ICICI Bank 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F46

As per the assessment done, there is no likely financial impact of the above letters issued to overseas regulators or of

the indemnity agreements at March 31, 2011.

In addition to the above, the Bank has also issued letters of comfort in the nature of letters of awareness on behalf

of banking and non-banking subsidiaries in respect of their borrowings made or proposed to be made and for other

incidental business purposes. As they are in the nature of factual statements or confirmation of facts, they do not create

any financial impact on the Bank.

The letters of comfort that are outstanding at March 31, 2011 pertain to facilities aggregating equivalent to ` 40,240.9

million (March 31, 2010: ` 76,408.0 million) as availed of by such subsidiaries. The repayments of facilities pertaining

to which such letters were issued, aggregate to ` 30,022.6 million and letters that were expired during the year ended

March 31, 2011 pertained to facilities aggregating to ` 8,356.0 million. A letter pertaining to facilities aggregating to

` 2,229.8 million was re-issued during the year ended March 31, 2011.

As advised by RBI, the Bank has provided additional capital of ` 1,700.5 million (March 31, 2010: ` 3,312.4 million) on

the letters of comfort that are in the nature of letters of awareness issued on behalf of its subsidiaries for their borrowing

programmes.

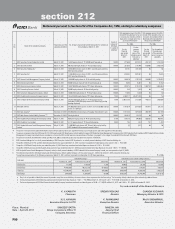

Related party balances

The following table sets forth, the balance payable to/receivable from subsidiaries/joint ventures/associates/other related

entities/key management personnel and relatives of key management personnel at March 31, 2011.

` in million

Items/Related party Subsidiaries

Associates/ joint

ventures/other

related entities

Key

Management

Personnel

Relatives of Key

Management

Personnel

Total

Deposits with ICICI Bank ........ 9,028.7 1,572.2 35.8 12.1 10,648.8

Deposits of ICICI Bank ........... 117.8 — — — 117.8

Call/term money lent .............. — — — — —

Call/term money borrowed .... — — — — —

Advances ................................ 18,162.2 44.3 10.6 7.7 18,224.8

Investments of ICICI Bank ...... 135,409.7 7,518.6 — — 142,928.3

Investments of related parties

in ICICI Bank ............................ 387.2 15.0 3.5 — 405.7

Receivables1 ............................ 516.8 188.2 — — 705.0

Payables1 ................................. 69.0 117.8 — — 186.8

Guarantees/ letter of credit .... 5,975.9 0.1 — — 5,976.0

Swaps/forward contracts

(notional amount) ................... 271,676.7 — — — 271,676.7

Employee stock options

outstanding (Numbers) .......... — — 2,263,000 — 2,263,000

Employee stock options

exercised2 .............................. — — — — —

1. Excludes mark-to-market on outstanding derivative transactions.

2. During the year ended March 31, 2011, no employee stock options were exercised.

forming part of the Accounts (Contd.)

schedules