ICICI Bank 2011 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F100

Policies and processes

All credit risk related aspects are governed by Credit and Recovery Policy (Credit Policy). Credit Policy outlines the type

of products that can be offered, customer categories, target customer profile, credit approval process and limits. The

Credit Policy is approved by the Board of Directors.

The delegation structure for approval of credit limits is approved by the Board of Directors. All credit proposals other

than retail products, program lending and certain other specified products are rated internally by the Risk Management

Group (RMG) prior to approval by the appropriate forum.

Credit facilities with respect to retail products are provided as per approved product policies. All retail products and

policies require the approval of the Committee of Executive Directors.

• Within the retail operations, there is segregation of the sourcing, verification, approval and disbursement of retail

credit exposures to achieve independence.

• Program lending involves a cluster based approach wherein a lending program is implemented for a homogeneous

group of individuals/business entities which comply with certain laid down parameterised norms. The approving

authority as per the Board approved authorisation lays down these parameters.

• For certain products including dealer funding, builder finance and facilities fully collateralised by cash and cash

equivalents, the delegation structure approved by the Board of Directors may permit exemption from the stipulation

pertaining to internal rating, up to a certain loan amount. Credit approval limits with respect to such products are

laid out in the delegation structure approved by the Board of Directors.

A risk based asset review framework has been put in place wherein the frequency of asset review would be higher for

cases with higher outstanding and/or lower credit rating.

Structure and organisation

RMG is responsible for rating of the credit portfolio, tracking trends in various industries and periodic reporting of

portfolio-level changes. RMG is segregated into sub-groups for corporate, small enterprises, rural and agri-linked

banking group and retail businesses.

The overseas banking subsidiaries of the Bank have also established similar structures to ensure adequate risk

management, factoring in the risks particular to the respective businesses and the regulatory and statutory guidelines.

The risk heads of all overseas banking subsidiaries have a reporting relationship to the Head - RMG, in addition to

reporting to the Chief Executive Officer of the respective subsidiaries.

Credit risk assessment process

There is a structured and standardised credit approval process including a comprehensive credit risk assessment

process, which encompasses analysis of relevant quantitative and qualitative information to ascertain credit rating of

the borrower.

The credit rating process involves assessment of risk emanating from various sources such as industry risk, business

risk, financial risk, management risk, project risk and structure risk.

In respect of retail advances, the Bank’s credit officers evaluate credit proposals on the basis of the operating notes

approved by the Committee of Executive Directors and the risk assessment criteria defined by RMG.

Credit approval authorisation structure

The Board of Directors has delegated the authority to the Credit Committee consisting of a majority of independent

Directors, the Committee of Executive Directors consisting of whole time Directors, the Committee of Senior

Management consisting of whole time directors and Group Executives, the Committee of Executives, the Regional

Committee, Small and Medium Enterprise and corporate Agriculture Forums and Retail Credit Forums, all consisting of

designated executives, and to individual executives in the case of program/policy based products, to approve financial

assistance within certain individual and group exposure limits set by the Board of Directors. The authorisation is based

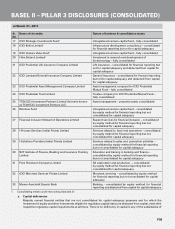

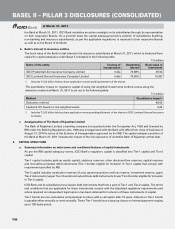

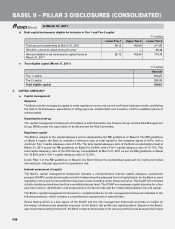

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2011