ICICI Bank 2011 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F89

forming part of the Consolidated Accounts (Contd.)

14. Small and Micro Industries

Under the Micro, Small and Medium Enterprises Development Act, 2006 which came into force from October 2, 2006,

certain disclosures are required to be made relating to enterprises covered under the Act. During the year ended

March 31, 2011, the amount paid after the due date to vendors registered under the MSMED Act, 2006 was ` 17.9

million (March 31, 2010: ` 65.2 million). An amount of ` 0.7 million (March 31, 2010: ` 1.7 million) has been charged to

profit and loss account towards accrual of interest on these delayed payments.

15. Transfer of merchant acquiring operations

During the year ended March 31, 2010, the Bank and First Data, a company engaged in electronic commerce and

payment services, formed a merchant acquiring alliance and a new entity, 81.00% owned by First Data, was formed,

which acquired ICICI Bank’s merchant acquiring operations through transfer of assets, primarily comprising fixed assets

and receivables, and assumption of liabilities, for a total consideration of ` 3,744.0 million. This transfer of assets and

liabilities to the new entity would be considered a ‘slump sale’ for tax purposes. The Bank realised a profit of ` 2,029.0

million from this transaction, which was included in Schedule 14 – “Other income” for the year ended March 31, 2010.

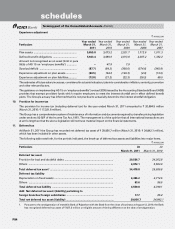

16. Repurchase transactions

Upto March 31, 2010, the Bank used to account for market repurchase and reverse repurchase transactions in

government securities and corporate debt securities, if any, as “sale and repurchase” transactions. However, as per RBI

circular no. RBI/2009-2010/356 IDMD/ 4135/11.08.43/2009-10 dated March 23, 2010, the Bank has started accounting for

such transactions as “borrowing and lending” transactions, effective April 1, 2010.

If the Bank had continued to account the repurchase and reverse repurchase transactions as “sale and repurchase” at

March 31, 2011, the investments would have been higher by ` 122.8 million and the ‘Balances with Banks and Money

at call and short notice’ and ‘Borrowings’ would have been lower by ` 124.0 million and ` 1.2 million respectively.

Pursuant to above guidelines, ICICI Securities Primary Dealership Limited has also started accounting for such

transactions as “borrowing and lending” transactions, effective April 1, 2010. If ICICI Securities Primary Dealership

Limited had continued to account the repurchase and reverse repurchase transactions as “sale and repurchase” at

March 31, 2011, the borrowing would have been higher by ` 21,895.9 million, the investment would have been higher

by ` 21,831.0 million and interest accrued on investment would have been higher by ` 64.9 million.

17. Settlement date accounting for government securities

Pursuant to RBI circular DBOD.No.BP.BC.58/21.04.141/2010-11 dated November 4, 2010, the Bank has changed the

accounting for purchase and sale of government securities from trade date basis to settlement date basis with effect

from January 1, 2011. Under settlement date accounting, the purchase and sale of securities are recognised in the

books on the date of settlement. The changes in fair value of investments between trade date and settlement date are

recognised in case of purchased securities while such changes are ignored in case of securities sold. In case the Bank

had continued to follow the trade date accounting, investments portfolio at March 31, 2011 would have been lower by

` 655.2 million (net), the other assets would have been higher by ` 1,153.6 million, other liabilities would have been

higher by ` 500.2 million and the impact on the profit and loss account would have been Nil.

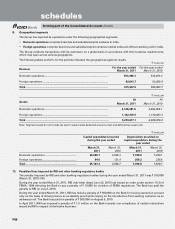

18. Contribution to Motor Third Party Insurance Pool by ICICI Lombard General Insurance Company Limited

(ICICI General)

In accordance with IRDA guidelines, ICICI General, together with all other general insurance companies participates in

the Indian Motor Third Party Insurance Pool (‘the Pool’), administered by the General Insurance Corporation of India

(‘GIC’) from April 1, 2007. The Pool covers reinsurance of third party risks of commercial vehicles.

ICICI General has ceded 100.00% of the third party premium collected to the Pool and has recorded its share of results

in the Pool based on unaudited statements received from the Pool for the period from March 2010 upto February 2011.

Based on the statements received from the Pool, liability for IBNR claim for the Pool was provided in the past. During

the current year, IRDA carried out independent assessment of the provision required and vide its order IRDA/NL/ORD/

MPL/046/03/2011 dated March 12, 2011 directed all general insurance companies to make a provision of not less than

153.00% for each of the four years from the inception of the Pool (i.e. from 2007-08). Due to this, an additional provision

of ` 2,720.0 million has been created during the current year by ICICI General.

Accordingly, the Bank’s consolidated net profit before tax for FY2011 includes impact of additional losses on account of

the pool of ` 2,000.6 million. IRDA has also indicated that there will be a peer review of the provisions requirement by

independent actuary and further provisions, if any will be made once the review is completed. The impact of the same

in the consolidated financial statements is presently not determinable.

In view of above developments, IRDA has allowed increase in the rate of premium applicable to Motor Third Party

Liability insurance business by 68.50% with effect from April 25, 2011.

schedules