ICICI Bank 2011 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F95

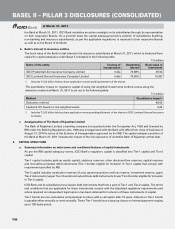

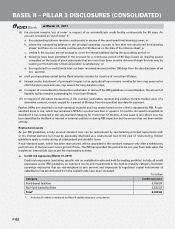

The upper Tier-2 bonds are cumulative and have an original maturity of 15 years with call option after 10 years.

The interest on upper Tier-2 bonds is payable either annually or semi-annually. Some of the upper Tier-2 debt

instruments have a step-up clause on interest payment ranging up to 100 basis points.

The lower Tier-2 bonds (subordinated debt) are cumulative and have an original maturity between 5 to 15 years.

The interest on lower Tier-2 capital instruments is payable quarterly, semi-annually or annually.

RBI vide its circular dated January 20, 2011 stipulated that henceforth capital instruments issued with step-up

option will not be eligible for inclusion in the capital funds. Capital issuances with step-up option prior to the

release of the above-mentioned circular would continue to remain eligible for inclusion in regulatory capital. The

Bank is in compliance with this stipulation and the existing Tier-1 and Tier-2 capital instruments with step-up option

have all been issued prior to January 20, 2011.

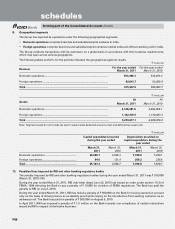

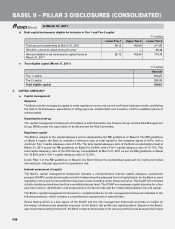

b. Amount of Tier-1 capital (March 31, 2011)

` in billion

Tier-1 capital elements Amount

Paid-up share capital112.74

Reserves2540.94

Innovative Tier-1 capital instruments 28.12

Minority interest 0.66

Gross Tier-1 capital 582.46

Deductions:

Investments in instruments eligible for regulatory capital of financial

subsidiaries/associates

24.73

Securitisation exposures including credit enhancements 23.59

Deferred tax assets 27.68

Others32.02

Minority interest not eligible for inclusion in Tier-1 capital 0.18

Net Tier-1 capital 504.25

1. Includes preference shares permitted by RBI for inclusion in Tier-1 capital.

2. Includes statutory reserves, disclosed free reserves, capital reserves and special reserves (net of tax payable).

3. Includes goodwill and adjustments for less liquid positions.

c. Amount of Tier-2 capital (March 31, 2011)

` in billion

Tier-2 capital elements Amount

General provisions 17.87

Upper Tier-2 capital instruments 142.04

Lower Tier-2 capital instruments 173.79

Gross Tier-2 capital 333.70

Deductions:

Investments in instruments eligible for regulatory capital of financial

subsidiaries/associates

24.73

Securitisation exposures including credit enhancements 23.59

Net Tier-2 capital 285.38

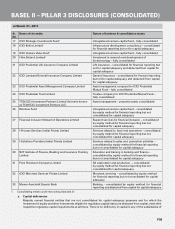

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2011