ICICI Bank 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our provision coverage ratio (i.e. total provisions made against non-performing assets as a percentage of gross non-

performing assets), at year-end fiscal 2011 was 76.0%. We have been permitted by RBI to achieve the stipulated level

of provision coverage ratio of 70% in a phased manner by March 31, 2011, which was achieved at December 31, 2010.

At March 31, 2011, total general provision held against standard assets was ` 14.80 billion compared to the general

provision requirement as per the RBI guidelines of about ` 10.86 billion. The excess provision was not reversed in line

with the RBI guidelines.

At March 31, 2011, the net non-performing loans in the retail portfolio were 1.5% of net retail loans as compared with

3.1% at March 31, 2010. The decrease in the ratio was primarily on account of sharp decline in accretion to retail NPAs

and higher provisioning against retail loans. At March 31, 2011, the net non-performing loans in the collateralised retail

portfolio were 1.2% of the net collateralised retail loans and net non-performing loans in the non-collateralised retail

portfolio (including overdraft financing against automobiles) were about 5.6% of net non-collateralised retail loans.

Our aggregate investments in security receipts issued by asset reconstruction companies were ` 28.31 billion at

March 31, 2011 as compared to ` 33.94 billion at March 31, 2010.

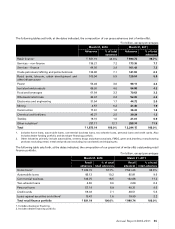

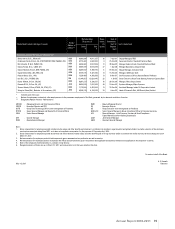

Classification of Non-Performing Assets by Industry

The following table sets forth, at March 31, 2010 and March 31, 2011, the composition of gross non-performing assets

by industry sector.

` in billion, except percentages

March 31, 2010 March 31, 2011

Amount % Amount %

Retail finance1` 64.73 67.2% ` 66.35 65.6%

Wholesale/retail trade 2.17 2.3 3.85 3.8

Food and beverages 1.62 1.7 2.88 2.9

Services – finance 2.43 2.5 2.30 2.3

Textiles 1.90 2.0 2.25 2.2

Chemicals and fertilisers 2.47 2.6 2.05 2.0

Metal and metal products 0.68 0.7 1.30 1.3

Electronics and engineering 0.69 0.7 0.68 0.7

Automobiles 0.59 0.6 0.55 0.5

Paper and paper products 0.03 0.0 0.46 0.5

Services – non finance 0.38 0.4 0.38 0.4

Power 0.14 0.1 0.18 0.2

Iron/steel and products 1.43 1.5 0.17 0.2

Shipping 0.01 0.0 0.06 0.1

Other Industries217.00 17.7 17.68 17.3

Total ` 96.27 100.0% ` 101.14 100.0%

1. Includes home loans, automobile loans, commercial business loans, two wheeler loans, personal loans and credit cards. Also

includes NPAs in dealer funding and developer finance portfolios.

2. Other industries primarily include construction, drugs and pharmaceuticals, agriculture and allied activities, FMCG, gems and

jewellery, manufacturing products excluding metal, crude petroleum/refining and petrochemicals, mining, cement, etc.

3. All amounts have been rounded off to the nearest ` 10.0 million.

Segment Information

RBI in its guidelines on “segmental reporting” has stipulated specified business segments and their definitions, for the

purposes of public disclosures on business information for banks in India.

Management’s Discussion & Analysis

68