ICICI Bank 2011 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

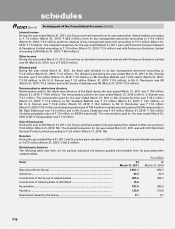

F85

forming part of the Consolidated Accounts (Contd.)

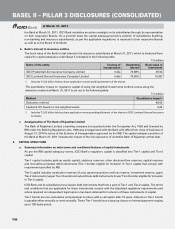

At March 31, 2011, ICICI Prudential Life Insurance Company has created deferred tax asset on carry forward unabsorbed

losses amounting to ` 1,330.8 million (March 31, 2010: ` 2,041.5 million) which can be set off against future taxable

income and on timing differences arising from funds for future appropriation under linked line of business. ICICI Lombard

General Insurance Company has created deferred tax asset on carry forward unabsorbed losses amounting to ` 305.8

million (March 31, 2010: Nil).

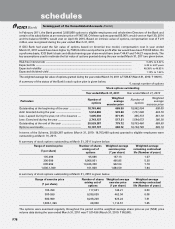

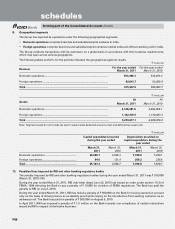

12. Information about business and geographical segments

A. Business segments for the year ended March 31, 2011

The primary segment for the Group has been presented as follows:

1. Retail banking includes exposures of the Bank which satisfy the four criteria of orientation, product, granularity and low

value of individual exposures for retail exposures laid down in the Basel Committee on Banking Supervision document

‘International Convergence of Capital Measurement and Capital Standards’, as per the RBI guidelines for the Bank.

2. Wholesale banking includes all advances to trusts, partnership firms, companies and statutory bodies, by the Bank

which are not included under Retail Banking segment, as per the RBI guidelines for the Bank.

3. Treasury includes the entire investment portfolio of the Bank, ICICI Eco-net Internet and Technology Fund, ICICI Equity

Fund, ICICI Emerging Sectors Fund, ICICI Strategic Investments Fund and ICICI Venture Value Fund.

4. Other banking business includes hire purchase and leasing operations and other items not attributable to any particular

business segment of the Bank. Further, it includes the Bank’s banking subsidiaries i.e. ICICI Bank UK PLC, ICICI Bank

Canada and its subsidiary, namely, ICICI Wealth Management Inc. (upto December 31, 2009) and ICICI Bank Eurasia LLC.

5. Life insurance represents results of ICICI Prudential Life Insurance Company Limited.

6. General insurance represents results of ICICI Lombard General Insurance Company Limited.

7. Venture fund management represents results of ICICI Venture Funds Management Company Limited.

8. Others includes ICICI Home Finance Company Limited, ICICI International Limited, ICICI Securities Primary Dealership

Limited, ICICI Securities Limited, ICICI Securities Holdings Inc., ICICI Securities Inc., ICICI Prudential Asset Management

Company Limited, ICICI Prudential Trust Limited, ICICI Investment Management Company Limited, ICICI Trusteeship

Services Limited, TCW/ICICI Investment Partners Limited, ICICI Kinfra Limited, ICICI West Bengal Infrastructure

Development Corporation Limited (upto December 31, 2010), I-Ven Biotech Limited and ICICI Prudential Pension Funds

Management Company Limited, Loyalty Solutions & Research Limited (upto March 31, 2010).

Income, expenses, assets and liabilities are either specifically identified with individual segments or are allocated to

segments on a systematic basis.

All liabilities are transfer priced to a central treasury unit, which pools all funds and lends to the business units at appropriate

rates based on the relevant maturity of assets being funded after adjusting for regulatory reserve requirements.

The results of reported segments for the year ended March 31, 2011 are not comparable with that of reported segments

for the year ended March 31, 2010 to the extent entities have been discontinued from consolidation.

schedules