ICICI Bank 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F61

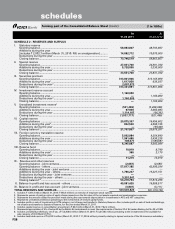

forming part of the Consolidated Balance Sheet (Contd.) (` in ‘000s)

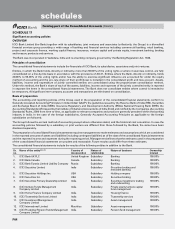

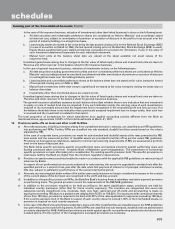

SCHEDULE 9 - ADVANCES (net of provisions)

A. i) Bills purchased and discounted ............................................................. 70,301,265 47,219,427

ii) Cash credits, overdrafts and loans repayable on demand ................... 307,352,546 260,401,668

iii) Term loans .............................................................................................. 2,057,775,362 1,809,026,622

iv) Securitisation, finance lease and hire purchase receivables ................ 124,763,964 141,133,563

TOTAL ADVANCES .............................................................................................. 2,560,193,137 2,257,781,280

B. i) Secured by tangible assets [includes advances against book debts] .. 1,922,059,342 1,612,468,494

ii) Covered by bank/government guarantees ............................................ 27,057,409 21,202,426

iii) Unsecured................................................................................................ 611,076,386 624,110,360

TOTAL ADVANCES .............................................................................................. 2,560,193,137 2,257,781,280

C. I. Advances in India

i) Priority sector .................................................................................. 534,015,609 539,773,871

ii) Public sector .................................................................................... 13,788,639 3,201,088

iii) Banks ................................................................................................ 1,810,607 41,790

iv) Others .............................................................................................. 1,132,200,854 916,388,589

TOTAL ADVANCES IN INDIA ............................................................................... 1,681,815,709 1,459,405,338

II. Advances outside India

i) Loans to banks ................................................................................. 43,708,080 13,683,352

ii) Due from others

a) Bills purchased and discounted ................................................ 11,610,861 17,714,187

b) Syndicated and term loans ....................................................... 752,209,407 693,892,525

c) Others ......................................................................................... 70,849,080 73,085,878

TOTAL ADVANCES OUTSIDE INDIA .................................................................. 878,377,428 798,375,942

TOTAL ADVANCES ............................................................................................... 2,560,193,137 2,257,781,280

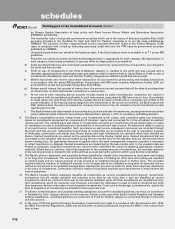

1. Includes acquisition cost of investment in associates of ` 578.7 million (March 31, 2010: ` 524.5 million).

2. Includes appreciation of ` 72,320.7 million (March 31, 2010: ` 93,112.5 million) on investments held to cover linked liabilities of life insurance business.

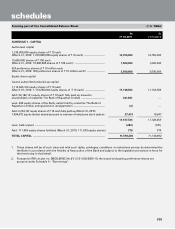

At

31.03.2011

At

31.03.2010

SCHEDULE 8 - INVESTMENTS

I. Investments in India (net of provisions)

i) Government securities .......................................................................... 732,979,973 732,093,813

ii) Other approved securities .................................................................... 356,398 45,009

iii) Shares (includes equity and preference shares)1 ................................. 41,536,041 42,426,779

iv) Debentures and bonds .......................................................................... 206,459,725 75,752,082

v) Assets held to cover linked liabilities of life insurance business ........ 588,265,347 514,692,566

vi) Others (commercial paper, mutual fund units, pass through

certificates, security receipts, certificate of deposits, Rural

Infrastructure Development Fund deposits and other related

investments etc.) ................................................................................... 388,530,238 337,886,043

TOTAL INVESTMENTS IN INDIA ........................................................................ 1,958,127,722 1,702,896,292

II. Investments outside India (net of provisions)

i) Government securities ......................................................................... 54,619,909 38,707,855

ii) Others ................................................................................................... 83,780,160 121,593,693

TOTAL INVESTMENTS OUTSIDE INDIA ............................................................ 138,400,069 160,301,548

TOTAL INVESTMENTS ........................................................................................ 2,096,527,791 1,863,197,840

III. Investments in India

Gross value of investments2 ......................................................................... 1,984,587,186 1,718,296,361

Less: Aggregate of provision/depreciation/(appreciation) ......................... 26,459,464 15,400,069

Net investments ............................................................................................ 1,958,127,722 1,702,896,292

IV. Investments outside India

Gross value of investments ......................................................................... 141,810,619 164,916,920

Less: Aggregate of provision/depreciation/(appreciation) ......................... 3,410,550 4,615,372

Net investments ............................................................................................ 138,400,069 160,301,548

TOTAL INVESTMENTS ........................................................................................ 2,096,527,791 1,863,197,840

schedules