ICICI Bank 2011 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F111

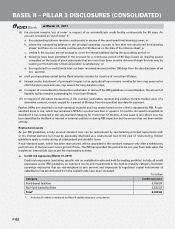

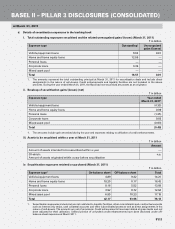

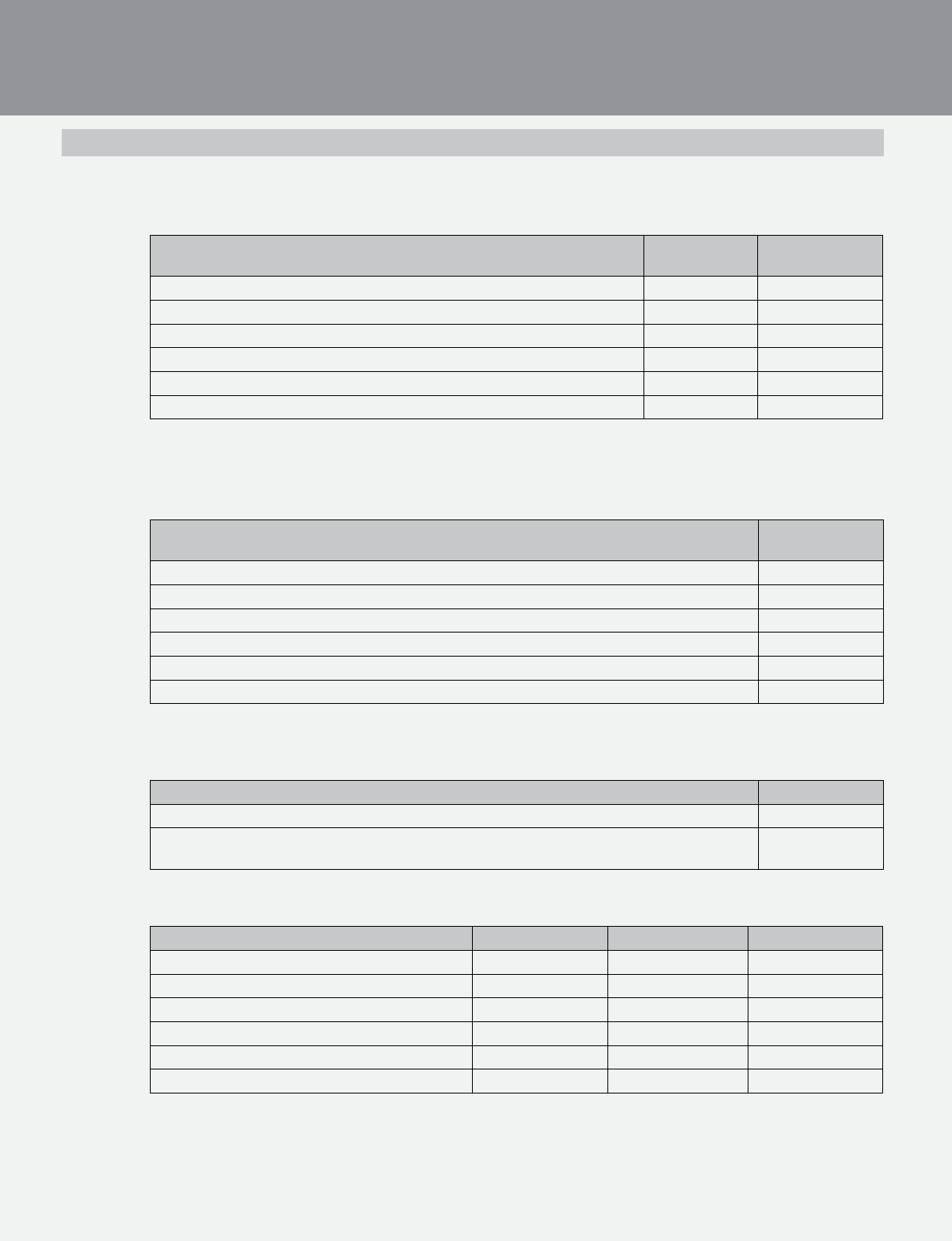

d. Details of securitisation exposures in the banking book

I. Total outstanding exposures securitised and the related unrecognised gains/(losses) (March 31, 2011)

` in billion

Exposure type Outstanding1Unrecognised

gains/(losses)

Vehicle/equipment loans 0.62 0.01

Home and home equity loans 12.56 —

Personal loans — —

Corporate loans 3.39 —

Mixed asset pool — —

Total 16.57 0.01

1. The amounts represent the total outstanding principal at March 31, 2011 for securitisation deals and include direct

assignments in the nature of sell-downs. Credit enhancements and liquidity facilities are not included in the above

amounts. During the year ended March 31, 2011, the Bank had not securitised any assets as an originator.

ii. Break-up of securitisation gains/(losses) (net)

` in billion

Exposure type Year ended

March 31, 20111

Vehicle/equipment loans (4.35)

Home and home equity loans 0.09

Personal loans (1.25)

Corporate loans 0.05

Mixed asset pool (0.03)

Total (5.49)

1. The amounts include gain amortised during the year and expenses relating to utilisation of credit enhancements.

iii. Assets to be securitised within a year at March 31, 2011

` in billion

Amount

Amount of assets intended to be securitised within a year —

Of which:

Amount of assets originated within a year before securitisation

n.a.

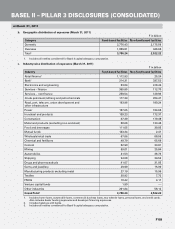

iv. Securitisation exposures retained or purchased (March 31, 2011)

` in billion

Exposure type1On-balance sheet Off-balance sheet Total

Vehicle/equipment loans 4.89 9.32 14.21

Home and home equity loans 18.25 0.17 18.42

Personal loans 8.16 5.52 13.68

Corporate loans 3.92 8.72 12.64

Mixed asset pool 6.95 10.23 17.18

Total 42.17 33.96 76.13

1. Securitisation exposures include but are not restricted to liquidity facilities, other commitments and credit enhancements

such as interest only strips, cash collateral accounts and other subordinated assets as well as direct assignments in the

nature of sell-downs. The amounts are net of provisions. Credit enhancements have been stated at gross levels and not

been adjusted for their utilisation. Utilised portion of unfunded credit enhancements have been disclosed under off-

balance sheet exposures at March 2011.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2011