ICICI Bank 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F23

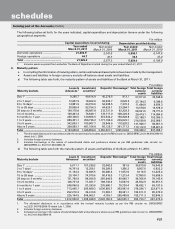

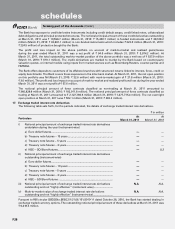

A summary of stock options outstanding at March 31, 2011 is given below.

Range of exercise price (` per share)

Number of shares

arising out of options

Weighted average

exercise price

(` per share)

Weighted average

remaining contractual

life (Number of years)

105-299 .................................................................. 95,086 137.13 1.07

300-599 .................................................................. 6,906,951 466.85 5.30

600-999 .................................................................. 13,426,350 942.54 7.78

1,000-1,399 ............................................................ 101,000 1,084.59 7.94

A summary of stock options outstanding at March 31, 2010 is given below.

Range of exercise price (` per share)

Number of shares

arising out of

options

Weighted average

exercise price

(` per share)

Weighted average

remaining contractual

life (Number of years)

105-299 .................................................................. 117,601 146.21 2.03

300-599 .................................................................. 9,339,639 462.04 6.08

600-999 .................................................................. 9,238,220 923.24 7.61

1,000-1,399 ............................................................ 68,000 1,114.57 7.65

The options were exercised regularly throughout the period and weighted average share price as per NSE price volume

data during the year ended March 31, 2011 was ` 1,014.96 (March 31, 2010: ` 853.80).

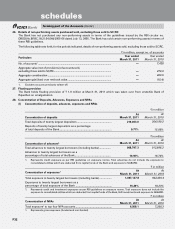

9. Reconciliation of nostro account

In terms of RBI circular no. DBOD.BP.BC.No. 133/21.04.018/2008-09 dated May 11, 2009, ` 2.6 million (March 31, 2010:

` 10.4 million) representing outstanding credit balances of individual value less than US$ 2,500 or equivalent lying in

nostro account, which were originated up to March 31, 2002, was transferred to profit and loss account during the year

ended March 31, 2011 and has been subsequently appropriated to General Reserve.

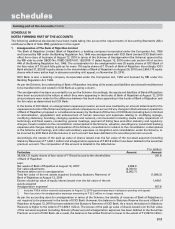

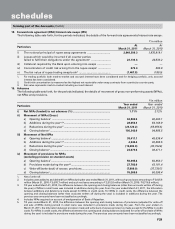

10. Subordinated debt

During the year ended March 31, 2011, the Bank raised subordinated debt qualifying for Tier II capital amounting to

` 59,790.0 million. The following table sets forth, the details of these bonds:

` in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Lower Tier II ............................................... April 05, 2010 8.88%(semi-annually) 10 years 25,000.01

Lower Tier II ............................................... September 29, 2010 8.90% (annually) 15 years 14,790.0

Lower Tier II ............................................... January 13, 2011 9.11% (annually) 10 years 20,000.0

Total ........................................................... 59,790.0

1. During the year ended March 31, 2010, Bank had raised an amount of ` 25,000.0 million towards application money on subordinated

debt bonds which was pending for allotment at March 31, 2010 and was subsequently allotted on April 5, 2010.

During the year ended March 31, 2010, the Bank raised subordinated debt qualifying for Tier II capital amounting to

` 62,000.0 million. The following table sets forth, the details of these bonds.

` in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Lower Tier II ................................................ April 22, 2009 9.30% (annually) 10 years 15,000.0

Upper Tier II ................................................ August 31, 2009 8.92% (semi-annually)115 years110,000.0

Lower Tier II ................................................ December 9, 2009 8.75% (annually) 10 years 13,200.0

Upper Tier II ............................................... January 12, 2010 8.90% (annually)215 years27,800.0

Upper Tier II ............................................... January 29, 2010 8.81% (semi-annually)315 years316,000.0

Total ........................................................... 62,000.0

1. 50 basis points over and above the coupon rate payable semi-annually for the balance years after August 30, 2019, if the call

option is not exercised by the Bank; call option exercisable on August 31, 2019 with RBI approval.

2. 50 basis points over and above the coupon rate payable annually for the balance years after February 27, 2020, if the call option

is not exercised by the Bank; call option exercisable on February 28, 2020 with RBI approval.

3. 50 basis points over and above the coupon rate payable annually for the balance years after February 27, 2020, if the call option

is not exercised by the Bank; call option exercisable on February 28, 2020 with RBI approval.

forming part of the Accounts (Contd.)

schedules