ICICI Bank 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

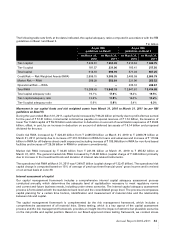

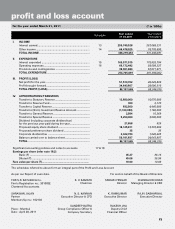

Other Banking Segment

Profit before tax of other banking segment decreased from ` 2.45 billion in fiscal 2010 to ` 1.74 billion in fiscal 2011.

CONSOLIDATED FINANCIALS AS PER INDIAN GAAP

The consolidated profit after tax including the results of operations of our subsidiaries and other consolidating

entities increased from ` 46.70 billion in fiscal 2010 to ` 60.93 billion in fiscal 2011 mainly due to improved financial

performance of ICICI Bank and ICICI Prudential Life Insurance Company Limited offset, in part, by decline in profits of

certain subsidiaries and net loss of ICICI Lombard General Insurance Company Limited. The consolidated return on

average equity increased from 9.6% in fiscal 2010 to 11.6% in fiscal 2011.

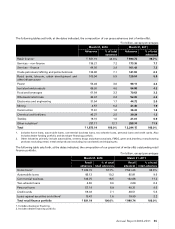

Profit after tax of ICICI Bank UK PLC decreased marginally from ` 1.76 billion in fiscal 2010 to ` 1.67 billion in fiscal 2011

primarily due to decrease in fee income, lower mark-to-market (MTM) gains on derivatives and lower gains realised

on buyback of bonds in fiscal 2011, offset, in part, by increase in net interest income due to an increase in net interest

margin and lower operating expenses.

Profit after tax of ICICI Bank Canada decreased marginally from ` 1.54 billion in fiscal 2010 to ` 1.45 billion in fiscal 2011

primarily due to decrease in non-interest income offset, in part, by increase in net interest income due to an increase

in net interest margin and lower operating expenses.

Profit after tax of ICICI Bank Eurasia Limited Liability Company decreased from ` 0.53 billion in fiscal 2010 to ` 0.21 billion in

fiscal 2011 primarily due to decrease in net interest income, non-interest income and reduction in overall business levels.

Profit after tax of ICICI Prudential Life Insurance Company Limited increased from ` 2.58 billion in fiscal 2010 to ` 8.08

billion in fiscal 2011 due to an increase in net premium earned, fund management fees and policy fees and lower

operating and commission expenses. Net premium earned increased by 8.1% from ` 164.76 billion in fiscal 2010 to

` 178.17 billion in fiscal 2011 primarily due to increase in single premium business from ` 2.75 billion in fiscal 2010

to ` 21.69 billion in fiscal 2011. Operating expenses (other than staff cost) decreased by 18.6% from ` 14.17 billion in

fiscal 2010 to ` 11.53 billion in fiscal 2011 due to space rationalisation initiatives, decrease in policy related expenses

and other branch related expenses.

ICICI Lombard General Insurance Company Limited had a loss of ` 0.80 billion in fiscal 2011 as compared to a profit of

` 1.44 billion in fiscal 2010. In accordance with IRDA guidelines, ICICI Lombard General Insurance Company Limited,

together with all other general insurance companies participates in the Indian Motor Third Party Insurance Pool (‘the

Pool’), administered by the General Insurance Corporation of India (‘GIC’) from April 1, 2007. The Pool covers reinsurance

of third party risks of commercial vehicles. Based on an analysis of the performance of the Pool by an independent

consultant, IRDA has instructed all general insurance companies to provide at a higher provisional loss ratio of 153.0%

(for each of the four years from fiscal 2008 to fiscal 2011) in the financial results for fiscal 2011. Accordingly, the loss

before tax of ICICI General for fiscal 2011 includes the impact of the additional pool losses of ` 2.72 billion.

Profit after tax of ICICI Securities Limited decreased marginally from ` 1.23 billion in fiscal 2010 to ` 1.13 billion in fiscal

2011 primarily due to decrease in brokerage income on account of market conditions and increase in staff cost.

Profit after tax of ICICI Securities Primary Dealership Limited decreased from ` 0.85 billion in fiscal 2010 to ` 0.53 billion

in fiscal 2011 as fixed income markets offered limited opportunities for trading profits during fiscal 2011 and higher

funding costs reduced the net interest income.

Profit after tax of ICICI Home Finance Company Limited increased from ` 1.61 billion in fiscal 2010 to ` 2.33 billion in

fiscal 2011 primarily due to increase in net interest income following an increase in net interest margin and decrease

in staff cost, administrative costs and lower provisions. Provisions on loans and advances decreased by 20.7% from

` 0.29 billion in fiscal 2010 to ` 0.23 billion in fiscal 2011 primarily due to decrease in the size of the loan book.

Profit after tax of ICICI Prudential Asset Management Company Limited decreased from ` 1.28 billion in fiscal 2010 to

` 0.72 billion in fiscal 2011 primarily due to the decrease in management fees on account of decrease in average assets

under management and higher administrative expenses.

Profit after tax of ICICI Venture Funds Management Company Limited increased from ` 0.51 billion in fiscal 2010 to

` 0.74 billion in fiscal 2011 primarily due to increase in management fees on account of increase in carry income from

funds and lower marketing and financial expenses in fiscal 2011.

Management’s Discussion & Analysis

70