ICICI Bank 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F34

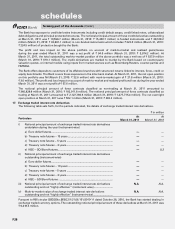

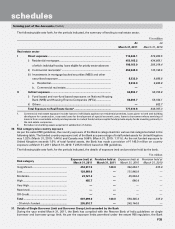

(b) The following table sets forth, the names of SPVs/trusts which are not sponsored by the Bank/subsidiaries and

are consolidated:

Sr.

No.

Name of the SPV1

A. Domestic

1. Rainbow Fund

B. Overseas

None

1. The nature of business of the above entities is given in significant accounting policies (Schedule 17) in the notes to accounts

to consolidated financial statements.

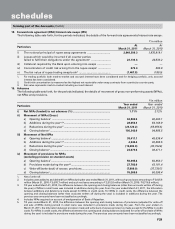

29. Lending to sensitive sectors

The Bank has lending to sectors, which are sensitive to asset price fluctuations. The sensitive sectors include capital

markets and real estate.

The following table sets forth, for the periods indicated, the position of lending to capital market sector.

` in million

At

March 31, 2011

At

March 31, 2010

Capital market sector

i) Direct investment in equity shares, convertible debentures and units

of equity-oriented mutual funds, the corpus of which is not exclusively

invested in corporate debt

19,481.6 22,082.3

ii) Advances against shares/bonds/ debentures or other securities or

on clean basis to individuals for investment in shares (including IPOs/

ESOPs), convertible bonds, convertible debentures, and units of equity-

oriented mutual funds

12,659.3 34,463.6

iii) Advances for any other purposes where shares or convertible bonds or

convertible debentures or units of equity oriented mutual funds are taken

as primary security

5,513.6 5,315.6

iv) Advances for any other purposes to the extent secured by the collateral

security of shares or convertible bonds or convertible debentures or units

of equity oriented mutual funds

—330.6

v) Secured and unsecured advances to stockbrokers and guarantees issued

on behalf of stockbrokers and market makers

31,845.2 22,771.3

vi) Loans sanctioned to corporate against the security of shares/bonds/

debentures or other securities or on clean basis for meeting promoter’s

contribution to the equity of new companies in anticipation of raising

resources

——

vii) Bridge loans to companies against expected equity flows/issues ——

viii) Underwriting commitments taken up by the Bank in respect of primary

issue of shares or convertible bonds or convertible debentures or units of

equity oriented mutual funds

——

ix) Financing to stockbrokers for margin trading ——

x) All exposures to Venture Capital Funds (both registered and unregistered) 10,338.6 12,214.3

xi) Others 26,014.9 14,091.8

Total Exposure to Capital Market 105,853.2 111,269.5

Note:The above excludes the exposure under non disposable undertaking (NDU) and power of attorney (PoA) structure and acquisition

financing which are backed only by contractual comfort of shares.

forming part of the Accounts (Contd.)

schedules