008 2.00 p.m. Professor Chandravadan Mehta

Auditorium, General Education

Centre, Opposite D. N. Hall Ground,

The Maharaja Sayajirao University,

Pratapgunj, Vadodara 390 002.

Fifteenth AGM Monday, June 29, 2009 1.30 p.m.

Extra-ordinary General

Meeting

Monday, June 21, 2010 1.30 p.m.

Sixteenth AGM Monday, June 28, 2010 1.30 p.m.

The details of the Resolution passed under Section 44A of the Banking Regulation Act, 1949 and Reserve Bank

of India’s guidelines for merger/amalgamation of private sector banks dated May 11, 2005 are given below.

General Body Meeting Day, Date Resolution

Extra-ordinary General

Meeting

Monday, June 21, 2010 Merger of The Bank of Rajasthan Limited with

ICICI Bank Limited (passed by requisite majority

as provided under Section 44A of the Banking

Regulation Act, 1949)

Postal Ballot

At present, no special resolution is proposed to be passed through postal ballot. No resolution was passed

through postal ballot during fiscal 2011.

XIII. Disclosures

1. There are no materially significant transactions with related parties i.e., directors, management,

subsidiaries, or relatives conflicting with the Bank’s interests. The Bank has no promoter.

2. Penalties or strictures imposed on the Bank by any of the stock exchanges, the Securities & Exchange

Board of India (SEBI) or any other statutory authority, for any non-compliance on any matter relating to

capital markets, during the last three years are detailed below:

•No penalties or strictures have been imposed on the Bank by any of the stock exchanges or SEBI for

any non-compliance on any matter relating to capital markets during the last three years.

•RBI, vide letter dated April 26, 2011, has imposed a penalty of ` 1.5 million on the Bank along with 18

other banks for violation of the guidelines on derivatives and extant instructions thereunder.

3. In terms of the Whistle Blower Policy of the Bank, no employee of the Bank has been denied access to

the Audit Committee.

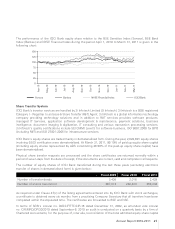

XIV. Means of Communication

It is ICICI Bank’s belief that all stakeholders should have access to complete information regarding its position

to enable them to accurately assess its future potential. ICICI Bank disseminates information on its operations

and initiatives on a regular basis. ICICI Bank‘s website (www.icicibank.com) serves as a key awareness facility

for all its stakeholders, allowing them to access information at their convenience. It provides comprehensive

Directors’ Report

}

24