ICICI Bank 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F52

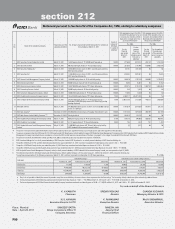

auditors’ report

1. We have audited the attached consolidated balance sheet of ICICI Bank Limited (the ‘Bank’) and its subsidiaries,

associates and joint ventures (the ‘ICICI Group’), as at March 31, 2011, and also the consolidated profit and loss account

and the consolidated cash flow statement for the year ended on that date annexed thereto. These financial statements

are the responsibility of the ICICI Bank Limited’s management and have been prepared by the management on the basis

of separate financial statements and other financial information regarding components. Our responsibility is to express

an opinion on these financial statements based on our audit.

2. We conducted our audit in accordance with the auditing standards generally accepted in India. Those Standards require

that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of

material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures

in the financial statements. An audit also includes assessing the accounting principles used and significant estimates

made by management, as well as evaluating the overall financial statement presentation. We believe that our audit

provides a reasonable basis for our opinion.

3. We did not audit the financial statements of certain subsidiaries, whose financial statements reflect total assets of

` 1,292,190.2 million as at March 31, 2011, total revenue of ` 277,710.8 million and cash flows amounting to

` (39,042.3) million for the year then ended. These financial statements and other financial information have been

audited by other auditors whose reports have been furnished to us, and our opinion is based solely on the report of

other auditors.

4. We did not audit the financial statements of Singapore, Bahrain and Hong Kong branches, whose financial statements

reflect total assets of ` 850,507.9 million as at March 31, 2011, the total revenue of ` 42,480.8 million for the year ended

March 31, 2011 and net cash flows amounting to ` 39,302.7 million for the year ended March 31, 2011. These financial

statements have been audited by other auditors, duly qualified to acts as auditors in the country of incorporation of the

said branches, whose reports have been furnished to us, and our opinion is based solely on the report of other auditors.

5. We have also relied on the un-audited financial statements of certain subsidiaries, associates and joint ventures, whose

financial statements reflect total assets of ` 11,857.3 million as at March 31, 2011, total revenues of ` 3,141.8 million and

net cash flows amounting to ` (178.0) million for the year then ended.

6. We report that the consolidated financial statements have been prepared by the ICICI Bank Limited’s management in

accordance with the requirements of Accounting Standards (AS) 21, Consolidated financial statements, Accounting

Standards (AS) 23, Accounting for Investments in Associates in Consolidated Financial Statements and Accounting

Standard (AS) 27, Financial Reporting of Interests in Joint Ventures notified pursuant to the Companies (Accounting

Standards) Rules, 2006, (as amended).

7. The actuarial valuation of liabilities for life policies in force is the responsibility of the ICICI Group’s life insurance

subsidiary’s appointed actuary (the Appointed Actuary). The actuarial valuation of these liabilities as at March 31, 2011

has been duly certified by the Appointed Actuary and in his opinion; the assumption for such valuation are in accordance

with the guidelines and norms issued by the Insurance Regulatory and Development Authority (‘IRDA’) and the Actuarial

Society in concurrence with the IRDA. The statutory auditors of ICICI Prudential Life Insurance Company Limited have

relied upon the Appointed Actuary’s certificate in this regard.

8. The actuarial valuation of liability in respect of claims incurred but not reported (‘IBNR’) and those incurred but not

enough reported (‘IBNER’) (the Appointed Actuary). The actuarial valuation of these liabilities as at March 31, 2011 has

been duly certified by the Appointed Actuary and in his opinion; the assumption for such valuation are in accordance

To the Board of Directors of ICICI Bank Limited on the Consolidated Financial

Statements of ICICI Bank Limited and its Subsidiaries, Associates and Joint Ventures.