ICICI Bank 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F35

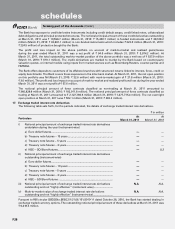

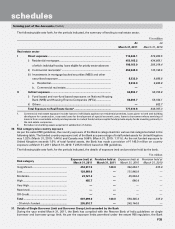

The following table sets forth, for the periods indicated, the summary of lending to real estate sector.

` in million

At

March 31, 2011

At

March 31, 2010

Real estate sector

I Direct exposure ...................................................................................... 712,446.1 579,950.5

i) Residential mortgages ......................................................................

of which: individual housing loans eligible for priority sector advances

453,165.2

190,163.0

434,865.1

205,019.4

ii) Commercial real estate1 ................................................................... 250,948.9 135,198.6

iii) Investments in mortgage backed securities (MBS) and other

securitised exposure ........................................................................ 8,332.0 9,886.8

a. Residential.................................................................................. 8,332.0 9,886.8

b. Commercial real estate.............................................................. ——

II Indirect exposure ................................................................................... 64,893.7 58,756.8

i) Fund based and non-fund based exposures on National Housing

Bank (NHB) and Housing Finance Companies (HFCs) .................... 64,893.7 58,104.1

ii) Others ............................................................................................... —652.7

Total Exposure to Real Estate Sector2.................................................. 777,339.8 638,707.3

1. Commercial real estate exposure include loans to individuals against non-residential premises, loans given to land and building

developers for construction, corporate loans for development of special economic zone, loans to borrowers where servicing of

loans is from a real estate activity and exposures to mutual funds/venture capital funds/private equity funds investing primarily in

the real estate companies.

2. Excludes non-banking assets acquired in satisfaction of claims.

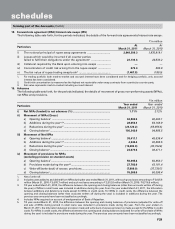

30. Risk category-wise country exposure

As per the extant RBI guidelines, the country exposure of the Bank is categorised into various risk categories listed in the

following table. The funded country exposure (net) of the Bank as a percentage of total funded assets for United Kingdom

was 1.32% (March 31, 2010: 1.44%) and Canada was 0.99% (March 31, 2010: 1.11%). As the net funded exposure to

United Kingdom exceeds 1.0% of total funded assets, the Bank has made a provision of ` 140.0 million on country

exposure at March 31, 2011 (March 31, 2010: ` 235.0 million) based on RBI guidelines.

The following table sets forth, for the periods indicated, the details of exposure (net) and provision held by the bank.

` in million

Risk category Exposure (net) at

March 31, 2011

Provision held at

March 31, 2011

Exposure (net) at

March 31, 2010

Provision held at

March 31, 2010

Insignificant ................................................ 452,917.5 140.0 392,684.7 235.0

Low ............................................................. 129,968.6 — 131,940.9 —

Moderate.................................................... 23,727.2 — 25,024.4 —

High ............................................................ 485.7 — 696.4 —

Very High ................................................... — — — —

Restricted ................................................... — — — —

Off-Credit ................................................... — — — —

Total ........................................................... 607,099.0 140.0 550,346.4 235.0

- Of which: funded .................................... 295,610.7 — 245,144.8 —

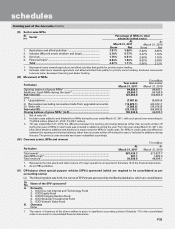

31. Details of Single Borrower Limit and Borrower Group Limit exceeded by the Bank

During the year ended March 31, 2011, the Bank has complied with the Reserve Bank of India guidelines on single

borrower and borrower group limit. As per the exposure limits permitted under the extant RBI regulation, the Bank

forming part of the Accounts (Contd.)

schedules